The significant volatility in the price of iron ore has recently captured the attention of our clients. This report aims to provide context and technical insights into recent trends in iron ore, alongside an analysis of some broader market factors at play.

Sector context

Iron ore is a crucial commodity globally, primarily underpinning the steel industry which is a cornerstone of the construction, transportation, and energy sectors. Australia plays a key role in this equation, providing around half of the global iron ore supply. On the other hand, China is the dominant importer purchasing about 70% of the global seaborne iron ore market. Key players in the iron ore sector include Fortescue Metals Group Ltd (FMG), BHP Group Ltd (BHP), and Rio Tinto Group (RIO). FMG focuses solely on iron ore mining, whereas RIO and BHP have diversified operations. All three are among the world's top iron ore producers.

Market dynamics and price influences

The iron ore market is generally balanced in supply and demand, which means that any shifts in pricing factors can significantly impact the commodity's price. The price has historically been largely influenced by China's demand, propelled by its ambitious growth targets, particularly in its infrastructure and property sectors. Recent trends show a decline in iron ore prices, affected by various factors including China's economic policies and global market conditions. In May 2021, the price peaked at nearly $230 USD per tonne, influenced by two main factors: supply constraints linked to Covid and China's robust government-backed infrastructure initiatives.

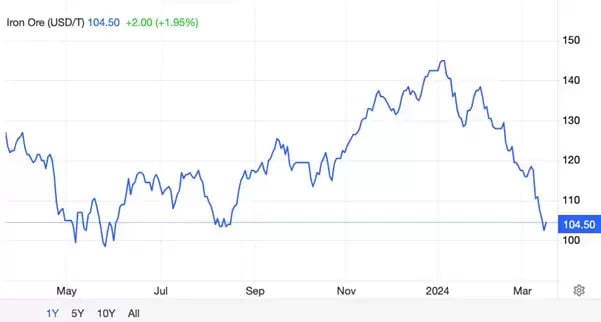

At the onset of 2024, iron ore was trading at close to $145 USD per tonne but has since dipped to 7-month lows around $100 USD per tonne, registering a roughly 24% decline year-to-date. While supply-side factors influence iron ore prices, they often reflect the state of China's economy. Despite the easing of some property policies in China, investments in the sector are dropping, and consumption is sluggish. However, China is committed to intensifying its stimulus efforts to boost its decelerating economic growth. There is an anticipation that a resurgence in infrastructure demand could potentially work to counterbalance the property market's frailty.