Asia markets are set to open higher as both US and EU stocks gained for the second straight trading day in the week amid optimism toward ceasefire talks between Ukraine and Russia. Russia said it would reduce military operations in two areas, but Ukraine and the US remain unconvinced. Crude oil prices have finished lower for two days in a row, but still, hold up above the US$100-mark.

Australia and New Zealand stocks

SPI futures are indicating a 0.75% gain on the S&P/ASX 200 in Australia. The benchmark index continues to rise towards the January high of 7656.50, with the energy sector keeping the strong momentum amid expectations for rising profit margins for companies resulting from surging commodity prices.

Australia handed down its federal budget on Tuesday night, with Treasurer Josh Frydenberg detailing an $8.6bn cost-of-living package that includes halving the petrol tax, among other cash benefits and tax cuts. NAB said it “contained few surprises and won’t be a big influence on markets this morning”.

Budget papers painted a bullish outlook for the Australian economy despite higher energy prices as a result of Russia’s war with Ukraine. Annual non-mining business investment is forecast to surge by 7% this financial year and 9% the following year to reach over $200bn by June 2023.

Andy Penn will step down as Telstra boss after more than seven years in the role, the company announced in a statement to the ASX. Penn joined Telstra in 2012 as chief financial officer and became chief executive in May 2015. He will be replaced by Vicki Brady, who is currently the group’s chief financial officer. She will begin in the role on September 1.

A landmark US$50bn deal between a major German energy company and Fortescue Future Industries signed in Berlin on Tuesday will see FFI, the company chaired by Andrew Forrest, providing five million tonnes a year of green hydrogen for the energy company E.ON and its 50 million households by 2030, according to Renewables Now.

The NZX 50 was up 0.6% in the first half an hour of trading, with bank stocks leading the gains. Westpac Banking Group was up 1.39% and ANZ bank rose 0.75% at the start of trade.

US and EU stocks

The Dow Jones Industrial Average rose 338.30 points, or 0.97%, to close at 35,294.29. The S&P 500 gained 1.23% to 4,631.60, while the Nasdaq Composite climbed 1.84% to 14,619.64. The Dow and S&P 500 have advanced in four straight trading sessions.

Growth stocks again led gains, with all of the tech giants finishing higher. Meta Platforms rose near 3%, Amazon and Tesla were up 0.6% and 0.7% respectively. The rest of the mega-caps all climbed more than 1%.

Airline stocks gained on the falling oil prices, with all the major carriers up by more than 3% each.

Bank stocks jumped initially but cut gains at close due to moderating bond yields.

Energy is the only sector that finished lower as crude oil prices fell for the second trading day.

On the economic front, the CB consumer confidence index was recorded at 107.2, higher than estimated, indicating strong labor markets may offset inflation concerns. March non-farm payrolls data is due later this week.

The positive progress in the ceasefire talks sparked a strong relief rally across Europe, with Stoxx 50 up 2.96%, DAX rising 2.80%, and CAC 40 advancing 3.08%. The FTSE 100 was up 0.86%.

