Welcome to Michael Kramer’s pick of the top three market events to look out for in the week beginning Monday, 12 August 2024. Plus, he also offers an update on the US presidential election.

The coming week will focus on inflation, with consumer price index (CPI) readings from the UK and the US on Wednesday set to confirm whether or not the cooling in price growth over the past two months is genuine and lasting. After a volatile few days for markets, the US data will be crucial, serving as a potential indicator of whether traders should prepare for a US recession, a Fed rate cut in September, or both. The UK announcement should offer clues as to whether the Bank of England, which cut its base rate by a quarter point to 5% on 1 August, will lower rates again at its next meeting on 19 September.

On the company earnings front, the key announcement to look out for comes from Walmart, which is set to report its second-quarter results on Thursday. In May, the world’s biggest retailer raised its full-year outlook after its Q1 results beat analyst forecasts, boosting its shares to a record high. Since then, the stock has risen a further 6% to current levels near $68.

With less than three months to go until the US election on 5 November, uncertainty over who will win the keys to the White House could continue to contribute to market volatility in the coming weeks. If the US really is heading for a recession, upcoming economic announcements could have a significant impact on voting intentions.

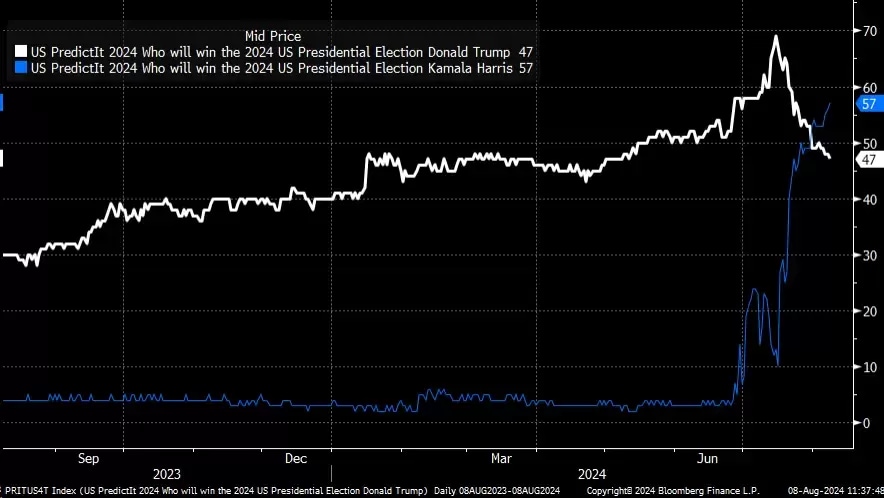

Recent polling suggests that the race for the presidency has tightened since Kamala Harris replaced Joe Biden as the Democratic candidate. Some prediction markets, including PredictIt (see the below chart), are now indicating that vice president Kamala Harris could prevail over former president Donald Trump.

Although the S&P 500 has been struggling since President Biden withdrew from the race, the causality isn’t clear, with various other factors – from Japan’s interest rate rise to a weak US jobs report – also weighing on US stock markets. For a while there was some suggestion that a Trump win could benefit US small-cap stocks, but small-caps and regional banking stocks have faded since the weak US labour report, making things unclear for the moment. Traders will be hoping for greater clarity in the coming weeks.

Data gathered by the New Zealand-based online prediction market PredictIt suggests that Kamala Harris may be on course for victory over Donald Trump in November’s US presidential election

UK July CPI

Wednesday 14 August

Economists estimate that the UK’s CPI rose 2.3% in the year to July, up from 2% in June. On a monthly basis, consumer prices are forecast to have decreased 0.2% in July, versus an increase of 0.1% in June. Another weak inflation reading could encourage the Bank of England to cut interest rates sooner than the market expects. Current market expectations are for the next BoE rate cut to come at the Monetary Policy Committee’s 7 November meeting.

