Tomorrow’s US non-farm payrolls report covering August is set to be released at 1.30pm (UK time), and comes at a crucial time, with doubts about the strength of the economic cycle increasing volatility in cyclical assets. This data could confirm or dispel growing recession concerns.

Will recession warnings be confirmed?

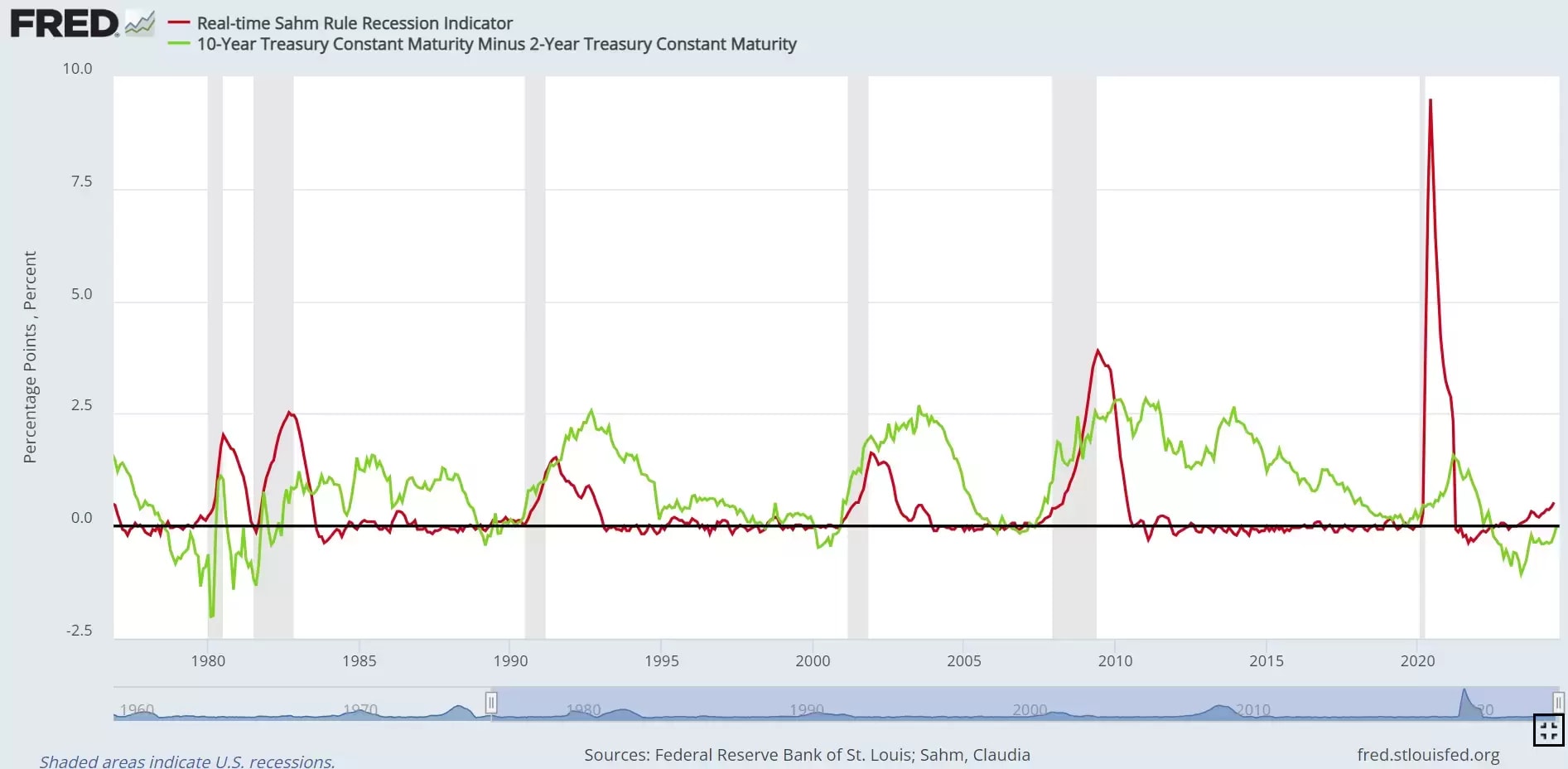

The economy is slowing, with key recession indicators being triggered. The yield curve is de-inverting after a long period of inversion, driven by a sharp drop in short-term interest rates, signalling possible steep rate cuts. The market sees a 43% chance that the US Federal Reserve may cut interest rates by 50 basis points, marking a departure from its 25-point comfort zone.

Additionally, the unemployment rate is rising sharply, triggering a recession alert based on the Sahm rule, which activates when unemployment over the past three months increases by more than half a percentage point from the 12-month low.

Sahm's real-time recession indicator (red) and US 10-year and 2-year rate spread (green); grey background implies recession.

Consensus and potential impact

The Thomson Reuters market consensus expects an improvement from July, with 160,000 jobs created (compared to 114,000 the previous month) and unemployment dropping from 4.3% to 4.2%.

• If the data aligns with market expectations, a "Goldilocks" scenario of soft economic growth could remain, benefiting risk assets like stocks and cyclical commodities, while potentially weakening defensive assets like bonds and gold.

• A negative surprise (under 100,000 jobs and unemployment at or above 4.3%) could raise recession fears and hurt risk assets as investors shift to defensive assets.

• A positive surprise (over 220,000 jobs and unemployment at or below 4.2%) would signal a strong economy. Safe-haven assets might suffer, while stocks could stagnate due to potential rate hikes.

CMC Markets erbjuder sin tjänst som ”execution only”. Detta material (antingen uttryckt eller inte) är endast för allmän information och tar inte hänsyn till dina personliga omständigheter eller mål. Ingenting i detta material är (eller bör anses vara) finansiella, investeringar eller andra råd som beroende bör läggas på. Inget yttrande i materialet utgör en rekommendation från CMC Markets eller författaren om en viss investering, säkerhet, transaktion eller investeringsstrategi. Detta innehåll har inte skapats i enlighet med de regler som finns för oberoende investeringsrådgivning. Även om vi inte uttryckligen hindras från att handla innan vi har tillhandhållit detta innehåll försöker vi inte dra nytta av det innan det sprids.