Tesla is in crisis. But retail investors? They’re still bullish.

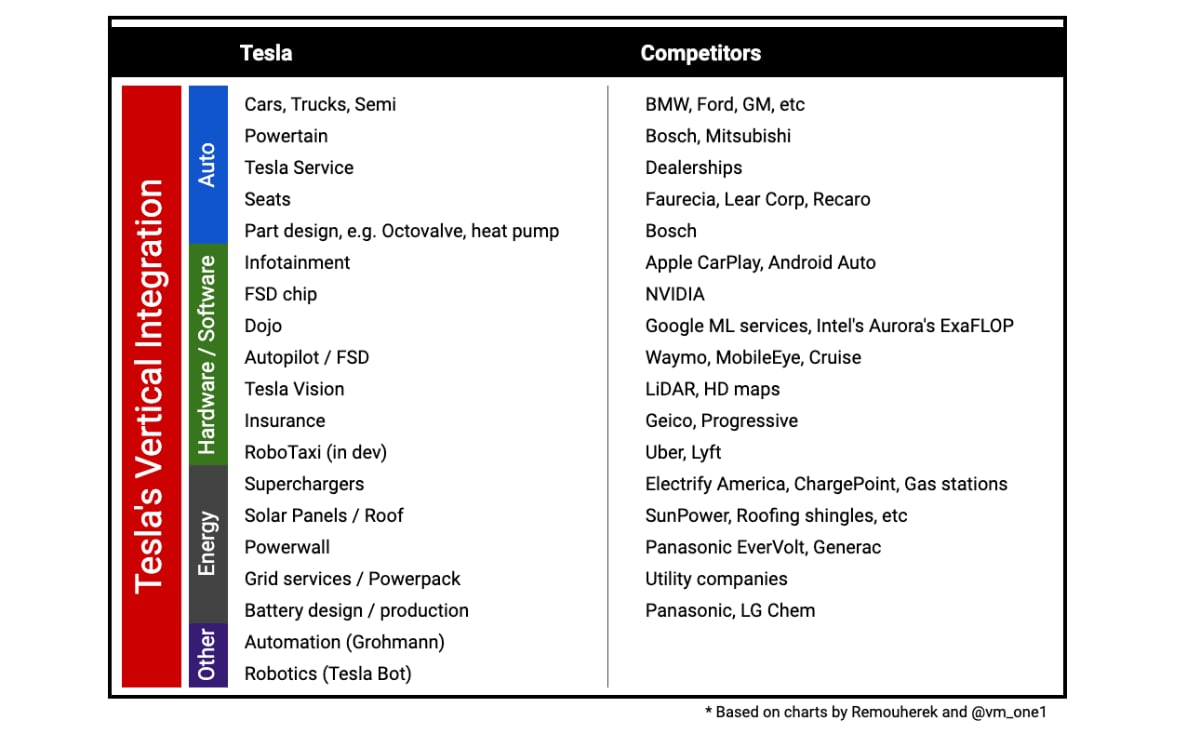

Tesla has undoubtedly been one of the most divisive stocks over the past five years. On one side, there is the promise of insanely transformative innovation. Technologies like Robotaxis and humanoid robots offer a vision of the future that captivates many. On the other, there are deep concerns. Elon Musk’s controversies, Tesla’s stretched valuation, a barrage of negative headlines, and intensifying competition all raise red flags.

Tesla (TSLA:US) surged more than 90% following Trump’s election win, driven by optimism over Elon Musk’s perceived closeness to the new administration. But sentiment soured quickly. Tesla shares fell 50% from their December peak before rebounding sharply since March 11. A tug of war is clearly underway. Even as the stock declined, retail investors stepped in, accumulating shares at near-record levels. According to JPMorgan, retail traders have recently purchased a net $7.3 billion worth of Tesla stock over 12 consecutive trading sessions.1 Meanwhile, some institutional players and hedge funds were heading for the exits or building short positions,2 while prominent insiders also reduced their exposure throughout the selloff.3 Market analysts are split as well, with TipRanks data currently revealing a broad spread in price targets, highlighting both optimistic upside potential and cautious downside risks. The question is, who’s going to be right?

Let’s start with what’s going wrong. Tesla bears have plenty of ammunition on that front.