Commodities Trading

Commodities are the building blocks of the global economy energy, metals, and agricultural products that power industries worldwide. Through CFD trading, you can access price movements in oil, gold, wheat, and 100+ other markets without owning physical assets. Go long when you expect prices to rise, or short when you anticipate declines all with the flexibility and leverage that active traders demand.

Why Trade Commodities With CMC Markets

Your Favourites in One Place

Over 100 commodities to trade, including favourites like gold, silver, natural gas, Brent crude, and WTI oil.

Precise Pricing

We combine multiple feeds from tier-one banks to get you the most accurate bid/ask prices.

Minimal Slippage

With fully automated, lightning-fast execution in 0.0040 seconds.

Professional Research

Free access to quantitative equity analysis from Morningstar.

Dedicated Customer Service

Our experienced team is here whenever the markets are open to support you on your trading journey.

No Partial Fills

No dealer intervention - we don't reject or partially fill trades based on size.

Trade Commodities With Spreads From Just 0.2 Points.

Access 100+ commodity markets with both cash and forward contracts. Capitalise on volatility in gold, silver, natural gas, Brent crude, and WTI oil; plus diversify across metals, energy, and agriculture.

*Rebate amount is in USD and per million in turnover

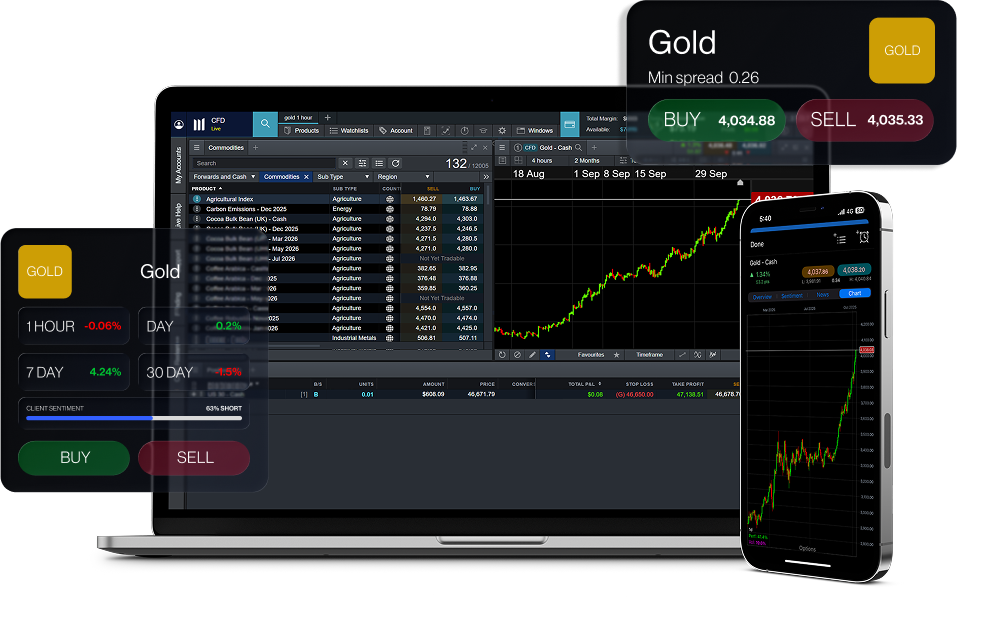

Choose Your Platform

Whether you choose our award-winning platform or the renowned MetaTrader 4, you'll find tight spreads and no hidden fees.

Our award-winning proprietary trading platform combines institutional-grade features and security, with lightning-fast execution and best-in-class insight and analysis.

Trade CFDs on popular indices, forex pairs, commodities and cryptocurrencies with the world's favourite trading platform, backed by our exceptional service.