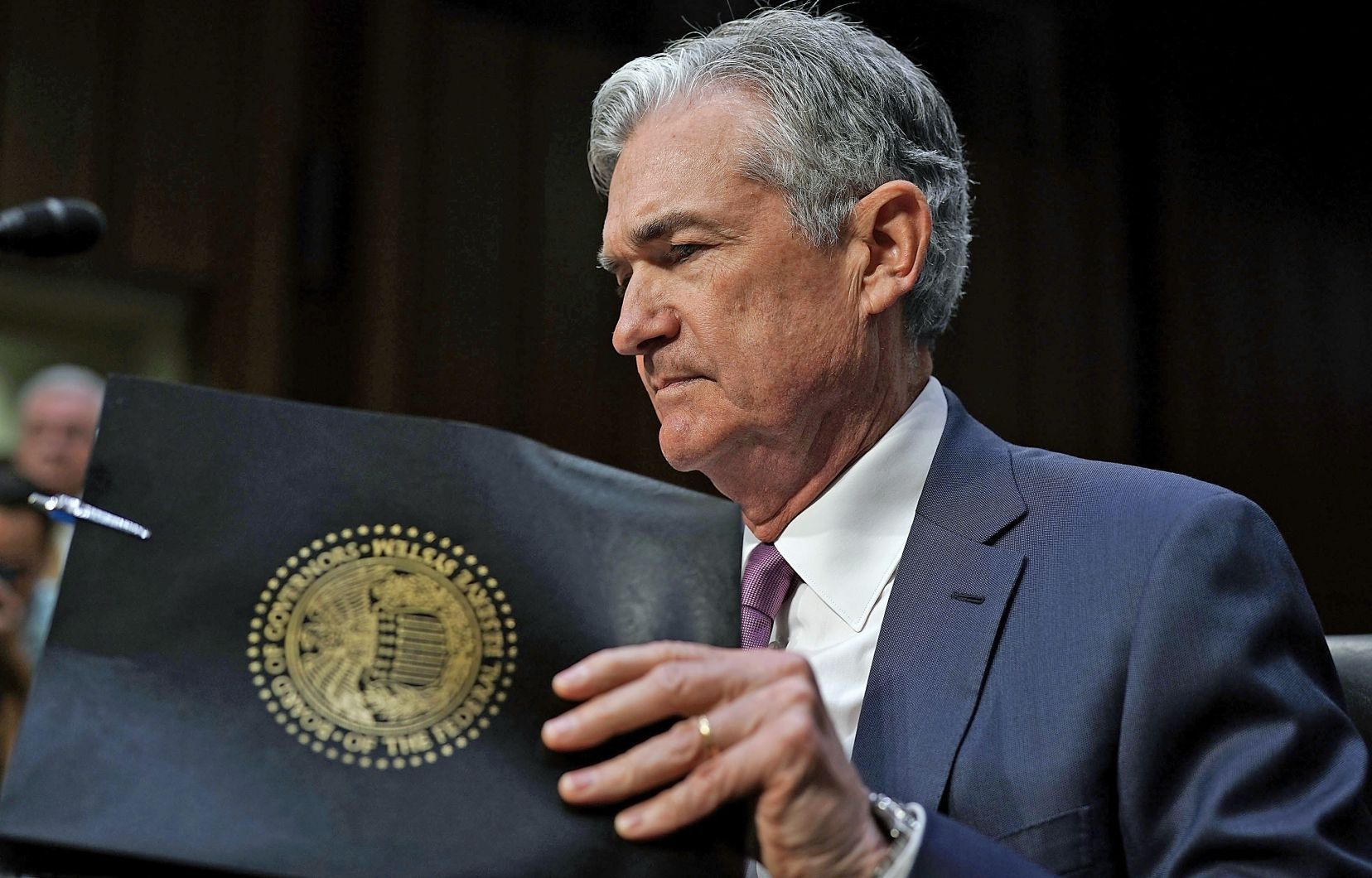

It had been a fairly subdued session for European markets for most of the day, chopping between positive and negative territory amidst a backdrop of caution ahead of today’s comments from Jerome Powell, chairman of the Federal Reserve, where he struck a more hawkish tone in contrast to his last post FOMC press conference.

Europe

Even allowing for the timing of today’s testimony which isn’t great given the closeness of this week’s payrolls report, next week’s CPI, and the next Fed meeting, which is in 2 weeks’ time, today’s remarks contrasted to the tone of Powell’s press conference back in February.

While being careful not to pre-judge the upcoming data when he spoke to lawmakers this afternoon, he still had to acknowledge how much better than expected recent data has been, saying the central bank is prepared to increase the pace of rate hikes if needed, and that the likely rate peak could well be higher than expected.

This change of tone saw yields pop higher and European stocks head towards the lows of the day, although today’s weakness has been fairly contained.

Industrial equipment rental company Ashtead Group is amongst the best performers on the FTSE100 after reporting Q3 results that saw a 23% rise in revenue, to $2.42bn, driven mainly by rental revenues of $2.19bn. profits before tax rose by 29% to $505m, pushing year-to-date profits up to $1.69bn, a rise of 33%. The US business trading under the name Sunbelt Rentals has been the main driver of the group’s outperformance, the company raising its full-year guidance for rental revenue to 23% to 25% from 20% to 23%.

Mexican gold and silver miner Fresnillo shares are lower after announcing full-year results that saw revenues decline 10% to $2.43bn and profits fall by 29.7% to $308.3m. The miner blamed higher costs, as well as lower gold and silver prices for the decline even as silver production rose by 1.2%, however, gold production fell by 15.3%. The weakness of metals prices today is also acting as a drag.

