Forex trading

Spread bet or trade CFDs on 300+ forex pairs on our award-winning platform1. Trade major, minor or exotic currencies with tight spreads, lightning-fast execution2, and dedicated customer support 24/5.

Licensed and regulated in the EU

35 years' expertise

Search instruments:

A superior platform for forex traders

We've got your pair

With over 300 available, we've got more FX pairs than any other broker1.

Reuters news

Get the latest news and analysis from Reuters3, free for live account holders.

Minimal slippage

With fully automated, lighting-fast execution in 0.0030 seconds2.

Regulated in the EU

CMC Markets Germany GmbH is regulated by the German Federal Financial Supervisory Authority under registration number 154814.

Dedicated client service

Our experienced customer service team is available from Friday nights to Sunday nights, whenever you need them.

No partial fills

Get the trade you want – we don't reject or partially fill trades based on size.

More FX pairs than anyone else1

Get exposure to over 300 currency pairs with spreads from as low as 0.5 pips. Trade on favourites like GBP, USD and EUR through to less popular currencies like the Turkish lira and Norwegian krone, on the world's most liquid market.

Other popular instruments

Pricing is indicative. Past performance is not a reliable indicator of future results.

See our forex costs

Whether you trade on majors, minors or our exclusive forex indices, you need to keep an eye on fees. That's why we strive to be transparent about our pricing - check out our spreads, holdings costs for trades held overnight, and margin rates on our most popular forex pairs.

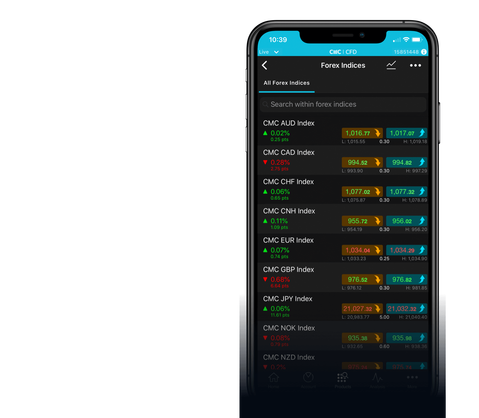

Trade on forex indices

EXCLUSIVE TO CMC

Expecting a significant update from the US Federal Reserve? Our forex indices are a collection of related, strategically-selected pairs, grouped into a single basket. Trade on 12 baskets of FX pairs, including the CMC USD Index.

The platform built for forex trading

Fast execution, precise charting, and accurate insights are vital to your success as a forex trader. Our award-winning forex trading platform1 was built with the successful forex trader in mind.

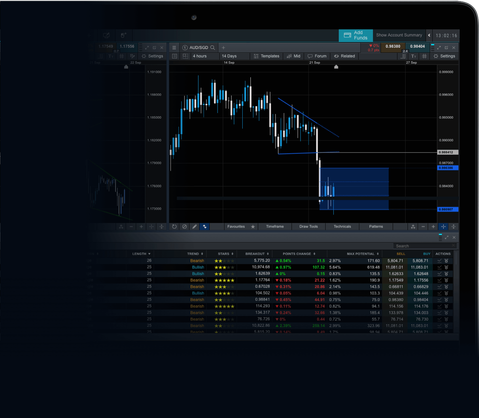

Pattern recognition scanner

We automatically scan over 120 of our most popular instruments every 15 minutes for emerging and completed chart patterns, such as wedges, channels and head & shoulders formations.

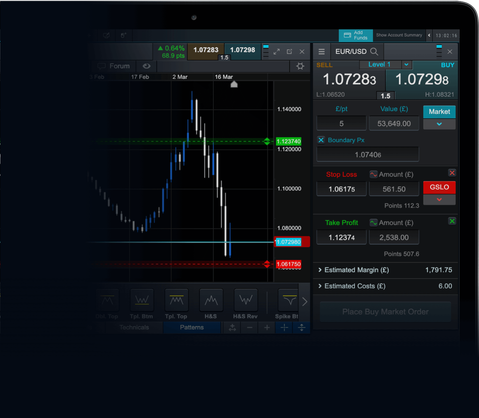

Advanced order execution

We offer a range of advanced order types, including trailing and guaranteed stop losses, partial closure, market orders and boundary orders on every trade, so you have the flexibility to trade your way.

