Gold continues its strong rally from January, with the yellow metal holding above its previous record of $2,790 per ounce and recording double-digit gains in 2025. Its next key upside target is $3,000.

The excesses keep on coming

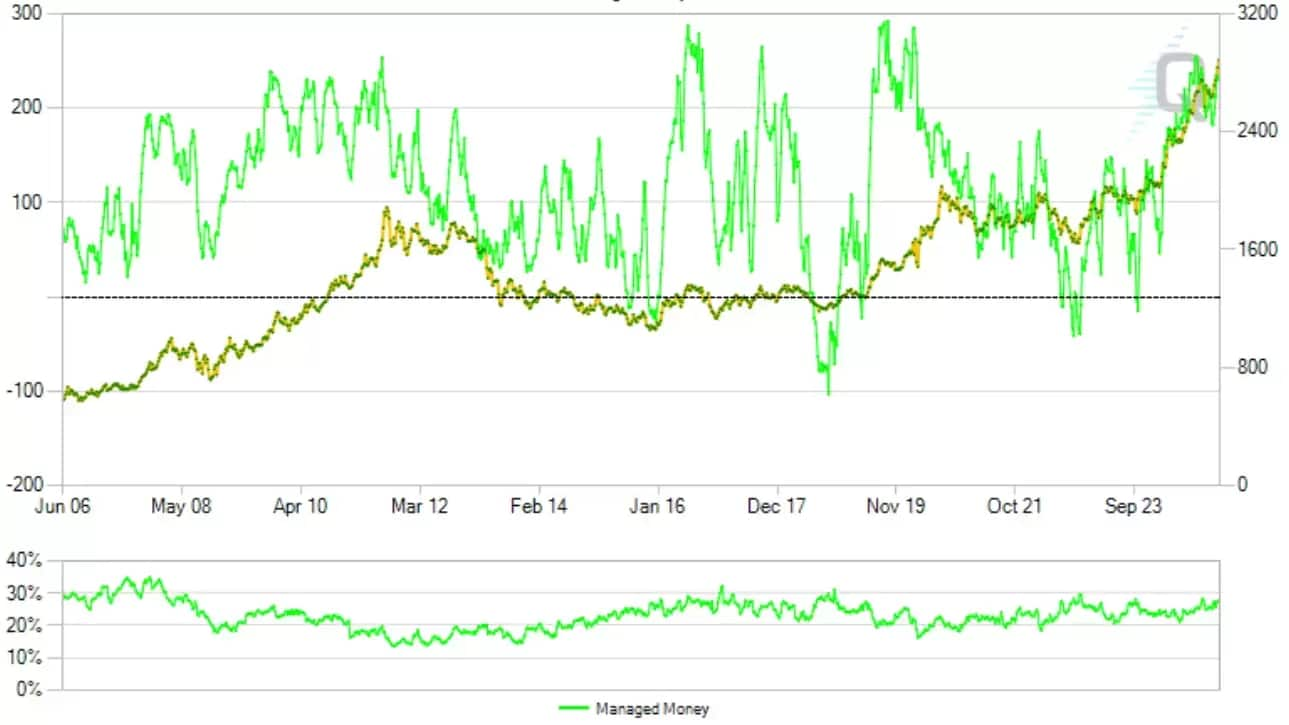

This bullish trend shows no sign of stopping, with overbought signals across daily, weekly, and monthly charts. Investor sentiment is bordering on exuberance - 70.83% bullish versus 4.17% bearish, according to the latest MacroMicro survey.

Positioning may be becoming more widespread. According to commodity futures and trading commission data compiled by CME, the net long balance of directional (non-hedging) positions in the derivatives markets (options and futures) is close to 30% of the open interest of total open positions.

The yellow metal also seems to be breaking some of its historical correlations with other macroeconomic variables, appreciating in an environment of high interest rates and a stronger US dollar.

Strong hands demand bullion

The appetite for gold is strong. The World Gold Council’s 5 February report shows record highs in both volume and value ($382bn in 2024). Demand for gold as an investment rose 25%, driven by bullion purchases, while demand for gold as jewellery declined.

A demand for bullion is usually associated with strong hands (central banks and large investors) who like to keep gold close. The Financial Times noted that demand for physical gold in the US had delayed deliveries from the London Bullion Market Association last week.

What could support the high appetite for gold at these prices?

Gold's rally is supported by strong trend and momentum signals, attracting trend-following investors in derivatives markets. However, rising interest rates and a stronger US dollar typically work against gold, and could do so now.

The key drivers now appear to be risk and uncertainty — nine out of the 10 economic policy uncertainty indices rose in January, with trade, tax, and regulation concerns leading the surge.

CMC Markets erbjuder sin tjänst som ”execution only”. Detta material (antingen uttryckt eller inte) är endast för allmän information och tar inte hänsyn till dina personliga omständigheter eller mål. Ingenting i detta material är (eller bör anses vara) finansiella, investeringar eller andra råd som beroende bör läggas på. Inget yttrande i materialet utgör en rekommendation från CMC Markets eller författaren om en viss investering, säkerhet, transaktion eller investeringsstrategi. Detta innehåll har inte skapats i enlighet med de regler som finns för oberoende investeringsrådgivning. Även om vi inte uttryckligen hindras från att handla innan vi har tillhandhållit detta innehåll försöker vi inte dra nytta av det innan det sprids.