Platform trading tools

Whether you’re spread betting or trading CFDs, Next Generation provides a number of platform trading tools such as client sentiment charts and pattern recognition to help you analyse the markets and identify potential trading opportunities.

Client sentiment

Our client sentiment feature shows you the percentage of CMC Markets clients who have bought versus the percentage who have sold on a particular product, so you can gain an understanding of other clients' expectations. You can also see the monetary value of these positions as a percentage.

'All' and 'Top' client data

You can choose to view data for ’All Clients’ with an open position in a product, or filter out the noise by switching to the 'Top Clients’ view to see data from only top clients who have made an overall profit* on their account over the last three months.

Updated every minute

Our client sentiment analysis data is updated every minute, meaning these valuable insights are based on almost real-time information. This is especially useful during volatile periods when market prices can change rapidly.

See sentiment changes

Compare the up-to-the-minute sentiment (wide outer circle) with the figure at 10pm (UK time) the previous day (inner circle) to gauge recent changes in client trading.

Get trade ideas

Use the 'Also being Traded' section as a source of trading ideas. It shows which other products are being traded by clients that are currently trading the product you're viewing.

Multiple layouts

Our range of platform trading tools include multiple layouts, which enable you to create and save up to five different trading layouts within the platform. This gives you a much larger trading dashboard and lets you use the space more efficiently. Switch between layouts quickly and easily via the quick links in the top navigation toolbar.

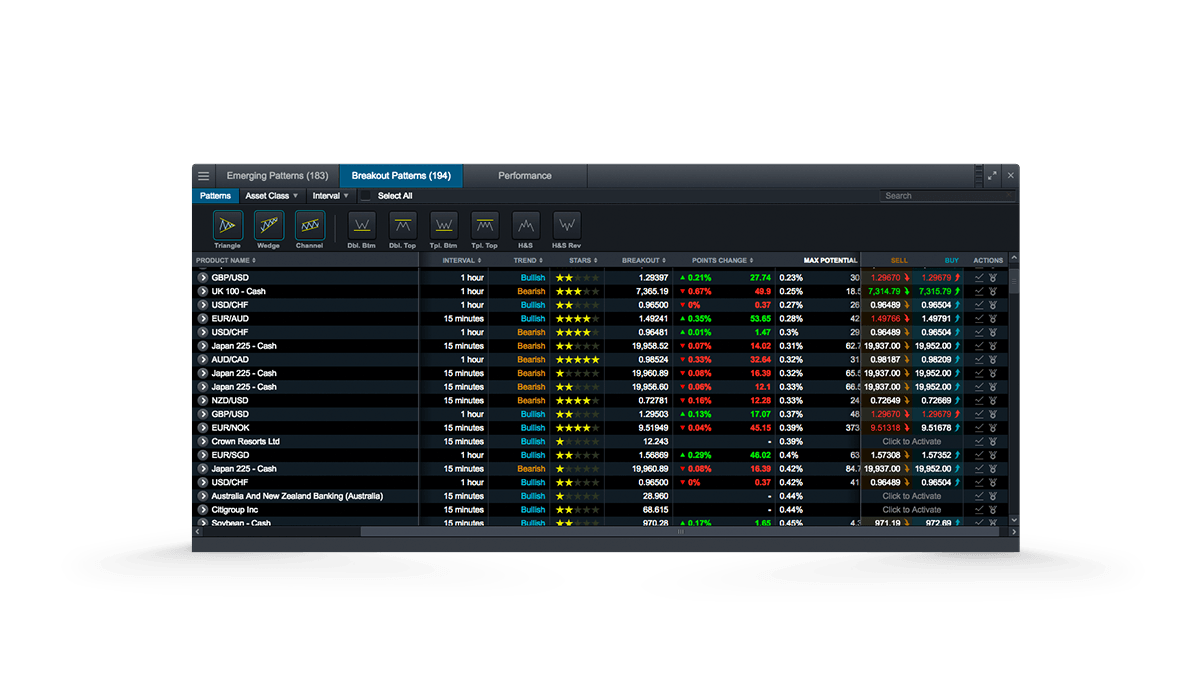

Pattern recognition scanner

Pattern recognition scanner is another feature of our platform trading tools. Scan over 120 of our most popular products every 15 minutes for emerging and completed chart patterns such as wedges, channels and head and shoulders formations. Set up automatic alerts so you're notified of technical trade set-ups and potential trading opportunities.**

Price projection box

When patterns complete, a price projection box is generated using technical analysis to highlight where the price action could go on the instrument's chart. You can use the inbuilt back-testing tool to measure the historical performance of each pattern and see how frequently price has hit the projection box.

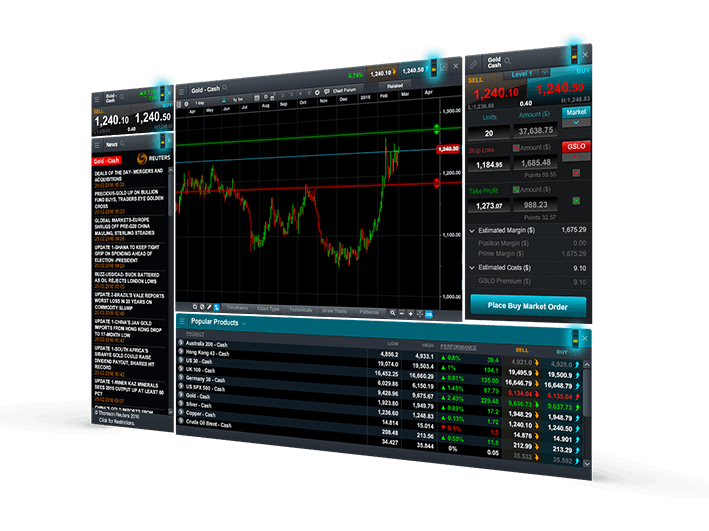

Module linking

This feature allows you to group different modules together, so that when you change the product shown in one module, all of the other grouped modules will automatically update to show the new product. You can link your watchlists to Reuters market news, client sentiment, charts and order tickets to quickly analyse your favourite products and place trades.

*Overall profit takes into account spreads and commissions. 'Top Clients' refers to overall account performance and is not specific to performance in that particular CMC Markets product.

**The pattern recognition scanner is for general information only and is not intended to provide trading or investment advice. We do not guarantee the accuracy, completeness or timeliness of the data. All analysis, resulting conclusions and observations in the Pattern Recognition Scanner are based upon historical chart information and patterns which are in turn based upon historical CMC Markets trading data and not data relating to the ultimate underlying instrument(s). Note that our charts display prices denominated in the underlying currency for the instrument. Any information relating to past performance does not necessarily guarantee future performance. The use of charting data has inherent limitations and you should not use this data solely to decide (or assist you in determining) which instrument to buy or sell.