Welcome to Michael Kramer’s pick of the top three market events to look out for in the week ahead, and his latest US election update.

The coming week will feature two US inflation readings for August, with consumer price data out on Wednesday and producer price data due on Thursday. We’ll also get the European Central Bank’s interest rate decision on Thursday, with a quarter-point cut widely expected. On the company results front, the standout report comes from software company Oracle, which will announce its Q1 earnings on Monday. And on Tuesday, Kamala Harris and Donald Trump go head-to-head in the first televised presidential debate between the two White House hopefuls.

US election update

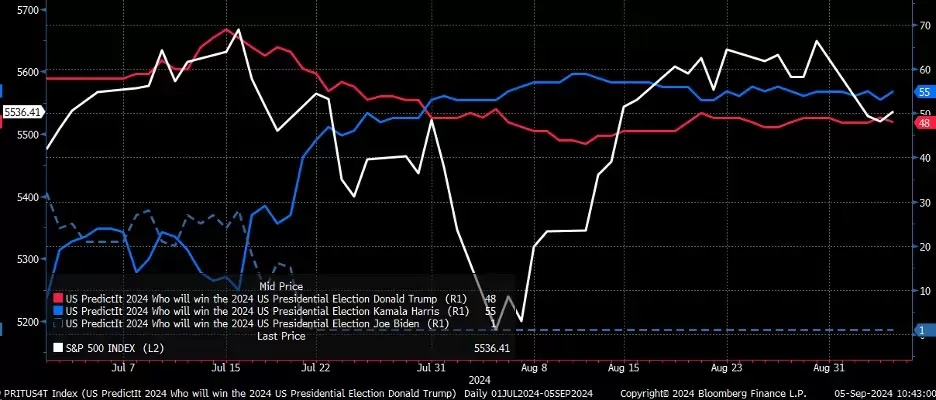

The first debate between Democratic vice-president Harris and Republican former president Trump on 10 September (at 9pm, US eastern time; 2am on Wednesday 11 September, UK time) comes as Harris opens up a seven-point lead in the polls, according to PredictIt, an online prediction market that covers political events. Their latest polling has Harris in the lead with a 55% chance of winning the presidency, with Trump on 48%.

Since the market sell-off at the start of August, US equity indices such as the S&P 500 have bounced back. Although investors don’t appear to have been paying too much attention to the election polls so far, the upcoming debate could mark a turning point. The debate itself – a useful reminder that an election is fast approaching – and the public’s reaction to it could attract investors’ attention. Watch out for a potential spike in market volatility ahead of and around the event.

US election poll tracker, July 2024 - present

Oracle Q1 results

Monday 9 September

Analysts expect Oracle to report that its fiscal first quarter 2025 earnings grew 12.1% to $1.33 a share, while revenue is forecast to have increased 6.5% to $13.3bn, driven by cloud services which grew 21.2% to $5.6bn. Meanwhile, analysts predict the company will guide fiscal second-quarter earnings of $1.49 a share on revenue of $14.1bn, which would represent growth of 11.1% and 8.7%, respectively. Options market pricing suggests that the Oracle share price – which closed on Thursday at $142.61, up 37% year-to-date – could move higher or lower within a range of about 7.7% after the earnings announcement.

Oracle shares face overhead resistance at $145, near the level of the previous record highs in June and July. That level is also the region with the most call option gamma. Put gamma is very light, suggesting that traders are feeling bullish and placing upside bets. However, given that implied volatility is likely to fall once the results are released, gamma and delta levels in the options will drop significantly, bringing a lot of stock for sale. The stock could fall towards support at around $125 if the results and guidance are in line with or only slightly above expectations.

Oracle share price, December 2023 - present

US August CPI

Wednesday 11 September

US consumer prices are expected to have risen 2.6% in the year to August, based on economists’ estimates, easing from annual growth of 2.9% in July. Core consumer price inflation, which strips out volatile items such as food and energy, is also thought to have cooled, falling to an estimated 3.1% in August, down from 3.2% in July. On a monthly basis, growth in both headline and core CPI is expected to have remained at 0.2% in August.

However, inflation swaps suggest that headline CPI could come in lower than forecast, possibly rising just 2.5% year-on-year and 0.1% month-on-month in August.

On Thursday, the release of producer price inflation figures will, alongside CPI, give analysts and investors a sense of what the US Federal Reserve’s preferred inflation gauge, the personal consumption expenditures (PCE) price index, might look like at the end of the month.

Lower-than-expected CPI figures on Wednesday could surprise markets, as it might signal that the US’ nominal GDP growth is slowing faster than expected. In turn, this could prompt the Fed to cut interest rates by 50 basis points at its upcoming meeting on 17-18 September.

A rate cut might further buoy GBP/USD, which appears to be breaking out of a technical bull flag. The pound could rise to around $1.33 against the dollar in the near term, and potentially to higher levels over the medium term.

GBP/USD, January 2023 - present

ECB interest rate meeting

Thursday 12 September

The market is pricing in a quarter-point interest rate cut by the European Central Bank on Thursday. Additionally, the market expects one or two more cuts by the 12 December rate-setting meeting. Traders will therefore be listening out for possible signals when ECB president Christine Lagarde speaks to the press following Thursday’s rate decision.

The decision could have an impact on EUR/USD. The euro has stalled around $1.11, but has recently broken out of a symmetrical triangle and the relative strength index is trending higher, suggesting bullish momentum. If the ECB is guarded on the question of its monetary policy stance moving forward and keeps the market guessing, EUR/USD may rise to around $1.12 and potentially higher.

EUR/USD, Jul 2019 - present

Key economic and company events

Our rundown of notable economic announcements and US and UK company reports scheduled for the coming week:

Monday 9 September

• China: August consumer price index (CPI), August producer price index (PPI)

• Results: Oracle (Q1), Rubrik (Q2)

Tuesday 10 September

• Australia: September Westpac consumer confidence index

• China: August exports, imports and trade balance

• Germany: August CPI

• UK: July unemployment rate and average earnings, August claimant count change

• US: Presidential debate live on ABC News

• Results: Academy Sports and Outdoors (Q2), Dave & Buster’s Entertainment (Q2), GameStop (Q2)

Wednesday 11 September

• UK: July gross domestic product (GDP)

• US: August CPI

• Results: Dunelm (FY), Oxford Industries (Q2), Ricardo (FY), Trustpilot (HY)

Thursday 12 September

• Eurozone: European Central Bank interest rate meeting

• UK: Bank of England monetary policy report hearings

• US: August PPI, initial jobless claims to 6 September

• Results: Adobe (Q3), Caleres (Q2), Kroger (Q2), Renishaw (FY), Signet Jewelers (Q2), Trainline (HY)

Friday 13 September

• Eurozone: July industrial production

• France: August CPI

• UK: Consumer inflation expectations

• US: September Michigan consumer sentiment index

• Results: No major scheduled earnings announcements

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.