CFD trading examples

Want to get started in CFD trading, but don’t know how? Our CFD trading examples will guide you through opening and closing trade positions, and calculating your profits or losses from your trades.

From initial impressions it may seem that CFD trading is more complicated than traditional trading, but as you will see from these examples, that’s not necessarily the case.

How to trade CFDs

The following steps provide a brief overview of CFD trading:

- Open a live CFD trading account – With CMC Markets you can open a live account to trade CFDs across a huge range of global markets.

- Choose the financial instrument – Choose the instrument, such as EUR/USD or UK 100, that you want to trade on. We offer CFDs across a wide range of global markets, including forex, indices, commodities, shares and treasuries.

- Choose to buy or sell – Buy (go long) if you think prices will rise, or sell (go short) if you think prices will go down.

- Enter a trade size – Decide on how many units you want to trade. The value of one CFD unit can vary depending on the instrument you’ve chosen to trade.

- Manage your risk – Select from a range of stop-loss orders, including guaranteed stop-loss orders (GSLOs). GSLOs work exactly the same as regular stop-loss orders except that for a premium, they guarantee to close you out of a trade at the price you specify regardless of market volatility or gapping. The premium is refunded in full if the GSLO is not triggered.

- Monitor your position – After placing your trade, monitor your open positions (including any stop orders or take-profit orders) to follow your real-time profit or loss.

- Close your position – If your trade is not automatically closed out as a result of a stop or take-profit order being triggered, close your trade when you are ready.

Calculating CFD profits and losses

Our CFD trading examples below offer a good way to learn how trading CFDs works, as it can help to see a trade in practice to fully understand the trading process. Whether you’re a beginner or a seasoned trader, these examples can help you to visualise making a trade, and the resulting profit or loss.

Your profit or loss is determined by the difference between the price you enter a trade at and the price you exit at. Remember that prices are always quoted with the sell price on the left and the buy price on the right.

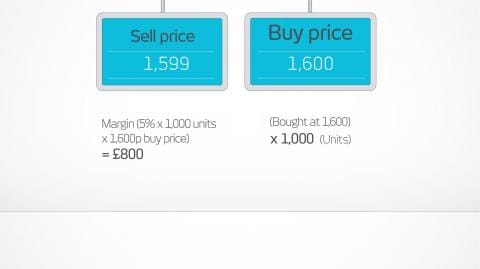

CFD example 1: buying ABC plc

In this CFD example, ABC plc is trading at a sell/buy price of 1,599/1,600p. Assume you want to buy 1,000 share CFDs (units) because you think the price will go up. ABC plc has a tier 1 margin rate of 5%, which means that you only have to deposit 5% of the position’s value as position margin.

In this example, your position margin will be £800 (5% x (1,000 units x 1,600p buy price)). Remember that if the price moves against you, it is possible to lose more than your initial position margin of £800.

Outcome A: a profitable trade

Your prediction was correct and the price rises over the next hour to a sell/buy price of 1,625/1,626. You decide to close your position by selling at 1,625 (the new sell price).

The price has moved 25 points (1,625 – 1,600) in your favour. Multiply this by the size of your position (1,000 units) to calculate your gross profit which is £250.

The total commission charges to open and close a buy position would be calculated as follows:

1,000 (units) x 1,600 pence (price) x 0.10% = £16.00

1,000 (units) x 1,625 pence (price) x 0.10% = £16.25

Total commission = £16.00 + £16.25 = £32.25

Therefore, your total profit on ABC plc is your gross profit minus total commissions.

£250 - £32.25 = £217.75 net profit

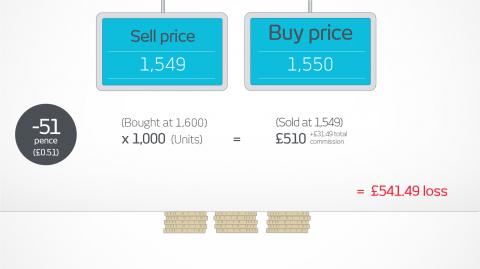

Outcome B: a losing trade

Unfortunately, your prediction was wrong and the price of ABC plc drops over the next hour to a sell/buy price of 1,549/1,550. You feel the price is likely to continue dropping, so to limit your potential loss you decide to sell at 1,549 (the new sell price) to close the position.

The price has moved 51 points (1,600 – 1,549) against you. Multiply this by the size of your position (1,000units) to calculate your loss, which is £510.

The total commission charges to open and close a buy position would be calculated as follows:

1,000 (units) x 1,600 pence (price) x 0.10% = £16.00

1,000 (units) x 1,549 pence (price) x 0.10% = £15.49

Total commission = £16.00 + £15.49 = £31.49

Therefore, your total loss on ABC plc is your gross loss + total commissions.

