Trade CFDs on baskets of commodities with our Agricultural Index, Energy Index and Precious Metals Index on our CMC Markets Platform. These indices offer a unique, cost-effective way to trade on the wider commodity market, giving you exposure to multiple commodities in one trade.

Commodity index trading

Major commodity indices to trade

Each commodity index represents a different sector of the commodity market: Agriculture, Energy and Precious Metals.

- Agricultural IndexThe Agricultural Index contains Soybean, Corn, Soybean Meal, Wheat, Coffee Arabica, Soybean Oil, Sugar Raw, Cotton, US Cocoa, Coffee Robusta, Sugar White and Oats, covering a broad spectrum of the soft commodities sector.

- Energy IndexThe Energy Index is designed to give an indication of how the energy sector is performing. Its constituent commodities are Heating Oil, Natural Gas, Crude Oil Brent & WTI, Gasoline and Low Sulphur Gasoil. Crude oil is one of the most popular raw materials to trade across the world.

- Precious Metals IndexThe Precious Metals Index groups together several precious metals so you can get exposure to the sector as a whole. It consists of Gold, Silver, Platinum and Palladium, where gold is one of the top traded commodities on our platform.

Commodity index details

View the spreads, margin rates and trading hours for our 3 major commodity indices in the table below.

Instrument | Margin rate | Minimum spread* | Trading hours (AEST) |

|---|---|---|---|

Agricultural Index | 10% | 3.4 | 20:45 - 00:45 / 01:30 - 04:30 (Mon - Sat) |

Energy Index | 10% | 2.4 | 12:00pm (midday) – 09:00am (Mon – Sat) |

Precious Metals Index | 10% | 1.8 | 10:00am - 09:00am (Mon - Sat) |

*A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade sizes in the relevant product. The spread will widen for larger trade sizes, see our platform for more information.

How do commodity indices work?

Our commodity indices group together individual commodities to make a commodities ‘basket’. The indices track the underlying prices of the commodities within that index. If the individual commodity prices in that index increase, then the value of the index will go up. Conversely, if the individual commodity prices decrease, then the value of that index will fall.

There are several benefits to commodity index trading as opposed to trading individual commodities. Firstly, it can be a more cost-effective and efficient way of trading the market, as it allows you to take a view on a commodity sector as a whole, without having to open a position on each individual commodity. Likewise, this can be a good way for you to diversify your portfolio.

However, it's important to be aware that CFDs are high-risk, speculative products. High volatility combined with leverage could lead to significant losses. As with any leveraged product, both profits and losses will be based on the full value of your position. While you could make a profit if the market moves in your favour, you could just as easily make significant losses if the trade moves against you and you don’t have adequate risk-management in place.

How our commodity indices are weighted

For the Energy Index and Agricultural Index, the components were initially weighted according to the average daily trade value of the nearest six futures contracts, where available, for the 12 months preceding the index launch date, based on the initial index value of $10m. For the Precious Metals Index, Gold and Silver are split equally to collectively make up 70% of the index weight. The remaining two components, Platinum and Palladium, are also split equally and collectively make up 30% of the index weight. Subsequent index reviews are applied as shown in the index methodology.

Expecting big things in energy? Diversify your portfolio and spread risk with our unique commodity indices, which allow you to take a view on a commodity sector as a whole with a single position.

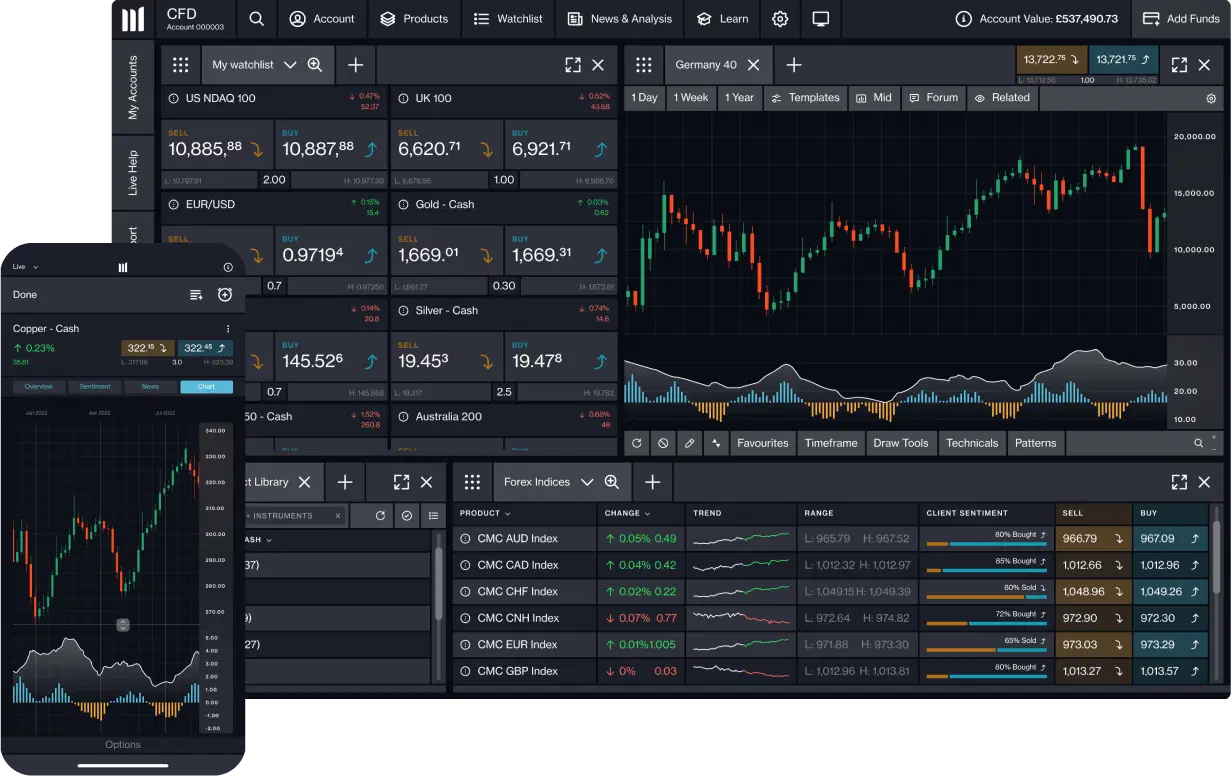

Our charting package ranked highest for charting in the 2019 Investment Trends survey. Choose from over 115 technical indicators and drawing tools, more than 70 patterns and 12 in-built chart types.

We offer a range of advanced order types, including trailing and guaranteed stop losses, partial closure, market orders and boundary orders on every trade, so you have the flexibility to trade your way.

Join over 1 million global traders and investors

Winner 2023

#1 web platform

ForexBrokers

Winner 2024

Best for CFDs

WeMoney

Winner 2024

Best Mobile Trading Platform

ADVFN International Financial Awards 2024

Winner 2025

Most Currency Pairs

ForexBrokers

Winner 2025

#1 Commissions & Fees

ForexBrokers