High street bakers Greggs reported a solid set of full-year numbers, with total sales rising 23% to £1.5bn, while pre-tax profits increased by 1.5% to £148.3m. like-for-like sales rose 17.8% with the company opening 186 new shops in the last 12 months while closing 39.

On current trading, like-for-like sales are up 18.8% in the first few weeks of 2023, and trading is in line with expectations.

Wood Group shares have taken another leg higher after management confirmed that it had rejected a fourth proposal from Apollo with a value of 237p per share, saying that the offer continues to undervalue the business.

Premier Foods, makers of Mr. Kipling and Ambrosia brands has seen its shares rise sharply after raising its full-year guidance for sales and profit expectations. It now expects Q4 revenues to be at least 10% ahead of the previous year, and for, adjusted profit before tax, to come in at £135m.

US

US markets opened cautiously unchanged ahead of today’s testimony by Fed chairman Jay Powell to US lawmakers. Unusually a summary of his scheduled comments wasn’t pre-released in the lead up to his testimony, which perhaps wasn’t surprising given his comments that the pace of rate hikes may need to be accelerated, and that the likely rate peak could well be higher than expected, which proceeded to send markets to the lows of the day.

Today’s comments have prompted markets to price in the prospect of a return to 50bps in just over 2 weeks’ time. We of course still have to navigate the payrolls report on Friday and the CPI next week which could reverse this. Weak readings here could see today’s up moves in yields reverse, however even if they don’t an upshift to 50bps after downshifting to 25bps would not be a good look.

Nonetheless, higher for longer appears to be the new narrative and the Fed won’t want to be seen to flip flop on the pace of rate hikes, which means 25bps remains the most probable outcome with hawkish guidance.

The owner of Facebook and Instagram, Meta Platforms shares have edged higher on reports it is set to announce that it will be cutting thousands more positions on top of the 11k reduction it announced at the end of last year.

Dick’s Sporting Goods shares have moved higher after reporting a 5.3% rise in Q4 comparable sales, and better than expected profits of $2.93c a share. Net sales came in at $3.6bn a rise of 7.3% year on year. The retailer also upgraded its 2024 guidance expectations for EPS to $12.90 to $13.80c a share, while expecting only a modest 0-2% rise in comparable sales. .

Rivian shares have slumped after the electric car maker announced it was looking to raise $1.3bn in green bonds to help boost the launch of its R2 electric vehicles.

FX

The US dollar is broadly positive, pushing higher across the board, getting a big uplift in the wake of Powell’s comments to US lawmakers.

The Australian dollar is the worst performer falling below its lowest levels this year, taking out its January lows, despite the RBA raising rates by 25bps as expected to 3.6%.

The RBA issued what can only be described as dovish guidance even as they admitted that further interest rate rises were likely if data continued to come in hot. The central bank went on to say that inflation may have peaked and that the bar to further tightening is likely to be dependent on developments in the global economy, trends in household spending and the outlook for inflation.

The pound is also on the back foot despite comments from external MPC member Catherine Mann that called for further rate hikes, slipping back towards the January lows.

The euro is also finding it difficult to rally despite increased calls for further multiple 50bps rate hikes in the wake of next weeks expected 50bps rate move.

Commodities

The strength of the US dollar is also weighing on the commodity complex, with crude oil prices retreating from one-month highs, in the wake of Powell’s comments.

Precious metals prices are also sliding on the back of today’s US dollar strength as well as a reassessment of global demand in the wake of China’s setting of a lower-than-expected 2023 GDP target.

Platinum, Palladium and Silver are all down heavily, while gold prices are also lower on the back of the spike higher in yields and the firmer US dollar.

Copper prices are also on the back foot.

Volatility

Another 7.5% uptick in the THG share price on Monday kept the e-commerce group high up in the list of most active single stocks. Many see this as a grossly undervalued firm and with full-year results looming it appears there’s some hope this could offer up meaningful support. One day vol sat at 126.31% against 104.47% for the month.

Some signs of dollar weakness eroded the value of precious metals on Monday, although the impact of this on platinum proved to be short-lived. The metal traded in a close on 2% range as a result, with one-day volatility coming in at 34.96% against 29.76% for the month.

Copper also had a turbulent session with those downbeat growth estimates out of China serving to weigh. One-day volatility on spot copper printed 24.65%, a little ahead of the 22.9% seen for the month. Again, prices here could be vulnerable to any significant move in the value of the US Dollar.

And hotter than-expected inflation data out of Switzerland at the start of the week serve to bolster support for the Franc, even if the pace of price increases sits well below those seen in Europe and the US. That however drove volatility on CHF crosses, with the daily reading against the Euro coming in at 6.39% against 5.36% for the month.

CMC Markets erbjuder sin tjänst som ”execution only”. Detta material (antingen uttryckt eller inte) är endast för allmän information och tar inte hänsyn till dina personliga omständigheter eller mål. Ingenting i detta material är (eller bör anses vara) finansiella, investeringar eller andra råd som beroende bör läggas på. Inget yttrande i materialet utgör en rekommendation från CMC Markets eller författaren om en viss investering, säkerhet, transaktion eller investeringsstrategi. Detta innehåll har inte skapats i enlighet med de regler som finns för oberoende investeringsrådgivning. Även om vi inte uttryckligen hindras från att handla innan vi har tillhandhållit detta innehåll försöker vi inte dra nytta av det innan det sprids.