Award-winning app1

Extensive charting tools

No. 1 Platform Technology (UK)

ForexBrokers.com

Industry Pioneer (Germany)

Focus Money, Test Edition 36/2022

Best CFD Provider (UK)

Online Money Awards

Best Spread Betting Provider (UK)

The City of London Wealth Management

3 ways to trade forex with CMC Markets

As a forex trader, you can spread bet or trade CFDs on currency pairs with our proprietary trading platform, via your desktop PC, or on our optimised trading app. You can also trade forex CFDs on the popular MT4 platform with us.

Desktop trading

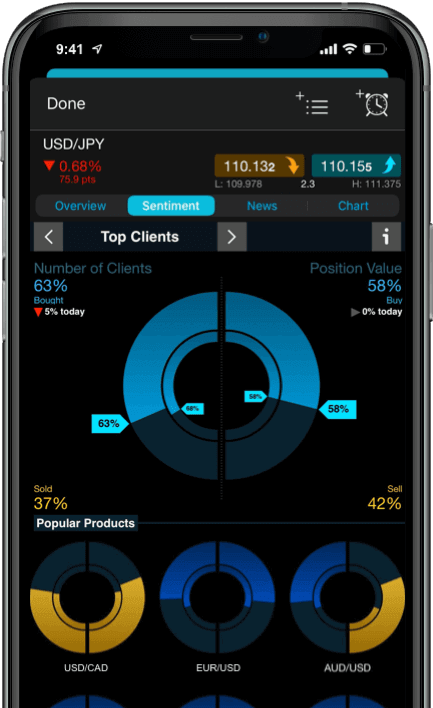

Trading apps

Selected trading strategies

Innovative trading

on the go

Trade like you’re on a desktop, on your mobile. Our award-winning mobile trading app1 allows you to seamlessly open and close trades, track your positions, set up notifications and analyse mobile-optimised charts.

FAQs

New to CMC Markets?

Is it free to open an account?

There's no cost when opening a live spread betting or CFD trading account. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you will need to deposit funds in your account to place a trade. Learn about the costs involved in spread betting and CFD trading

What are the costs of trading on forex?

There are a number of costs to consider when spread betting and CFD trading, including spread costs, holding costs (for trades held overnight which is essentially a fee for the funds you borrow to cover the leveraged portion of the trade), rollover costs for expired forward trades, and guaranteed stop-loss order charges (if you use this risk-management tool).

Is CMC Markets regulated?

CMC Markets Germany GmbH is a company authorized and regulated by the German Federal Financial Supervisory Authority (BaFin) under registration number 154814. CMC Markets meets the requirements of Section 84 of the German Securities Trading Act (WpHG) with regard to customer funds. It keeps retail client funds separate from its own funds in segregated bank accounts.

How does CMC Markets protect client funds?

CMC Markets Germany GmbH is a company authorized and regulated by the Federal Financial Supervisory Authority (BaFin). CMC Markets meets the requirements of Section 84 of the German Securities Trading Act (WpHG) with regard to customer funds. It keeps retail client funds separate from its own funds in segregated bank accounts. In the unlikely event that CMC Markets Germany GmbH is unable to meet its financial obligations, the EdW would cover up to 90% of the receivables from transactions (maximum EUR 20,000) provided certain criteria are met.

How does CMC Markets make its money?

Our income comes primarily from our spreads and commissions, while other charges - such as overnight holding costs - make a small contribution to our total revenue.

New to forex trading?

What is online forex trading?

FX trading, also known as foreign exchange trading, or forex trading, is the exchange of different currencies on a decentralised global market. It's one of the largest and most liquid financial markets in the world. Forex trading involves the simultaneous buying and selling of the world's currencies on this market. What is forex trading and how does it work?

How can you trade on forex?

When trading forex, you speculate on whether the price of one currency will rise or fall against another. For example, if you believe that the value of the Euro will rise, relative to the value of the US dollar, you would go ahead and trade the EUR/USD pair. Learn how to trade forex in Ireland

What are some forex trade examples?

To help you understand how forex trading works, view our CFD examples, which takes you through both buying and selling scenarios. See forex trading examples

What is margin in forex?

Forex margin rates are usually expressed as a percentage, with forex margin requirements typically starting at around 3.3% for major foreign exchange currency pairs. Your FX broker’s margin requirement shows you the leverage you can use when trading forex with that broker.

What is leveraged trading?

One of the advantages of spread betting and trading CFDs is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can also amplify losses, so it’s important to manage your risk.

Why spread betting?

Spread betting allows you to trade tax-free on a wide range of financial markets 24 hours a day, from Sunday nights through to Friday nights. Trade on your phone, tablet, PC or Mac on a wide range of instruments using leverage. Remember, tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK or Ireland. Learn how spread betting works