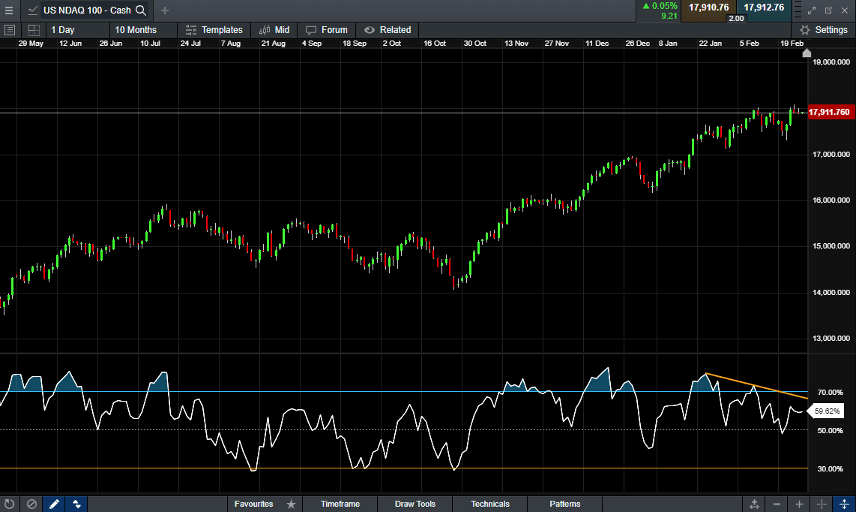

Source: CMC Markets CFD Trading Platform (27/2/2024)

Whether the current short selling in the Nasdaq is wise remains to be seen. However, from a risk management perspective, traders should be aware of the possibility that they're shorting too early.

Reasons Behind Premature Short Positions

Traders often fall into the trap of shorting the market too early for several reasons. One common mistake is overreliance on technical indicators. While indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can be valuable tools for identifying potential reversals, they can also mislead traders, especially during strong uptrends. Overbought signals may persist for extended periods in a robust uptrend, leading traders to initiate short positions prematurely based on these indicators.

Another contributing factor is the failure to assess the strength of the prevailing trend accurately. Inexperienced traders may misinterpret minor corrections or consolidations within an uptrend as signs of a reversal, leading them to short the market prematurely. Without a solid understanding of trend analysis and the ability to gauge trend strength, traders may enter short positions at inopportune times, missing out on potential profits as the uptrend continues.

Psychological biases also play a significant role in prompting traders to short the market too early. Fear of missing out (FOMO) and the desire to be contrarian can cloud judgment and lead traders to disregard the strength of the prevailing uptrend. Seeing prices rise steadily may induce FOMO, causing traders to rush into short positions out of fear of missing out on potential profits. This contrarian mindset can lead traders to ignore signals indicating the continuation of the uptrend and enter premature short positions.

Furthermore, the tendency of retail traders to hold onto short trades for too long can exacerbate losses if proper risk management isn't employed. Despite initial setbacks, some traders may cling to their short positions, hoping for a reversal that never materialises. This failure to cut losses short can turn manageable declines into significant drawdowns, highlighting the importance of disciplined risk management practices.

Harnessing the Power of Divergences

Divergences, a popular trading signal used to indicate potential trend reversals, can be invaluable tools for traders looking to avoid premature short positions. Unlike traditional technical indicators, which may give false signals during strong uptrends, divergences offer a unique perspective by highlighting discrepancies between price action and momentum.

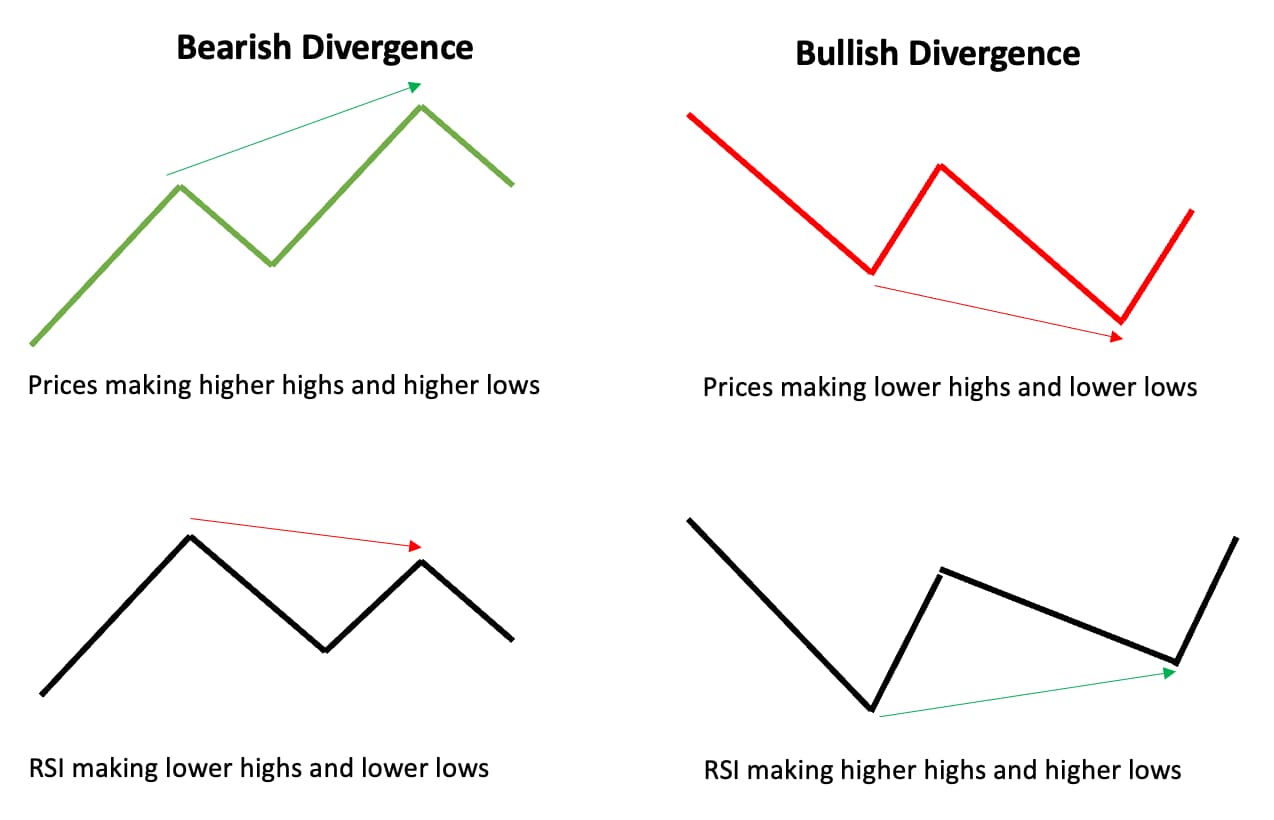

Bullish divergences occur when the price of an asset forms lower lows while the corresponding indicator forms higher lows. This suggests that despite the downward price movement, buying pressure is building, potentially signalling an upcoming reversal to the upside. By identifying bullish divergences, traders can avoid shorting the market too early and wait to confirm a trend reversal before entering short positions.

Conversely, bearish divergences occur when the price of an asset forms higher highs while the indicator forms lower highs. This indicates that although the price is rising, the underlying momentum is weakening, potentially foreshadowing a reversal to the downside. By recognising bearish divergences, traders can exercise caution and refrain from shorting the market prematurely, waiting for confirmation of a downtrend before entering short positions.