The prospect of an earlier-than-expected rate cut could weigh on GBP/USD. The pound has fallen against the US dollar recently, dropping below $1.28 this month after rising to a one-year high above $1.30 in July. Now trading back in the range of the past 12 months, GBP/USD could slide to $1.2620 if weak UK CPI data points to another rate cut from the BoE. The next downside target after that is around $1.24.

GBP/USD, March 2023 - present

US July CPI

Wednesday 14 August

US CPI is expected to have held steady at 3% in the year to July, the same rate of inflation as in June. The report is also expected to show that consumer prices increased 0.2% month-on-month, up from June’s decline of 0.1%. Meanwhile, core CPI – which excludes volatile items such as food and energy – is expected to have risen 3.2% year-on-year in July, easing from 3.3% in June, and to have increased 0.2% month-on-month, up from 0.1% a month earlier.

If inflation is in line with or higher than these expectations, USD/JPY could rise and the carry trade could be back in favour. As Robert Armstrong summarised in the Financial Times on Thursday, “a carry trade is just using capital from low interest rate countries to buy high-yielding assets elsewhere. This covers all the Japanese institutions and households who have used a cheap yen to invest abroad”. In the near term, if US economic data exceeds expectations, we could see the dollar strengthen. That might result in gains for USD/JPY, which could be positive for risk assets such as stocks.

USD/JPY, year-to-date performance

Walmart Q2 results

Thursday 15 August

Shares of Walmart have soared by more than a quarter this year, partly because Q1 revenue increased 6% to $161.5bn, beating analysts’ expectations of $159.5bn. Analysts now expect the retailer to report that Q2 earnings grew 5.1% to $0.64 a share, with revenue up an estimated 4.2% at $168.4bn. For Q3, analysts are forecasting that the company will guide earnings of $0.55 a share and revenue of $167.1bn. Options pricing suggests that the stock – a constituent of both the Dow Jones and the S&P 500 – could move up or down by about 5.1% following the results.

Although Walmart stock is up about 27% year-to-date, it has fallen roughly 4.7% from its mid-July peak. The shares appear to have already completed a 100% extension of the initial rally that began in December 2023, and the stock has also fallen below an uptrend that started in mid-May, the last time it reported results. Meanwhile, the relative strength index (RSI) has also declined, indicating a loss of momentum in the share price. Technical analysis would seem to suggest that, following the Q2 results, the most likely scenario may be for the shares to potentially fill the most recent gap shown on the below chart and fall back to mid-May levels of around $60.

Walmart share price, November 2023 - present

Key economic and company events

Here’s our rundown of notable economic announcements and company reports scheduled for the coming week:

Monday 12 August

• Japan: July producer price index (PPI)

• US: July monthly budget statement

• Results: Monday.com (Q2)

Tuesday 13 August

• Australia: August Westpac consumer confidence, Q2 wage price index

• Spain: July consumer price index (CPI)

• UK: June unemployment rate, June average earnings, July claimant count change

• US: July PPI

• Results: Home Depot (Q2), Nu (Q2), Sea Limited (Q2), Tencent Music Entertainment (Q2)

Wednesday 14 August

• Eurozone: Q2 gross domestic product (GDP)

• France: July CPI

• Japan: Q2 GDP

• New Zealand: Reserve Bank of New Zealand interest rate decision

• UK: July CPI, July PPI, July retail price index (RPI)

• US: July CPI

• Results: Aviva (HY), Balfour Beatty (HY), Cisco Systems (Q4)

Thursday 15 August

• Australia: July unemployment rate

• China: July industrial production, July retail sales

• UK: June GDP

• US: Weekly initial jobless claims to 9 August, July retail sales

• Results: Alibaba (Q2), Amcor (FY), Applied Materials (Q3), Deere & Co. (Q3), ITM Power (FY), JD.com (Q2), Walmart (Q2)

Friday 16 August

• UK: July retail sales

• US: August Michigan consumer sentiment index

• Results: Flowers Foods (Q2)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.