While the coming week will be light on macroeconomic headlines, preliminary purchasing managers’ index (PMI) readings from the US and Europe will offer a snapshot of how major economies are performing in October. Meanwhile, third-quarter earnings season will get into full swing with updates from Tesla, GE Aerospace, Coca-Cola, Unilever and more.

- Market News

- Weekly outlook

- The Week Ahead: Global PMI data; GE Aerospace, Tesla results

The Week Ahead: Global PMI data; GE Aerospace, Tesla results

- 1.US election update

- 2.GE Aerospace Q3 results

- 3.Tesla Q3 results

- 4.Global October PMI data

- 5.Key economic and company events

US election update

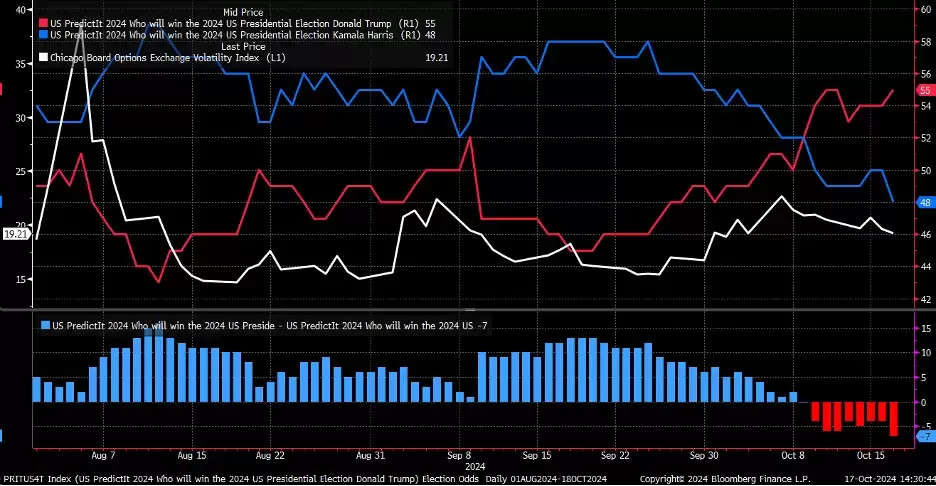

Former president Donald Trump has opened up a lead over vice-president Kamala Harris in the race for the White House, according to data from US betting site PredictIt. Ahead of the presidential election on 5 November, 55% of those betting on Trump back him to win and 45% think he’ll lose. Among those betting on Harris, 48% back her to win and 52% bet she’ll lose. Harris’ odds of winning have slipped to their lowest level so far.

Interestingly, the VIX volatility index (the white line on the below chart), which shows how much investors expect US stocks on the S&P 500 to fluctuate in the coming month, has declined since Trump took the lead, perhaps suggesting that market participants see the election result becoming less uncertain. If Trump’s odds of winning continue to improve, the VIX may fall further.

Trump has pulled ahead of Harris in the US betting market

Sources: PredictIt, Bloomberg, Michael Kramer

GE Aerospace Q3 results

Tuesday 22 October

GE Aerospace is one of the three separate companies that General Electric – the conglomerate founded by Thomas Edison in 1892 – split into in April, the others being GE Healthcare and the renewable energy unit GE Vernova. All three are scheduled to report third-quarter earnings this month, with GE Aerospace first up on Tuesday, followed by GE Vernova a day later and GE Healthcare on 30 October.

GE Aerospace shares have been flying high of late, soaring more than 90% year-to-date to just over $192. Analysts expect the company, which is set to report before the US market opens on Tuesday, to post Q3 earnings of $1.13 a share on revenue of $9bn. Looking ahead, analysts estimate that Q4 earnings may fall sequentially to $1.01 a share, while revenue is projected to climb to $9.6bn. Options market pricing suggests that the shares could move higher or lower by about 4% following the Q3 results.

Having more than doubled over the past 12 months, the GE Aerospace share price recently broke above a consolidation zone between $150 and $175. The technical chart below suggests that the stock may have formed a bearish bump-and-run pattern, and a potential bearish rising wedge. At the same time, the relative strength index (RSI), an indicator of momentum, has been trending lower towards the mid-60s, suggesting that the stock may break lower in the near term, with the first significant support level at $184. The next downside target could be around $160.

