Welcome to Michael Kramer’s pick of the top market events to look out for in the week ahead, plus his latest US election betting market update.

The coming week will be one of the busiest of the quarter, teeming with company earnings reports and economic announcements – particularly from the US. Big Tech will be the focus, with quarterly results from Google parent company Alphabet (Q3), Facebook owner Meta Platforms (Q3), Microsoft (Q1), Amazon (Q3) and Apple (Q4) likely to move US markets, particularly the tech-heavy Nasdaq. Investors will be paying close attention to what the tech giants say about their AI spending plans and where they see the benefits. Traders will also be keeping an eye on US inflation and labour market data, the last round of such figures before the US election on 5 November and the Federal Reserve’s rate-setting meeting from 6-7 November. In the interests of full disclosure, please note that Michael Kramer and the clients of his company Mott Capital Management own shares of Amazon, Apple, Alphabet (Class A) and Microsoft.

US election update

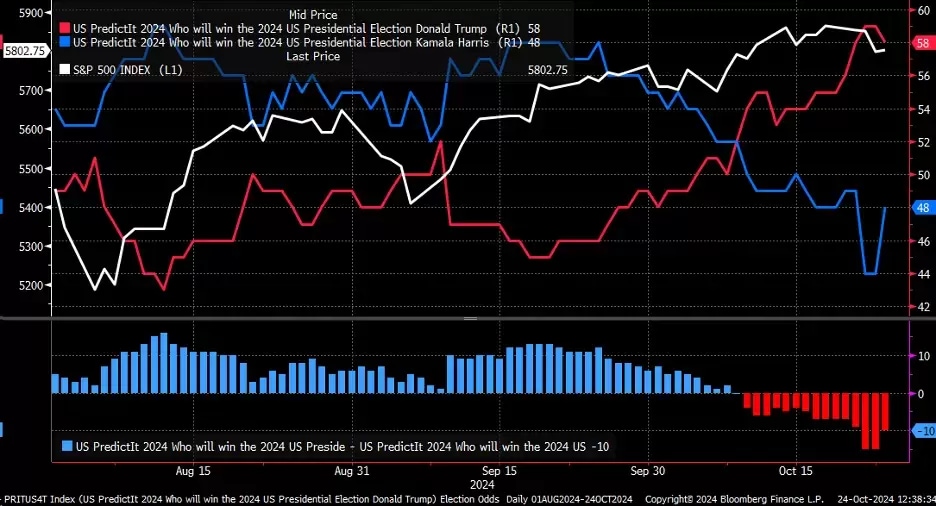

Former president Donald Trump’s lead over vice-president Kamala Harris in a key betting market widened over the past week. Data from the US betting site PredictIt indicates that 58% of those betting on Trump back him to win and 42% bet he’ll lose. Among those betting on Harris, 48% back her to win and 52% bet she’ll lose.

At this stage, the betting markets have Trump as the likely winner, but it’s possible that a small number of large stakes are skewing the data in his favour, perhaps in a bid by deep-pocketed Trump supporters to shape voter perceptions of his campaign momentum. It’s also possible that some sampling bias may be at play, as Trump supporters may be on the whole more likely to place bets than Harris supporters. In any case, whether the wisdom of the crowd will prove correct remains uncertain, since – as with any other market – nothing is guaranteed.

Trump is ahead of Harris in the US betting market

Microsoft Q1 results

Wednesday 30 October

Microsoft is expected to report fiscal first-quarter 2025 earnings of $3.11 a share, representing annual growth of 3.9%, on revenue of $64.5bn, up 14.2% from the year-ago period. However, the focus will be on revenue from the company’s Intelligent Cloud unit, which is expected to have grown 12.6% to $27.3bn. Within that unit, cloud computing platform Azure is forecast to have grown 30.2% on a constant currency basis, with AI contributing 9.25%. Capital expenditure (capex) is expected to be around $14.5bn.

Looking ahead to the next quarter, analysts expect earnings to rise to $3.25 a share on revenue of $69.8bn. Meanwhile, the Intelligent Cloud unit is projected to generate $29.3bn in revenue, with Azure growth of 29.7% and AI contributing 9.9%. Capex is expected to remain flat at approximately $14.4bn.

Following the Q1 results announcement, Microsoft shares – which closed at $424.73 on Thursday, up 14.5% year-to-date – could move 3.9%, either up or down, based on current options market pricing.

From a technical perspective, Microsoft’s share price has entered a somewhat negative phase. The chart below shows a rising megaphone pattern, which typically indicates a potential reversal to the downside. Momentum, as measured by the relative strength index (RSI), has been bearish for some time. Moving forward, the most likely outcome for the stock may be a break below the lower trendline of the megaphone pattern, potentially down towards support around $370. Upside potential appears more limited, with resistance around $440.

Microsoft share price, July 2023 - present

Amazon Q3 results

Thursday 31 October

For the third quarter, analysts expect Amazon to post earnings of $1.15 a share, up 22.7% versus the year-ago period, on revenue of $157.3bn, an increase of 10% year-on-year. Amazon Web Services (AWS) is estimated to have grown 19.1% to $27.4bn while operating income is expected to climb to $14.7bn.

For the fourth quarter, analysts project revenue to rise to $186.4bn, with operating income reaching $17.8bn. AWS revenue growth is forecast to accelerate slightly to 19.2%.

