Shares in Tesla staged a dramatic comeback on Friday, closing in the green after falling over 7% at the open.

Shares in Tesla hit a low of $101.81 shortly after the market opened, taking the current decline to almost 70% down from its high point. The sharp fall at the open came on the back of news that Tesla was planning further price cuts in China. Volume was also high on Friday. In total, just over 200 million shares were traded, compared to an average daily volume of 109.1 million.

Acute bearish sentiment at Tesla

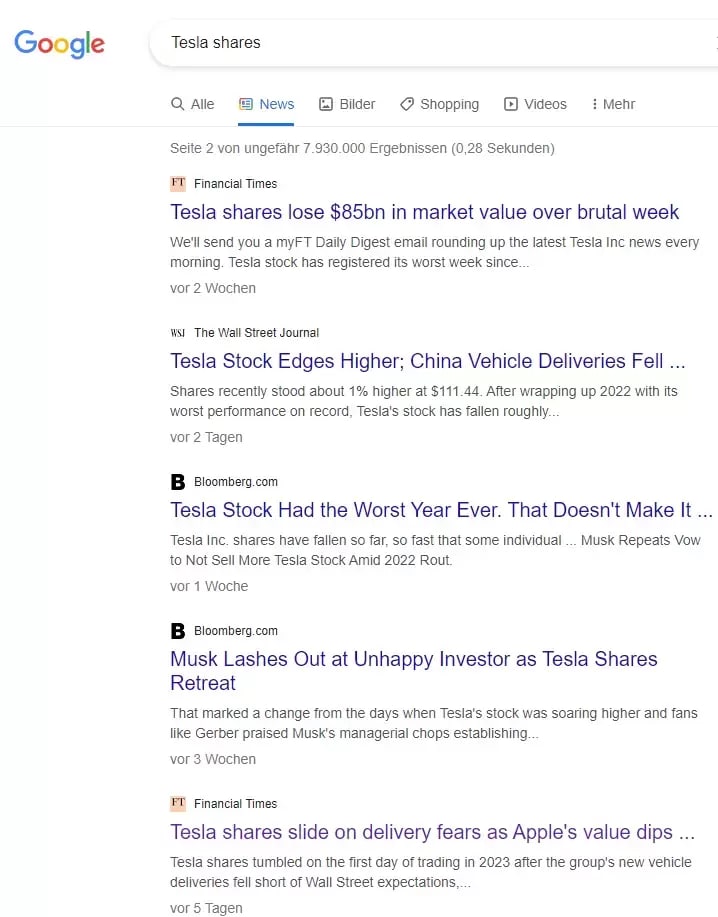

The bear is also leaving its mark on the sentiment of Tesla followers. Not much is left of the former stock market darling. A major problem now is its high valuation, while 12 months ago, this fact was being almost completely ignored. There appears to be a strong fear among investors that Tesla is going to become a kind of Nokia or Blackberry of the electric car industry. Even just googling Tesla shares shows up some less than positive results:.

In this case, however, it is worth noting that the bad news seems to be deflected by the price and is not initially having a negative impact. So is the sentiment too one-sided and too negative?

Big sell-offs in Tesla shares

Retail traders (small investors) have also been selling Tesla shares in droves. In the week leading up to the New Year, retail traders sold more than $3 billion worth of shares. The former darling of retail investors seems to have lost their confidence entirely. Investors’ willingness to buy, as well as their general interest in the company, has stalled due to these price losses. From a sentiment perspective, that could be the first sign that the selling pressure has run its course.

Quarterly figures show positive development

As described above, Elon Musk and Tesla are always in the headlines for various reasons. Operationally, Tesla has been on track for most of the past year, delivering record revenues. Last quarter's $21.45 billion in quarterly revenue was largely driven by the $18.69 billion the company generated from vehicle sales. Although Tesla more than doubled its net profit from $1.62 billion in the same period last year to $3.29 billion for the quarter, the company has recently struggled with rising raw material costs and difficulties in ramping up production in Germany and Texas. Tesla delivered more than 343,000 electric cars in the third quarter, another record, up more than 40% year-on-year. Gross margin was 27.9%. In addition to the car business, Tesla also generates revenue from power generation and maintenance. In the last quarter, Tesla generated $1.12 billion in revenue from energy production and storage. This division focuses on selling backup batteries for homes, businesses and utilities, and also installs rooftop solar panels. Tesla reported that energy storage was up 62% year-on-year. So you could say that last year's good operating performance was already priced into the stock in previous years. With the correction, the valuation now looks more reasonable. You could also say that sentiment on Tesla has rarely been worse than it is today.

Investors should therefore continue to focus on what Tesla is - the world's leading manufacturer of electric cars, more than a decade ahead of other carmakers. Tesla is able to produce cars at a much lower cost than its competitors, which gives it room to cut prices in order to stimulate demand in a way that others cannot. Tesla stock is certainly a risky bet, but with shares down as much as 70% from their all-time high of $101.81 and a 12-month earnings ratio of 21 times, compared to 201 times two years ago, the current situation is certainly different than most investors think.

Where can Tesla shares go from here?

With Tesla shares reaching the 38% retracement from the 2019 lows, potentially completing a Head and Shoulder formation, Tesla shares are completing a strong rally over the past two trading days. Meanwhile, the price has reached its first resistance level at the year-to-date high of $124.48. If this area can be breached, either through a retest of the low or a direct breakout, further upward movement towards $166.30 and $208 could follow. On the other hand, if the price loses the support zone of USD 101-107 for good, further declines towards USD 71 are likely.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.