Thanksgiving brings a holiday-shortened trading week for US markets, which will be closed on Thursday before shutting early on Friday. As a result, the Federal Reserve will release the minutes from its 6-7 November meeting on Tuesday, a day earlier than usual. The minutes will set the stage for the Fed’s December meeting and its Summary of Economic Projections, typically released every other meeting, which may signal fewer interest rate cuts in 2025 than were forecast in September. But our main focus is on US computer maker Dell’s third-quarter earnings and inflation updates from the US, Germany and the eurozone.

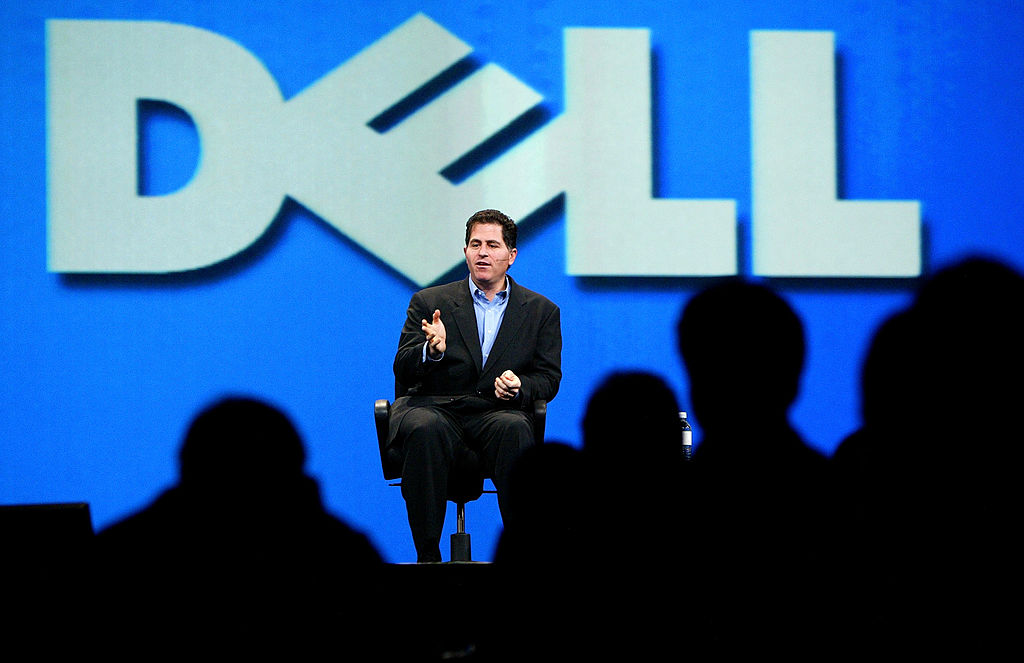

Dell Q3 results

Tuesday 26 November

Analysts expect Dell to report that per-share earnings increased 9% year-on-year to $2.05 in fiscal Q3 2025, with revenue growing 10.5% to $24.6bn. Much of the growth is likely to have come from the storage and networking unit known as Dell Infrastructure Solutions Group, where revenue is projected to have risen 33.4% to $11.3bn. Looking ahead, fourth-quarter earnings are forecast to grow 20.9% to $2.66 a share, with revenue increasing 14.1% to $25.4bn. The Infrastructure Solutions Group is projected to see a 30% increase in Q4 revenue to $12.1bn. Following the Q3 results, the Dell share price – which closed at $138.92 on Thursday, up more than 85% year-to-date – could rise or fall by 10.9%, based on options market pricing.

Since early August, Dell shares – which rejoined the S&P 500 this year – have been trending upwards in a channel, as shown on the chart below. Additionally, the relative strength index, a measure of momentum, has climbed to a reading of 60. A value above 60 can indicate further upside potential. This month the stock has consolidated around $138. If it can break above this resistance level after the results, it could rise to around $147, the level of the June and July highs.

Dell Technologies share price, May 2024 - present