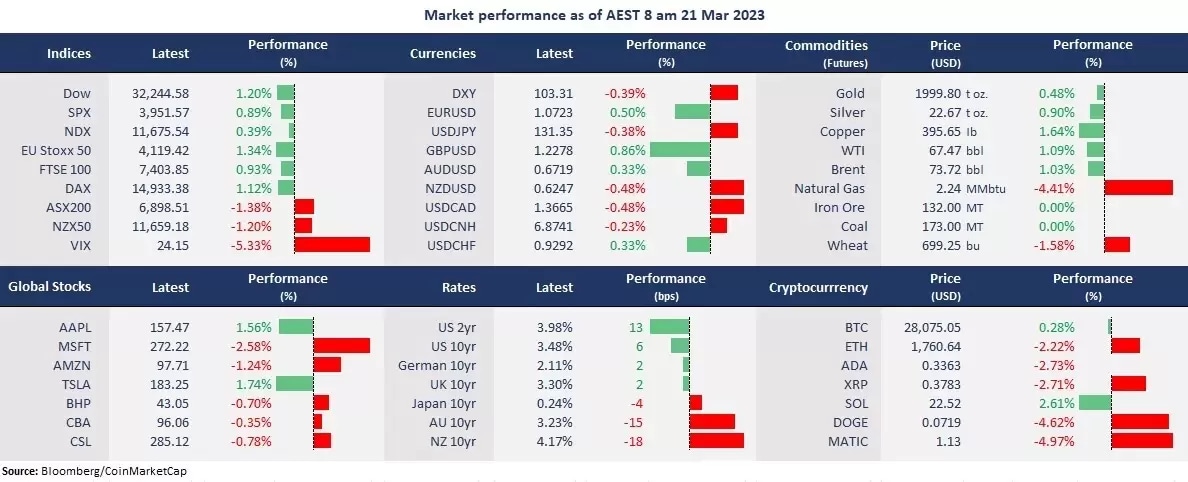

Both the EU and US markets finished higher after a wild session following UBS’s $3.2 billion acquisition of Credit Suisse. Banking stocks led broad markets to fall initially as the deal will make a $17 billion worth of AT1 bond be written off, causing a sharp selloff in those banks exposed to such type of debts. Sentiment recovered in the late session after ECB President reassured the central bank had sufficient liquidity to aid the “financial system,” with broad markets rebounding swiftly, led by mining stocks in Europe and the energy sector in the US.

Wall Street rose on a broad-based rally while US bonds pulled back after hitting a nearly 6-month high. The US dollar weakened further ahead of the FOMC meeting later this week as the recent banks’ turmoil may suggest that the Fed has to do something to regain market confidence. Commodities were mostly higher, particularly in crude oil and copper, both up more than 1%.

Asian markets are set to open higher, with the ASX futures up 0.66%, the Hang Seng Index futures rising 1.28%, and Nikkei 225 futures advancing 0.67%.

- All 11 sectors in the S&P 500 finished higher, with material and energy stocks leading gains, up 1.92% and 2.02%, respectively. The financial sector rose 1.28%, supported by regional banks, with New York Community Bancorp surging 32% after its subsidiary, Flagstar Bank, agreed to buy part of Signature Bank.

- Amazon plans to cut 9,000 jobs in the second round of layoffs since November when the company announced to reduce headcounts by 18,000. CEO Andy Jassy said the layoff aims to streamline costs as “uncertainty that exists in the near future”. This round will target to reduce costs in could computing, human resources, advertising, and Twitch live streaming businesses.

- UBS’s shares rose 1% after plunging 9% in the session as investors eased worries amid its acquisition deal with rival Credit Suisse. The Switzerland’s biggest bank is seen to benefit from Credit Suisse’s investment banking. The Swiss National Bank provides financial aid of up to 100 billion Swiss francs to support the deal. The combined bank will have $5 trillion of invested assets. Credit Suisse plummeted 56%.

- Gold futures rose slightly after hitting a one-year high of 2,015. The precious metal may continue to climb amid the recent market turmoil, heading off the highest level of 2,080 seen in March 2022 and August 2020.

- Crude oil WTI futures also finished higher after slumping 4.6% at a session low of 64.38 as investors’ sentiment recovered from an early selloff in risk assets after central banks’ reassurance to the banking system.

Today’s agenda:

- New Zealand Trade Balance and credit card spending for February. The country’s second-quarter GDP had a negative growth from the prior quarter. The economic data will provide clues for the first quarter’s economic trajectory, as two consecutive negative GDP growth will define a technical economic recession. The New Zealand dollar was the weakest among the G-10 currencies on Monday.

- The March RBA meeting minutes will be closely watched. Amid the global banking rout, the RBA is expected to keep its dovish stance. The Reserve Bank signed a pause in rate hikes in the March meeting.

ASX and NZX announcements/news:

- Incite Pivot sells its US ammonia plant for A$2.5 billion (US$1.7 billion), clearing the road to demerge. The company also secured a 25-year ammonia supply to CF Industries Holdings valued at $US425 million.

- NAB says convertible bank debts fell 5% to 15% in Europe amid recent UBS’s takeover of Credit Suisse, which caused a $17 billion written-off of the AT1 bonds.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.