£510 + £31.49 = £541.49 net loss

CFD example 2: selling ABC plc

In this example, ABC plc is trading at a sell/buy price of 1,599/1,600p. Assume you want to sell 1,000 share CFDs (units) because you think the price will go down. ABC plc has a tier 1 margin rate of 5% which means that you only have to put forward 5% of the total position’s value from your own funds as position margin.

In this example, your position margin will be £799.50 (5% x (1,000 units x 1,599p sell price)). Remember that if the price moves against you, it is possible to lose more than your initial position margin of £799.50.

Outcome A: a profitable trade

Your prediction was correct and the price falls over the next hour to a sell/buy price of 1,549/1,550. You decide to close your trade by buying back at 1,550 pence (the new buy price).

The price has moved 49 pence (1,599 – 1,550) in your favour. Multiply this by the size of your position (1,000 units) to calculate your profit, which is £490.

The total commission charges to open and close a sell position would be calculated as follows:

1,000 (units) x 1,599 pence (price) x 0.10% = £15.99

1,000 (units) x 1,550 pence (price) x 0.10% = £15.50

Total commission = £15.99 + £15.50 = £31.49

Therefore, your total profit for your successful trade on ABC plc is your gross profit minus total commissions.

£490 - £31.49 = £458.51 net profit

Outcome B: a losing trade

Unfortunately, your prediction was wrong and the price of ABC plc rises over the next hour to 1,649/1,650. You decide to cut your losses and buy at 1,650 (the new buy price) to close the position.

The price has moved 51 points (1,650 – 1,599) against you. Multiply this by the size of your position (1,000 units) to calculate your loss, which is £510.

The total commission charges to open and close a sell position would be calculated as follows:

1,000 (units) x 1,650 pence (price) x 0.10% = £16.50

1,000 (units) x 1,599 pence (price) x 0.10% = £15.99

Total commission = £16.50 + £15.99 = £32.49

Therefore, the total loss on your ABC plc trade is your gross loss + total commissions.

£510 + £32.49 = £542.49 net loss

CFD trading for beginners

When you start CFD (contracts for difference) trading as a beginner, you must first understand the basic process of trading CFDs, which is best exhibited with a demo account, where you can practise in a risk-free environment.

Once you learn the basics, you can progress on to advanced learnings within technical and fundamental analysis. However, as a beginner in CFD trading, our examples should help you understand how to work out profits and losses when trading. They also help you understand the CFD trading process. You should also be aware of the costs associated with trading CFDs.

CFD trading explained

CFD trading allows you to speculate on the price movements of an array of financial instruments. You can opt to go long and ‘buy’ if you believe the market price will rise, or go short and ‘sell’ if you think the market price will fall. You do not own the underlying asset you are speculating on, and therefore you are exempt from stamp duty. Find out more on our what are CFDs? page to help determine if they are right for you.

Commission explained

CFD commissions are only applicable for CFD shares. Therefore, opening and closing positions are commission-free for all forex, indices, cryptocurrencies, commodities and treasuries instruments. CFD share trades attract a commission charge for each trade. UK share trades cost 10 basis points (0.10%) with a £9 minimum commission charge per trade.

To determine how much commission you would pay, multiply your position size by the applicable commission rate.

Holding costs explained

If you hold any position after 5pm New York time, you will be charged a holding cost, or if the position has a fixed expiry the cost is built into the price of the product.

We calculate the holding rate applicable to the holding cost based on the risk-free or interbank rate of the currency in which the instrument is denominated. For example, the UK 100 (pound sterling) is based on the Sterling Overnight Index Average (SONIA) interest-rate benchmark. For buy positions, we charge 0.0082% above SONIA and for sell positions you receive SONIA minus 0.0082%, unless the underlying risk-free or interbank rate is equal to or less than 0.0082%, in which case sell positions may incur a holding cost.

You can view your historic holding costs from the 'account' menu and then choosing the 'history' tab.

View further information on how CFDs work and the benefits of CFD trading, such as going short and hedging physical shares.

Why trade CFDs with CMC Markets?

Here at CMC Markets we have been experts in CFD and spread betting trading since 1989. With 35 years’ experience in trading on the financial markets, you can be confident you’re trading CFDs with the right provider. We have a dedicated support team available 24 hours a day from Sunday evening through to Friday evening, to assist you with any problems you might have. There’s a lot to consider when choosing a trading partner, so make sure you visit our ‘why CMC’ page to see what makes us different.

Open a live CFD account to start trading CFDs.