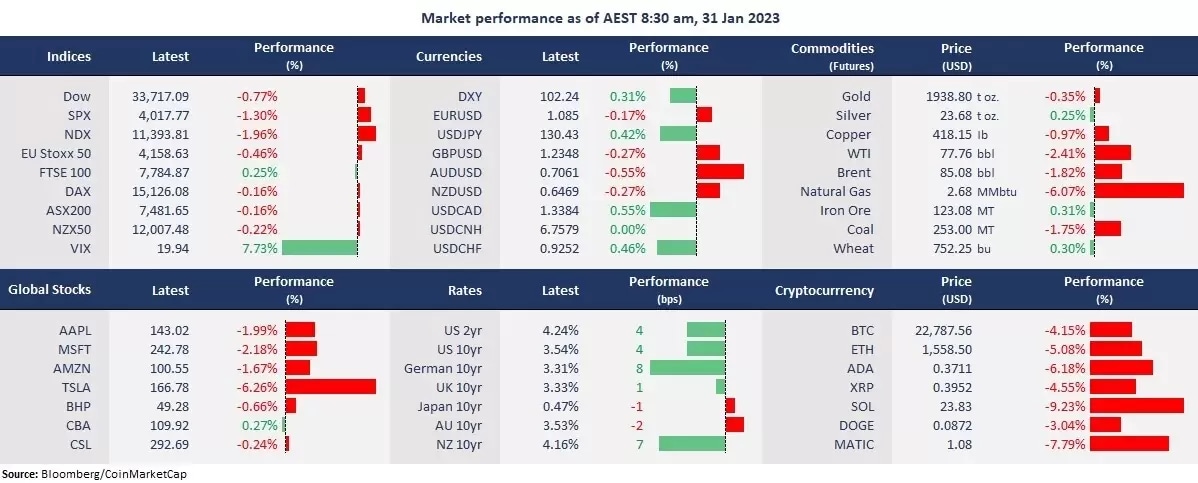

US stocks pulled back from their multi-week highs as tech shares fell ahead of the FOMC meeting and major earnings reports this week. While the US bond yields climbed higher, the US dollar strengthened against most of the other G-10 currencies, pressing on commodity prices. The retreat in risky assets flagged investors’ concerns about the Fed decision, where a more hawkish than expected iteration may spark a renewed selloff in broad markets.

In Asia, mainland Chinese shares jumped before paring gains on the return of the Luna New Year holiday, with CSI 300 briefly entering a bull market. However, Hong Kong stock markets reversed the gaining streak as investors were cautious ahead of major global events this week. The multinational conglomerate, Adani Group’s fraud allegations have also sparked risk-off sentiment across Asia. Futures point to a higher open in most of the APAC equity markets, with ASX futures slightly down 0.07%, and both Nikkei 225 futures and Hang Seng Index were up 0.22%.

- 10 out of the 11 sectors in the S&P 500 finished lower, with Energy and growth sectors, including Consumer Discretionary, Technology, and Communication Services, leading losses. The Energy stocks fell 2% due to a slump in oil prices. And all the big techs slid between 1-5%. Tesla shares were down 5.7% after a 31% jump last week, which is the best week since May 2013.

- Ford’s shares fell 3% after the car maker announces a plan to cut prices of its EV vehicles, Mustang Mach-E crossover to compete with Tesla. Ford will lower the price of Mach-E by between $600 to $5,9000 depending on the model after a deep price cut by Tesla amid weakened demands. But Tesla CEO Elon forecasts 2 million car sales amid the discounts.

- Baidu’s share surged 6% on the HKEX before paring gains on the news that the Chinese search engine giant will launch a similar service with ChatGPT in March. The core application is an OpenAI-like technology to allow users to have conversation-style communication in their search, following the move of Microsoft’s multi-billion investment into OpenAI recently, which makes ChatGPT a mainstream tech phenomenon.

- The US dollar index rose back to above 102 as the US bond yields stabilized ahead of the Fed rate decision later this week. Most of the other major currencies retreated from their 6-month highs against the king dollar. USD/JPY climbed above 130 again, testing on the 20-day moving average resistance. A breakout of this level could take the pair to further approach 133.

- Both gold and oil futures extended losses on a strengthened USD. The rally on gold losses steam and faces a further pullback risk as shown in the technical pattern with bearish divergence surfacing, while crude oil fell for the second straight trading day ahead of the FOMC meeting as recession fears loom.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.