Welcome to Michael Kramer’s pick of the top three market events to look out for in the week ahead, plus his reaction to Donald Trump’s election victory.

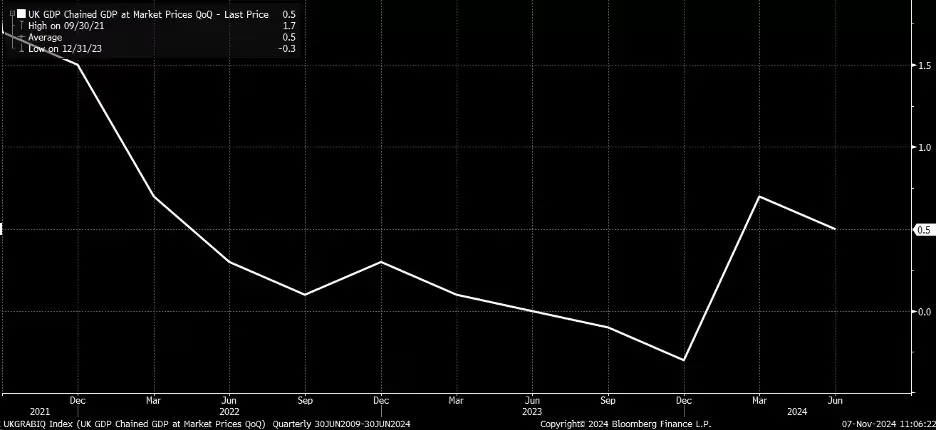

The coming days give markets a chance to catch their breath after a hectic week. The US presidential election resulted in a resounding win for Donald Trump, after which both the US Federal Reserve and the Bank of England cut interest rates by a quarter of a percentage point. As investors figure out what it all means, they’ll be keeping an eye out for upcoming announcements on US inflation and retail sales, as well as UK GDP.

US election: Trump romps to victory

Despite expectations of a tight race, president-elect Donald Trump comfortably beat vice-president Kamala Harris in the US election. Trump not only captured the required 270 electoral college votes to secure victory, he also became the first Republican candidate to win the popular vote since George W. Bush in 2004.

Wall Street reacted favourably to the election result, with US stock markets such as the S&P 500 and the Dow Jones driven higher by investor optimism about potential deregulation and economic growth under Trump. Bond yields also surged on inflation fears amid expectations that government borrowing will rise sharply to fund Trump’s proposed tax cuts. The US dollar strengthened against other major currencies as an expected pro-growth fiscal package could reduce the likelihood of sharp interest rate cuts from the Fed. The possibility of rates staying higher for longer makes dollar deposits more attractive. Recent US economic data has been strong, October’s hurricane-affected non-farm payrolls print aside, further supporting the case for fewer rate cuts, higher yields, and a stronger dollar.

However, it remains to be seen whether the equity market response to Trump’s win was a show of confidence in him or simply a volatility reset of the sort we typically see after major events. If the Fed delivers fewer rate cuts, the dollar strengthens, and government bond yields rise, financial conditions could tighten, which may be a negative for US stocks. Rates and the dollar seem likely to be the key drivers that could determine where equity markets go in the weeks and months ahead.

US October inflation

Wednesday 13 November (CPI), Thursday 14 November (PPI)

Analysts estimate that the US consumer price index (CPI) increased 2.6% in the year to October, up from 2.4% in September. On a monthly basis, CPI is expected to be up 0.2%, flat compared to September. Core CPI, which excludes volatile food and energy prices, is projected to have risen 3.3% year-on-year and 0.3% month-on-month, both unchanged from September.

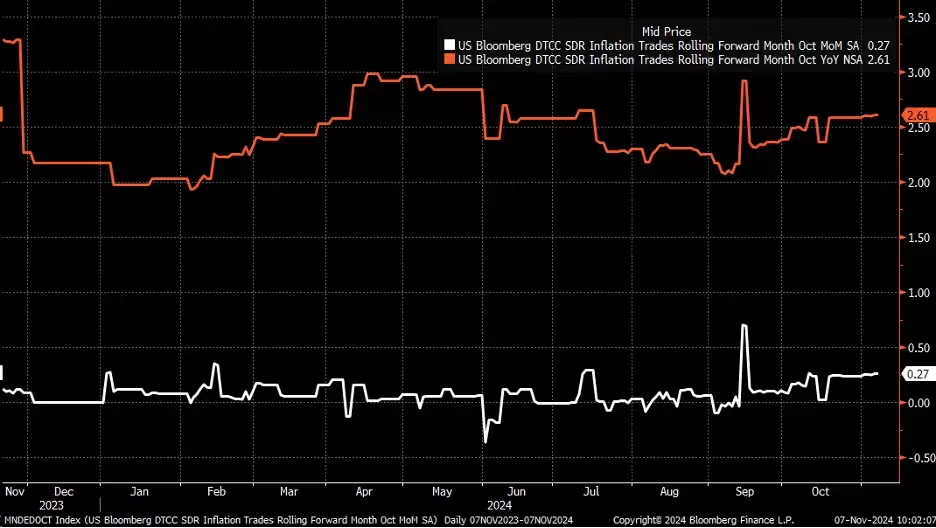

However, inflation swaps indicate the potential for a higher-than-expected monthly CPI reading of 0.3%, as shown on the chart below.

US inflation swaps, November 2023 - present