Guaranteed stop-loss orders

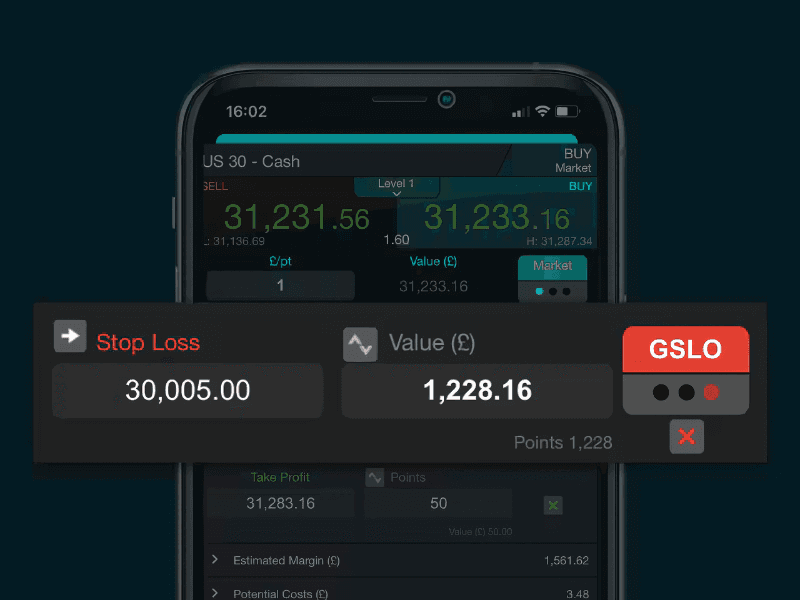

A guaranteed stop-loss order (GSLO) is a type of risk management tool that works in the exact same way as a regular stop-loss, except for the fact that, for a premium charge, it guarantees to close you out of a trade at the price you specify, regardless of market volatility or gapping.

Guaranteed stop-losses are particularly useful when market conditions are volatile and prices can fluctuate suddenly from one level or another, without passing the level in-between. This is called price gapping or slippage, which can occur following major economic events and news announcements. It can also occur on weekends, where prices open at a significantly different level than the previous close.

This article explains exactly what a guaranteed stop-loss order is, along with its various settings and how to set a GSLO on our online trading platform, Next Generation.

What is a guaranteed stop?

A guaranteed stop-loss order belongs alongside a traditional stop-loss order and a trailing stop-loss, all of which vary in the level of restriction. In particular, when placing a guaranteed stop-loss order, you need to follow certain rules and specifications. These include the following:

You can only place GSLOs during trading hours.

GSLOs must be placed at least a minimum distance away from the current market price. This distance is displayed within the product overview and a warning will appear if you try to place it closer.

If you add a GSLO to an open margin trade, the margin required will be the greater of the regulatory margin requirement or the maximum loss for that trade based on your GSLO.

GSLOs come with a premium charge, as this guarantees that you will close out your position at your specified price. This cost is based on the current market price in your account currency.

The original GSLO premium is refunded if it is not triggered. This can occur when it is removed from an open trade, changed to a regular or trailing stop-loss, when a take-profit order is triggered, or when an open trade is closed manually.

Modifications are free of charge and you can either cancel a GSLO or switch to a regular or trailing stop-loss.

Outside of trading hours, you can move the price of the GSLO further away from the current market price, instead of closer.

It is possible to set GSLOs as default when loading an order ticket through ‘Order Settings’. If you use minimum position margin, the default value will equal the GSLO’s minimum distance.

If you wish to place, modify or cancel a GSLO, you must ensure that you have sufficient available funds in your account to cover any increase in position margin as a result. Failure to pay any GSLO premium due in full may result in your GSLO being rejected or removed.

CFD guaranteed stop-loss

Traders are also able to place guaranteed stop-loss orders on their CFD positions (contracts for difference). CFDs are derivative products that enable you to trade on the price movements of the underlying financial asset without taking ownership.

Learn more about CFD trading or open a CFD demo account.

