Tesla is to release the fourth-quarter earnings result after the US markets close on 26 January. The EV maker’s shares slashed about 67% from its September high to almost $100 at the beginning of January, which is the lowest seen in 2016 but has rebounded about 30% since. Uncertainties around Tesla car demands and rising raw material costs are the main concerns of investors. CEO Elon’s share sales also hurt Tesla’s share price. Hence, Tesla’s profit margin will be a key focus for investors to gauge the company’s growth momentum.

A record delivery number but a drop in the profit margin

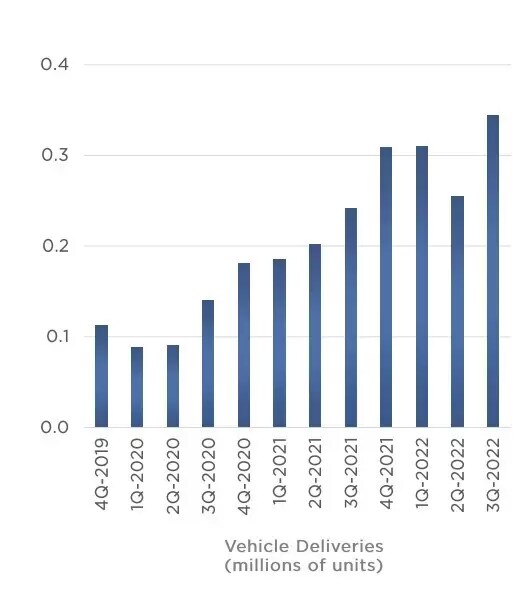

Tesla delivered a record quarterly delivery number of 405,000 vehicles in the fourth quarter, or a 40% year-on-year growth, bringing the whole year’s car deliveries to 1.31 million. But the figure fell short of analysts’ expectations of close to 430,000. The annual growth of 40% is also a sharp decline from 71% a year ago.

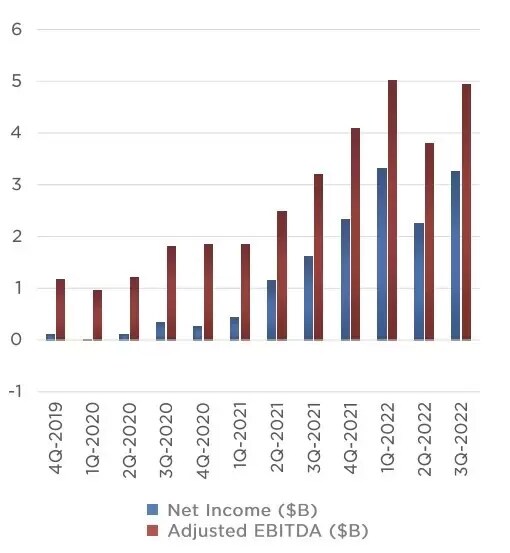

Not only a slowdown in the delivery number but the profit margin is also expected to be much lower too. Tesla offered intense incentives in both China and US to boost sales during the fourth quarter as the Covid outbreaks in China and strict health controls caused the production suspension and weakened demands. In the US, Tesla offered a discount of $3,750 on Model 3 and Model Y if buyers take delivery in 2022. The steep price discount and increased costs in raw materials and logistics will certainly lead to a big drop in its profit margin.

One positive note is that Tesla plans to start the production of the much-anticipated Cybertruck. But it also faces the challenges of supply chain woes and macro headwinds.

Tesla faces demand and competition challenges

The demand outlook for Tesla may not be rosy due to a surge in Covid cases in China since December. Tesla extends its price discount into the new year in China with a total discount of 10,000 yuan ($1,500) if buyers take delivery by 28 February. By contrast, its rival BYD Co. has raised its electric vehicle price due to the impact of reduced subsidies for new energy vehicles since November in China. Hence, Tesla faces both competition and demand challenges in its largest market in 2023.

In the US, the Inflation Reduction Act may help Tesla to promote its sales in 2023 but the EV tax credits require an income limit and car prices. However, the discount amount can be used for an upfront discount from 2024, which means more buyers may just wait.

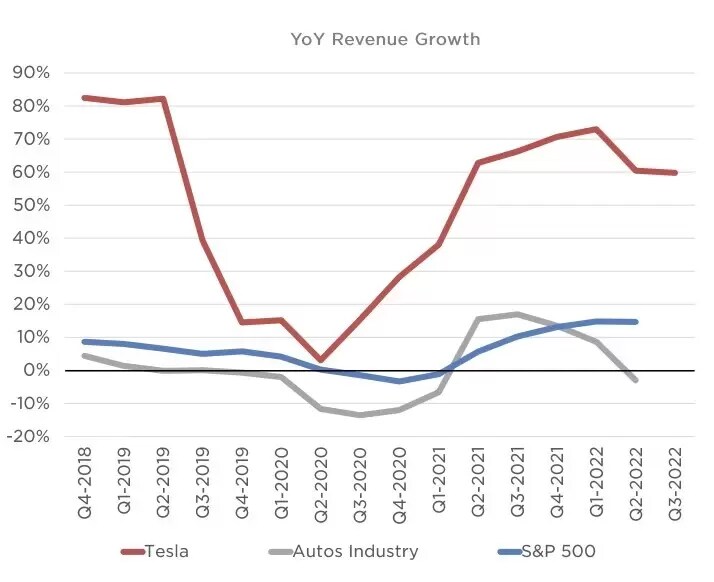

According to FactSet, Tesla’s earnings per share is $1.15, or a 38% growth from a year ago. The revenue estimate is 24.52 billion on average according to Yahoo finance and this number will also represent a 38% growth year on year, which is a sharp decline from an average of more than 50% in the past apart from the pandemic period. But considering the current P/E ratio of 39 a nearly 40% annual growth makes the share price look cheap, though the sector’s average P/E ratio is about 12. For long-term investors, whether Tesla can keep its relatively high growth is key to make their investment decisions.

Source: Tesla

The impact on Tesla shares of Elon’s Twitter deal

According to an SEC filing, the latest Tesla share sale from CEO Elon is 22 million shares worth $3.6 billion on 12 December after 19.5 million share sales in early November. Elon has sold a total of $22.9 billion worth of Tesla stocks since the first announcement of the Twitter acquisition in April, which accounts for about 5% of the EV maker’s market cap at the current share price. Despite the massive share sales, Elon still owns 423.6 million Tesla shares, and he has options to buy nearly 278 million shares, plus, he will probably receive more options because of the growth for the financial year 2022

Tesla shares dropped about 60% since Elon announced he would buy Twitter on 14 April, suggesting that the decline in Tesla shares was an overreaction and the social media purchase was not a major issue of Tesla stocks. So investors’ concerns are not only from CEO Elon’s social distraction, but also the EV business itself.

Technical Analysis

Tesla’s shares face the channel resistance of around 136 in the short term, a bullish breakout of this level may take it to further test the 50-day moving average of 154, then 200, which is the potential medium-term resistance.

The spike in Tesla shares’ trading volume may suggest dip-buyers are merging into the stock after the sharp decline. With RSI also moving on an uptrend, the directional bias is more bullish than bearish.

The pivot support is around the January low of 101. A breakdown below this level could cause a further crash in Tesla shares.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.