Treasuries

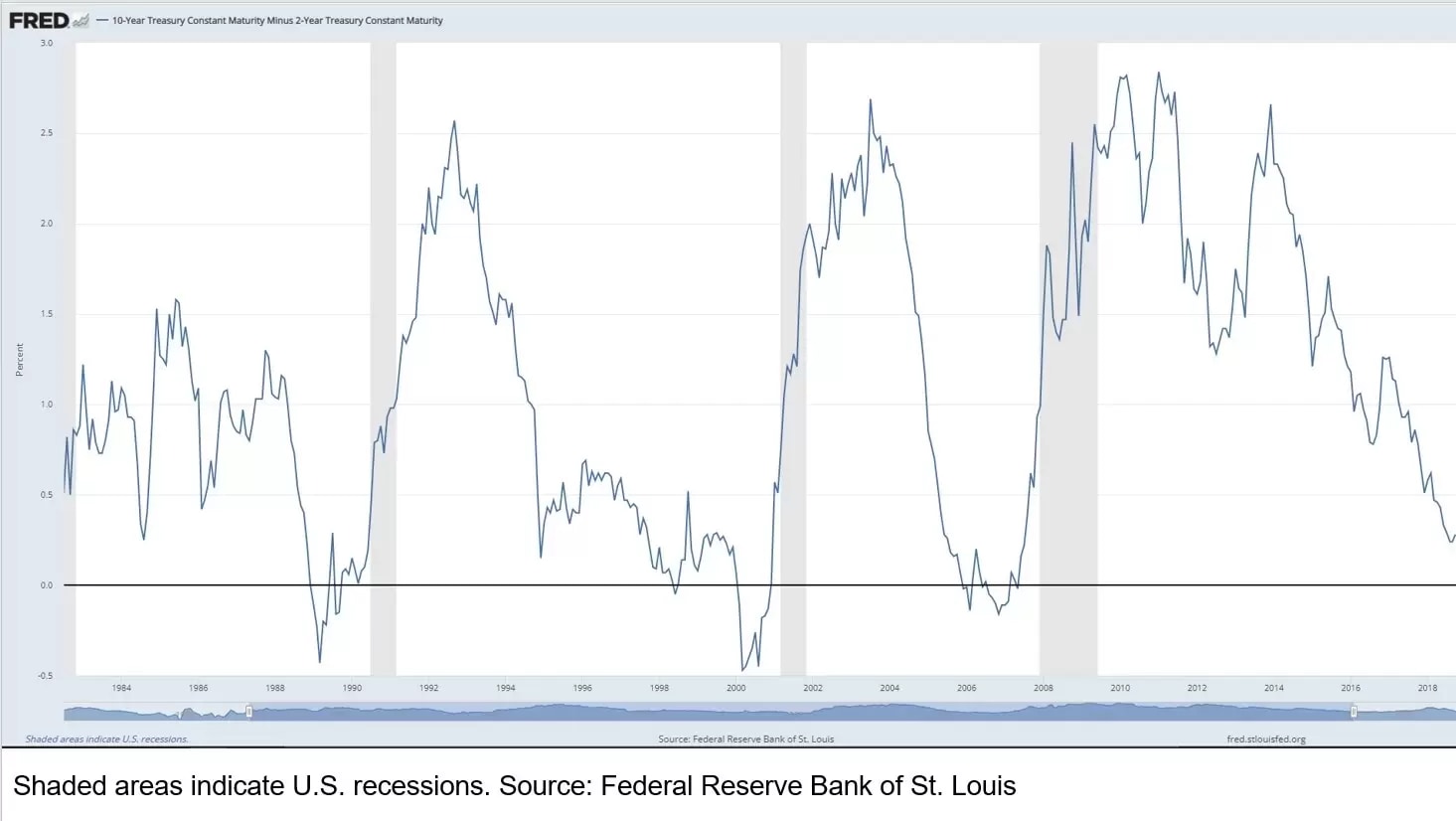

The US bond yields moderated on Tuesday as the selloff slowed. The 10-year US Treasury yield fell to 2.39% from 2.46% the previous day. The 2-year Treasury yield dropped to 2.38% from 2.71% a day ago. The 10-year and 2-year yield spread tightened further to 0.11, reaching the lowest level since April 2019, suggesting a recession may be near when it drops below 0. In history, the recession happens a year or so after the bond yields inversion occurs.

Both Australia and New Zealand bond yields keep rising. The Australia 5-year bond yield rose slightly to 2.68% and New Zealand 2-year swaps rose to 3.29%, a new high since June 2015.

Commodities

Oil prices fell sharply initially, but cut losses as the ceasefire talks between Russia and Ukraine ended up without an agreement. The WTI futures fell 0.63%, to US$105.16 per barrel after falling 7% to just below US$100. Brent was slightly down to US$108.61 per barrel after dropping to US$102.25.

Precious metals had similar moves to oil. The NYMEX gold futures fell 1.11%, to US$1,918.30 per ounce after briefly trading at US$1,888.40. Silver plummeted 1.12%, to US$24.91 per ounce after falling to just above US$24.

Currencies

The US dollar weakened on falling bond yields. Eurodollar rallied on ceasefire optimism, up 0.92% against the USD, to 1.1083. The USD/JPY also retreated from a 7-year high, down 0.83%, to 122.88. Commodity currencies, including AUD, NZD, and CAD, all rebounded again the US dollar.

Cryptocurrencies

The crypto markets were flat. The total market cap fell slightly to US$2.14 trillion from $2.16 in the past 24 hours. Bitcoin fell 0.65%, to US$47,490, Ethereum was up 0.13 %, to US$3,400.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.