What is spread betting?

Spread betting is a tax-efficient* way of speculating on the price movement of thousands of global financial instruments, including indices, shares, currency pairs, commodities and treasuries.

When you spread bet, you take a position based on whether you expect the price of an instrument to rise or fall in value. You will make a profit or loss based on whether or not the market moves in your chosen direction. Traders can open a spread betting account with the intention of trading at home or on-the-go, thanks to advances in desktop and mobile technology.

With spread betting, you don't buy or sell the underlying asset (for example a physical share or commodity). Instead you place a bet based on whether you expect the price of a product to go up or down in value. If you expect the value of a share or commodity to rise, you would open a long position (buy). Conversely, if you expect the share or commodity to fall in value, you would take a short position (sell).

How spread betting works: what is a spread bet stake?

With spread betting, you buy or sell a pre-determined amount per point of movement for the instrument you are trading, such as £5 per point. This is known as your spread bet 'stake' size. This means that for every point that the price of the instrument moves in your favour, you will gain multiples of your stake times the number of points by which the instrument price has moved in your favour. On the other hand, you will lose multiples of your stake for every point the price moves against you. See our spread betting examples for more on how to spread bet.

What is a spread?

The difference between the buy price and sell price is referred to as the spread. As one of the leading providers of spread betting in the UK, we offer consistently competitive spreads. See our range of markets page for more information about our spreads.

What is margin or leverage?

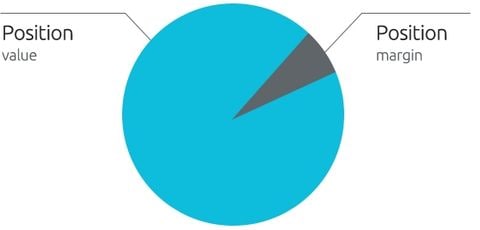

Spread betting is a leveraged product, which means you only need to deposit a small percentage of the full value of the spread bet in order to open a position (also called 'trading on margin'). While margined (or leveraged) trading allows you to magnify your returns, losses will also be magnified as they are based on the full value of the position.

Learn more about margined trading

Spread betting benefits

Many investors choose to spread bet on the financial markets as spread betting offers a number of benefits over buying physical shares:

- You can sell (go short or short sell) if you think the price of a product is going to fall

- You can trade on margin, so you only need to deposit a small percentage of the overall value of the trade to open your position

- Profits are tax-free*

- You can trade on global share markets, as well as spread betting forex, indices and commodities

- There is no separate commission charge to pay on spread bets (other fees and charges apply)

- Access to 24-hour markets

- There is no stamp duty* to pay

Sign up for a risk-free demo account or a live account now.

Are there any risks?

- The use of leverage can lead to loss of capital if your trade is unsuccessful, and even margin calls or account close-outs.

- You are also subject to costs such as overnight fees, which can be positive or negative depending on the direction of your position and the applicable holding rate.

- The financial markets can be volatile and lead to gapping and slippage of your positions, so it’s important that you monitor your positions carefully.

Understanding what can affect price movements

It's a good idea to keep up to date with current affairs and news because real-world events often influence market prices. To take a historic example, let's look at the Help to Buy housing scheme announced by the UK government a while ago.

Spread betting example

Many believed that this scheme would boost UK homebuilders' profitability. Let's say you agreed and decided to place a buy spread bet on Barratt Developments at £10 per point just before the market closed.

Let's say that Barratt Developments was trading at 255 / 256 (where 255 is the sell price and 256 is the buy price). In this example the spread is 1.

Let's assume that you opened a long position at £10 per point because you thought the price of Barratt Developments would go up. For every point that Barratts' share price moved up or down, you would have netted a profit or loss multiplied by your stake amount.

Outcome A: winning bet

Let's say your prediction was correct and Barratt Developments' shares then rose to 346 / 347. You decide to close your buy bet by selling at 346 (the current sell price).

The price has moved 90 points (346 sell price – 256 initial buy price) in your favour. Multiply this by your stake of £10 to calculate your profit, which is £900.

Outcome B: losing bet

Unfortunately, your prediction was wrong and the price of Barratt Developments' shares dropped over the next month to 206 / 207. You feel that the price is likely to continue dropping, so to limit your losses you decide to sell at 206 (the current sell price) to close the bet.

The price has moved 50 points (256 – 206) against you. Multiply this by your stake of £10 to calculate your loss, which is £500.

See our detailed spread betting examples.

Learn more about spread betting with us, or if you're ready to trade, open a live account now.

Losses are based on the full value of the position. Past performance is not indicative of future performance.

^Prices are taken from our platform. Our prices may not be identical to prices for similar financial instruments in the underlying market.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.