Difference between spread betting vs CFD trading

Spread betting and CFD trading are margined products and can provide similar economic benefits to investments in shares, indices, commodities and currencies.

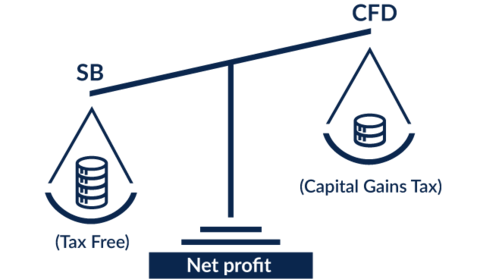

A form of financial derivatives trading, spread betting is popular with UK residents because profits are exempt from capital gains tax and stamp duty*.

See below for some of the main characteristics of spread betting and CFD trading.

Spread betting vs CFDs

The key difference between spread betting and CFD trading is how they are treated for taxation. Spread betting is free from capital gains tax (CGT) while CFD trading requires you to pay CGT*. Spread betting is also only available in the UK or Ireland, while CFDs are available globally.

| Spread betting | CFD trading | |

|---|---|---|

| Tax-efficient trading | Unlike share trading, profits made from spread betting are exempt from stamp duty and capital gains tax (CGT) in the UK*. | Since you don't own the underlying asset when trading CFDs, there is no stamp duty to pay*. However, you will be subject to capital gains tax. |

| Who can spread bet and trade CFDs? | Only available to customers who reside in the UK or Ireland. | Available to customers globally. |

| Short selling | You can go long as well as short so you can take a long position when market prices are rising or open a short position when prices are falling. | Ability to go long as well as short so you can take a long position when market prices are rising or open a short position when prices are falling. |

| Commission charge | When spread betting shares on our platform, no additional commission will be charged to your account (other fees and charges apply). | When trading CFD shares on our platform, a commission will be charged to your account upon execution of any order. This is in addition to the spread. |

| Spreads and holding costs | An additional spread is built into the prices displayed on our platform, which is applicable upon execution of any order. Holding costs may apply to spread bets. | With CFDs, holding costs may apply. |

| Calculating profit and loss | To calculate your profit or loss, find the difference between the price at which you enter and the price at which you exit, then multiply this difference by your stake. | With CFDs, your profit or loss is determined by the difference between the price at which you enter and the price at which you exit, multiplied by the number of CFD units. |

| Margined trading** | Spread betting is a financial leveraged product, which means you only need to deposit a small percentage of the full value of the spread bet in order to open a position. | CFDs are a leveraged product, which means that you only need to deposit a small percentage of the full value of the trade in order to open a position. |

How does spread betting work?

When you spread bet, you choose whether the price of a product or financial instrument (such as a share, stock index, currency pair or commodity) is likely to go up or down, and decide how much to bet. The amount you wish to bet per point of movement in price is your stake.

If the product's price moves in your favour, your profit is calculated by multiplying your original stake size by the number of points the instrument has moved. If it goes against you, your loss will be calculated in the same way. Remember, losses can exceed deposits.

Find out more about spread betting

How do CFDs work?

When trading CFDs, you buy or sell a number of units or a specific amount of CFDs in an instrument, similar to the way you would when trading physical instruments. With CFD trading however, you don't own the underlying asset and have the ability to trade on margin. This allows you to take a position with a notional value of much more than the amount of money you are required to deposit.**

Find out more about CFD trading

*Tax treatment depends on your individual circumstances. Tax law can change or may differ in a jurisdiction other than the UK.

**Remember, when trading on margin the amount you will be required to deposit reflects a percentage of the full value of the position. This means that your losses will be amplified and you could lose more than your deposits. Trading using margin is not necessarily for everyone and you should ensure you understand the risks involved and, if necessary, seek independent professional advice before placing any trades.