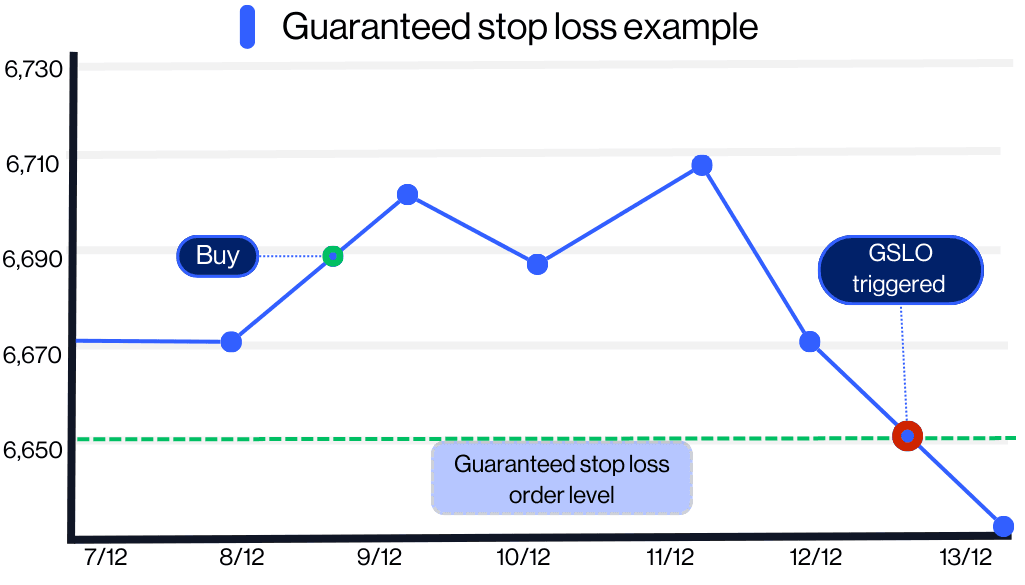

Guaranteed stop-loss example

Here is an example of a guaranteed stop-loss in action. Let’s say that you want to go long on the UK 100 stock index and our current sell/buy price is 6,694/6,695. You decide to buy one unit at 6,695. You are concerned about market volatility, so you decide to safeguard the trade by placing a GSLO at 6,650 to limit your losses, should the market go against you. In this example, the cost of placing a GSLO on your unit is $1.

An unexpected economic event takes place in the form of interest rate cuts by the US Federal Reserve. This causes volatility within the market overnight, leading the UK 100 to gap by 90 points. The following morning, the index opens at 6,604/6,605.

As you had placed a guaranteed stop-loss order, your trade closed out at 6,650, resulting in a loss of $45 (6,695-6,650 x 1).

If you hadn’t placed a guaranteed stop on your position, your trade would have closed at the next available price, which in this case was 6,605. This means that you could have lost $90 (6,695-6,605 x 1).

Additional information about GSLOs

Account positions screen

Trades with a GSLO attached are displayed in an aggregate area in the ‘Positions’ tab underneath positions placed using a standard margin requirement. You have the ability to close or reduce all standard margin positions, close all prime margin positions or close all positions for a particular instrument. Alternatively, you can close out each position individually.

Account close-out

There are two possible close-out levels that can be applied to a trading account, depending on how your open positions are set up:

If there are standard margin positions on the account, the close-out level used will be the standard close-out. These will be closed before prime positions.

If there are prime margin positions, the close-out level used will be the prime close-out. This type can close positions using both standard margin and prime margin.

For ease of use, we display the cash value of these levels, rather than just a percentage, but you can still view the relevant close-out percentage levels for your account.

Guaranteed stop-loss broker

Our trading platform, Next Generation, comes with a range of execution and order types, including GSLOs, regular and trailing stop-losses and take-profit orders. We understand how important risk management is for your trading success, which is why we offer a diverse range of stop-loss orders.

Open a live account to start trading the financial markets now

Open a demo account to practice risk-free with virtual funds

A stop-loss order is a regular market order that can help to manage your risk by closing a trade at a pre-determined price. This risk-management tool can help to minimize any losses on a trade. Besides a classic stop-loss order, trailing stop-loss orders and guaranteed stop-loss orders are also available to use.

A guaranteed stop-loss order (GSLO) is a type of risk-management tool that works in the same way as a regular stop-loss, except that, for a premium charge, it guarantees to close you out of a trade at the price you specify, regardless of market volatility or gapping. The premium is refunded if the GSLO is not triggered.

A trailing stop-loss order is similar to a standard stop-loss order, but it moves with a positive trend direction, remaining at the distance specified when the order was placed, while staying static during negative trend movements. A trailing stop-loss can help a trader follow the classic mantra of ‘cut your losses and let your profit run’.

You can set up a stop-loss order when placing a trade on an order ticket. You can choose between a stop-loss, trailing stop-loss or guaranteed stop-loss order. Your choice of stop-loss order should be pre-determined in your risk-management strategy. See how risk management is a key part of any trader’s strategy.

Do you have any questions?

Our client services team is here whenever the markets are open.

Email us at clientmanagement@cmcmarkets.ca or call us on 1-866-884-2608.