Rates and bonds trading

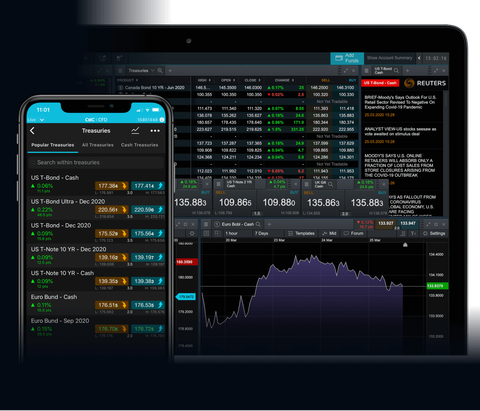

Trade on over 50 government bond and interest-rate instruments with leverage on our award-winning spread bet and CFD trading platform1.

Licensed and regulated in the EU

35 years' expertise

Search instruments:

More than a bonds trading platform

Over 50 global rates & bonds

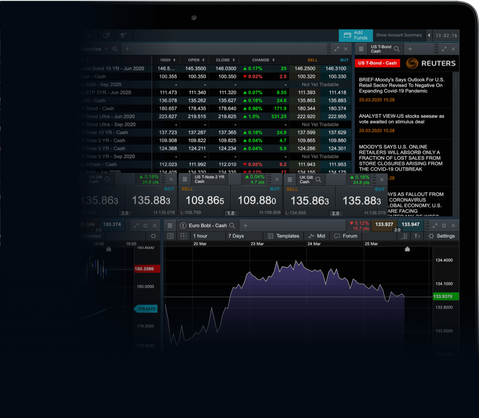

Spread bet and trade CFDs on interest rates and government debt obligations, such as gilts, bonds, bunds and treasury notes.

Reuters news

Get the latest news and analysis from Reuters2, free for live account holders.

Minimal slippage

With fully automated, lightning-fast execution in 0.009 seconds spread bet and CFD median trade execution time on CMC Markets' web and mobile platforms, 1 April 2024-31 March 2025. seconds3

Trade out of hours

Favourites like the US T-Bond trade up to 23 hours a day, so you don't have to stop when the underlying markets do.

Dedicated support

Our experienced customer service team is available from 24/5, whenever you need them.

No partial fills

And never any dealer intervention, regardless of your trade size.

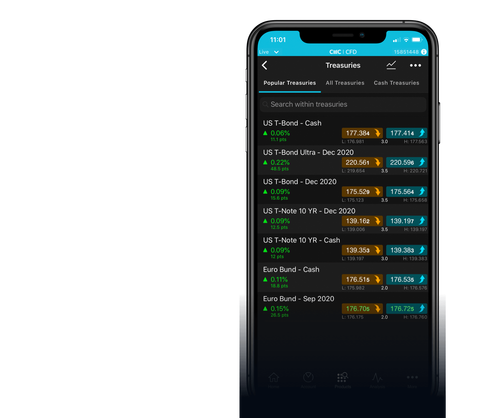

50+ rates and bonds at your fingertips

Get exposure to interest rates and government debt obligations, with spreads from as low as 1 point.

Other popular treasuries

Pricing is indicative. Past performance is not a reliable indicator of future results.

Our bonds trading costs

Whatever you trade, costs matter. We’re committed to keeping our costs as competitive as possible, whether you spread bet or trade CFDs on the US T-Note, UK Gilt or Eurodollar.

The platform built for bonds trading

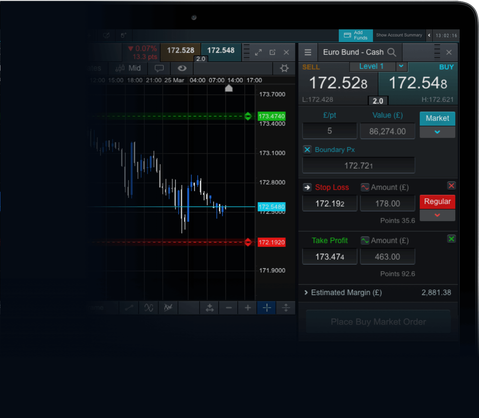

Fast execution3, exclusive insights and accurate signals are vital to your success as an interest rates and bond trader. Our award-winning trading platform1 was built with the successful trader in mind.