Following the Q3 results, the market is pricing in a share price move of 6.9%, either up or down. Amazon stock closed at $186.38 on Thursday, up 24.3% this year.

Amazon's technical chart, below, resembles that of Microsoft, with a decline in July followed by a rebound in August and September. Now, though, Amazon seems to be forming more of a traditional bear flag pattern. The stock may have already broken below its uptrend, signalling further downside potential. The first support level to watch is near $180, with a second support level at around $171. Upside potential appears somewhat limited, with resistance at $190 and $195.

Amazon share price, November 2023 - present

US September PCE price index

Thursday 31 October

The US personal consumption expenditures (PCE) price index, said to be the Fed’s favourite inflation gauge, is expected to have risen 2.1% in the year to September, based on analyst estimates, easing from 2.2% in August. Estimates also point to an increase of 0.2% on a monthly basis. The closely watched core PCE index, which excludes volatile food and energy prices, is expected to have increased 2.6% year-on-year, cooling from 2.7% in August, while rising 0.3% month-on-month.

The latest inflation data could have a bearing on the Fed’s upcoming interest rate decision, and may also play on the minds of voters in the US presidential election, with early in-person voting already underway.

US October jobs report

Friday 1 November

Analysts estimate that the US economy added 135,000 jobs in October, while the unemployment rate is predicted to have remained unchanged at 4.1%. Monthly growth in pay is anticipated to have slowed to 0.3% from 0.4%, maintaining a year-on-year growth rate of 4%. A weaker-than-expected payrolls number, or a noticeable rise in unemployment, could prompt the Fed to cut interest rates by 50 basis points, whereas a stronger report may result in no cut at all. The most likely move is a 25-basis-point cut, according to 95% of interest rate traders surveyed by CME FedWatch.

Implied volatility is likely to surge ahead of the jobs report, especially with the US election and the Fed meeting just around the corner. It's become common for the VIX 1-day to spike to around 20 points before the non-farm payrolls (NFP) report, as the below chart shows. This time should be no different, suggesting that options premiums may become expensive. But then, as implied volatility drops following the release of the non-farm payrolls print, put premiums may decrease, potentially sparking an initial rally for US equity markets such as the S&P 500.

CBOE 1-Day Volatility Index, March 2024 - present

Key economic and company events

Our rundown of notable economic announcements and US and UK company reports scheduled for the coming week:

Monday 28 October

• Canada: Bank of Canada governor Tiff Macklem’s speech at the Logic Summit, Toronto

• Japan: September unemployment rate

• Spain: September retail sales

• Results: Ford (Q3), On Semiconductor (Q3)

Tuesday 29 October

• Germany: November GfK consumer confidence survey

• US: August housing price index, September JOLTS job openings, October consumer confidence index

• Results: Advanced Micro Devices (Q3), Alphabet (Q3), American Tower (Q3), BP (Q3), Chipotle Mexican Grill (Q3), Electronic Arts (Q2), HSBC (Q3), McDonald’s (Q3), Mondelez (Q3), MSCI (Q3), PayPal (Q3), Pfizer (Q3), Royal Caribbean Cruises (Q3), Reddit (Q3), Snap (Q3), Stryker (Q3), Visa (Q4)

Wednesday 30 October

• Australia: September and Q3 consumer price index (CPI), September retail sales

• Eurozone: Q3 flash gross domestic product (GDP), October business climate index, October consumer confidence index

• France: Q3 flash GDP

• Germany: Q3 flash GDP, October flash CPI, October unemployment rate

• Italy: Q3 flash GDP

• Japan: September retail trade

• Spain: Q3 flash GDP, October CPI

• UK: Autumn Budget

• US: Q3 flash GDP, October ADP employment change

• Results: AbbVie (Q3), Amgen (Q3), Automatic Data Processing (Q1), Bausch + Lomb (Q3), Booking Holdings (Q3), Caterpillar (Q3), Chubb (Q3), Coinbase (Q3), DoorDash (Q3), eBay (Q3), Eli Lilly (Q3), Garmin (Q3), GE Healthcare (Q3), Kraft Heinz (Q3), Meta Platforms (Q3), Microsoft (Q1), MicroStrategy (Q3), Next (Q3), Robinhood Markets (Q3), Roku (Q3)

Thursday 31 October

• Australia: September building permits

• China: October NBS manufacturing purchasing managers’ index (PMI), October NBS services and construction PMI

• Eurozone: September unemployment rate, October harmonised CPI

• France: October flash CPI

• Germany: September retail sales

• Japan: Bank of Japan interest rate decision

• UK: October Nationwide housing prices

• US: September personal consumption expenditures (PCE) price index, initial jobless claims to 25 October

• Results: Amazon (Q3), Apple (Q4), Bristol-Myers Squibb (Q3), Comcast (Q3), ConocoPhillips (Q3), Estée Lauder (Q1) Intel (Q3), Linde (Q3), Mastercard (Q3), Merck & Co. (Q3), Prudential Financial (Q3), Roblox (Q3), Shell (Q3), Uber (Q3), United States Steel (Q3), Willis Towers Watson (Q3)

Friday 1 November

• Australia: Q3 producer price index (PPI)

• China: October Caixin manufacturing PMI

• Switzerland: October CPI

• US: October jobs report, including non-farm payrolls and average hourly earnings; October ISM manufacturing PMI

• Results: Chevron (Q3), Exxon Mobil (Q3)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.