GE Aerospace share price, Nov 2023 - present

Sources: TradingView, Michael Kramer

Tesla Q3 results

Wednesday 23 October

Tesla is expected to report Q3 earnings of $0.59 a share, down from $0.66 in the year-ago period, on revenue of $25.5bn, up from $25.1bn a year ago, according to analyst estimates. Gross margins are projected to rise from 17.9%. The company does not provide guidance.

The electric vehicle maker’s stock has undergone a sell-off in the past couple of weeks, falling 14% in October to $220.89, as of Thursday’s close. The market expects Tesla shares to swing by around 6.3% following the Q3 results, based on options pricing. However, this estimate could change, and potentially increase, as implied volatility in the options market rises closer to the earnings date.

As things stand, the Tesla share price has broken below the uptrend that began in August, and momentum has turned negative. As shown on the technical chart below, recent price action has formed an ‘island’, with gaps to be filled to the upside near $230 and $240. There are also downside gaps around $205. If the company’s Q3 results are in line with expectations, the stock could rebound, potentially filling the gap at $240, assuming that that any bad news or outbursts from CEO Elon Musk have already been priced in.

Tesla share price, May 2024 - present

Sources: TradingView, Michael Kramer

Global October PMI data

Thursday 24 October

Purchasing managers’ index (PMI) data is due throughout the trading day in continental Europe, the UK and the US on Thursday. The readings will provide insights into how the respective economies' manufacturing and services sectors are faring in October. Generally speaking, manufacturing data has been improving in the UK, but weak in the US and the eurozone. Meanwhile, the services sector has remained strong across all three economies.

That said, the US economy has been outperforming that of the eurozone overall, which has led to the euro weakening against the dollar. The euro has dropped to around $1.083 versus the dollar and is nearing support at $1.079. A break of this support level could send EUR/USD even lower, potentially down to $1.066, though this scenario could depend on US economic data continuing to outperform that of the eurozone.

EUR/USD, September 2023 - present

Sources: TradingView, Michael Kramer

Key economic and company events

Our rundown of notable economic announcements and US and UK company reports scheduled for the coming week:

Monday 21 October

• China: People’s Bank of China interest rate decision

• Germany: September producer price index (PPI)

• New Zealand: September imports, exports and trade balance

• US: Internation Monetary Fund meeting (to Saturday 26 October)

• Results: Verizon (Q3)

Tuesday 22 October

• UK: Bank of England governor Andrew Bailey’s speech at the Bloomberg Global Regulatory Forum, New York

• Results: Danaher (Q3), Fiserv (Q3), GE Aerospace (Q3), InterContinental Hotels (Q3), Lockheed Martin (Q3), Philip Morris (Q3), RTX (Q3), Texas Instruments (Q3)

Wednesday 23 October

• Australia: October flash Judo bank purchasing managers’ index (PMI) data

• Canada: Bank of Canada interest rate decision

• Eurozone: October flash consumer confidence index

• UK: BoE governor Andrew Bailey in conversation at the Institute of International Finance, Washington DC

• US: September existing home sales

• Results: AT&T (Q3), Boeing (Q3), Boston Scientific (Q3), Coca-Cola (Q3), GE Vernova (Q3), IBM (Q3), NextEra Energy (Q3), PensionBee (Q3), ServiceNow (Q3), T-Mobile (Q3), Tesla (Q3), Thermo Fisher Scientific (Q3)

Thursday 24 October

• Eurozone, France, Germany, UK, US: October flash PMI data

• Japan: October Tokyo consumer price index (PMI)

• US: Initial jobless claims to 18 October

• Results: Honeywell (Q3), S&P Global (Q3), Union Pacific (Q3), United Parcel Service (Q3), Unilever (Q3)

Friday 25 October

• Canada: August retail sales

• Germany: October IFO business climate index

• US: September durable goods orders, October Michigan consumer sentiment index

• Results: Colgate-Palmolive (Q3), HCA Healthcare (Q3)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.