A guaranteed stop-loss order (GSLO) is a type of risk management tool that works in the exact same way as a regular stop-loss, except for the fact that, for a premium charge, it guarantees to close you out of a trade at the price you specify, regardless of market volatility or gapping.

Guaranteed stop-losses are particularly useful when market conditions are volatile and prices can fluctuate suddenly from one level or another, without passing the level in-between. This is called price gapping or slippage, which can occur following major economic events and news announcements. It can also occur on weekends, where prices open at a significantly different level than the previous close.

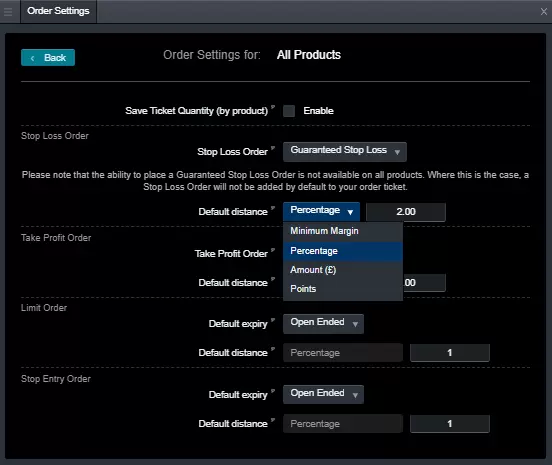

This article explains exactly what a guaranteed stop-loss order is, along with its various settings and how to set a GSLO on our online trading platform, CMC Markets Platform.

GSLOs: a video tutorial

Guaranteed stop-losses are available for most assets but not all, so please check our instruments page before opening a trade. Watch our video below for a tutorial on how to set guaranteed stop-loss orders.