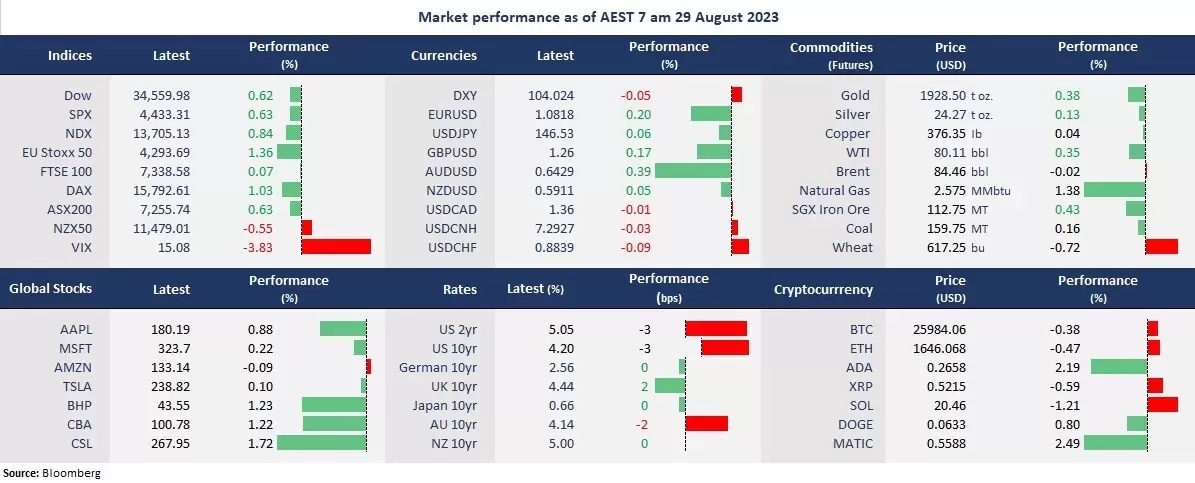

US stocks finished higher for the second straight trading day as risk-off sentiment abated following Fed Powell’s “higher for longer rates” signal last Friday. Markets are now pricing in one more possible rate hike by the Fed this year, higher than previously projected. However, bond yields may have priced in the hawkish stance, with both yields on the 2-year and 10-year Treasuries sliding 3 basis points to 5.04% and 4.21%, respectively. The broad-based rebound on Wall Street could have been a re-positioning move ahead of a bunch of crucial economic data, including the JOLT job openings, advanced Q2 GDP, and non-farm payroll this week.

The US dollar eased gains against most of the other G-10 currencies as it might have been overbought. Fed’s speech at Jackson Hole provided certainty to its future policy path, which may have caused a “sell the news” movement in the dollar. Commodity markets also benefited from the softened greenback, with metal and energy all finishing higher.

The equity market across Asia gained broadly following Wall Street’s comeback on Monday, while Chinese authorities imposed more measures to boost sentiment. China asked large exchanges to avoid selling onshore shares and cut the stamp duty on stock trades in half. Futures point to a higher open in Asian stock markets, with the Nikkei 225 futures up 0.50%, the ASX 200 futures rising 0.42%, and the Hang Seng Index futures climbing 0.96%.

Price movers:

- 10 out of 11 sectors finished higher in the S&P 500, with Communication Services and Technology, leading losses, up 1.05% and 0.81%, respectively. Industrial also outperformed, led by 3M, after the company amid a US$5.5 billion deal to settle over 30 lawsuits regarding selling defective earplugs to the US military.

- OpenAI launches ChatGPT Enterprise, an optimized AI chatbot business tier that enhances user utilization by adding enterprise-grade privacy and data analysis while performing the same tasks as ChatGPT.

- Apple plans to upgrade its iPad Pro amid a slump in sales. The upgrade aims to boost iPad sales through the new features, including a new Magic Keyboard, adoption of the M3 chip, and better displays.

- The indebted Chinese developer Evergrandeshares plunged 87% on the return after a 17-month suspension. The company reported a loss of 39.25 billion yuan for the six months that ended June, less than the loss of 86.17 billion during the same period last year. And the revenue was 128.81 billion yuan, up from 89.28 billion yuan from a year ago.

- Gold shows signs of rebound as the US dollar’s rally took a breather, and bond yields eased climbing. A potential double-bottom reversal pattern surfaces in the spot gold chart, suggesting the precious metal may continue the rebounding trend.

ASX and NZX announcements/news:

- Fisher & Paykel (NZX: FHP) provides guidance for FY24. The company expects revenue of approximately NZ$790 million in the first half and a net profit of approximately between NZ$95 million and NZ$105 million. The revenue projection represents a 14% growth year on year.

- Meridian Energy Limited (ASX: MEZ, NZX: MEL)’s new profit slumped to NZ$95 million for the year ended 30 June 2023, down from NZ$664 million last year. But net profit rose 35% to NZ$315 million, and operating earnings were up 10% to NZ$783 million, excluding the gain on sale of Meridian’s Australian business and non-cash movements in hedge instruments. The company will pay a dividend of NZ 11.90 cents per share, up 3% from a year ago.

Today’s agenda:

- RBA Gov-Designate Bullock’s speech

- US CB Consumer Confidence for August

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.