Industry-leading charting1

Analyse the markets with our wide selection of over 115 indicators and drawing tools, 70 chart patterns and 12 chart types.

Advanced order execution

We offer a range of advanced order types, including trailing and guaranteed stop losses, partial closure, market orders and boundary orders on every trade, so you have the flexibility to trade your way.

Reuters news and analysis2

Award-winning app1

No. 1 Platform Technology (UK)

ForexBrokers.com

Industry Pioneer (Germany)

Focus Money, Test Edition 36/2022

Best CFD Provider (UK)

Online Money Awards

Best Spread Betting Provider (UK)

The City of London Wealth Management

Innovative trading

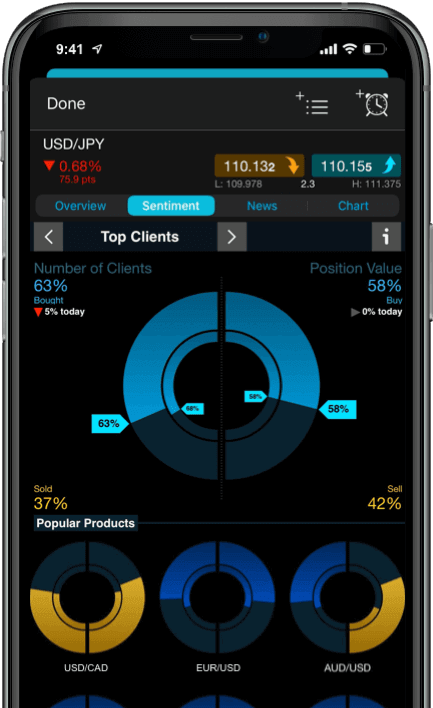

on the go

Trade like you’re on a desktop, on your mobile. Our award-winning mobile trading app1 allows you to seamlessly open and close trades, track your positions, set up notifications and analyse mobile-optimised charts.

FAQs

New to CMC Markets?

Is it free to open an account?

There's no cost when opening a live spread betting or CFD trading account. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you will need to deposit funds in your account to place a trade. Learn about the costs involved in spread betting and CFD trading

What are the costs of trading on bonds?

There are a number of costs to consider when spread betting and CFD trading, including spread costs, holding costs (for trades held overnight which is essentially a fee for the funds you borrow to cover the leveraged portion of the trade), rollover costs for expired forward trades, and guaranteed stop-loss order charges (if you use this risk-management tool).

Is CMC Markets regulated?

CMC Markets Germany GmbH is a company authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) under registration number 154814. CMC Markets meets the requirements of Section 84 of the German Securities Trading Act (WpHG) with regard to customer funds. It keeps retail client funds separate from its own funds in segregated bank accounts.

How does CMC Markets protect client funds?

CMC Markets Germany GmbH is a company authorised and regulated by the Federal Financial Supervisory Authority (BaFin). CMC Markets meets the requirements of Section 84 of the German Securities Trading Act (WpHG) with regard to customer funds. It keeps retail client funds separate from its own funds in segregated bank accounts. In the unlikely event that CMC Markets Germany GmbH is unable to meet its financial obligations, the EdW would cover up to 90% of the receivables from transactions (maximum EUR 20,000) provided certain criteria are met.

How does CMC Markets make its money?

Our income comes primarily from our spreads and commissions, while other charges - such as overnight holding costs - make a small contribution to our total revenue.

New to rates and bonds trading?

What are bonds?

A bond is a fixed-income instrument, or debt security, and represents a long-term lending agreement between a borrower and lender – effectively an ‘IOU’. The bond issuer is often a corporation or a government, and the funds are used to finance a project or operation.

What are the costs of trading on treasuries?

There are a number of costs to consider when spread betting and CFD trading, including spread costs, holding costs (for trades held overnight which is essentially a fee for the funds you borrow to cover the leveraged portion of the trade), rollover costs (for expiring forward positions) and guaranteed stop-loss order charges (if you use this risk-management tool).

Find out more about our costs

What is leveraged trading?

One of the advantages of spread betting and trading CFDs is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can also amplify losses, so it’s important to manage your risk.

Why spread betting?

Spread betting allows you to trade tax-free on a wide range of financial markets 24 hours a day, from Sunday nights through to Friday nights. Trade on your phone, tablet, PC or Mac on a wide range of instruments using leverage. Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.