Cryptocurrency index trading

Spread bet or trade CFDs on baskets of cryptocurrencies with our All Crypto Index, Major Crypto Index and Emerging Crypto Index. Our crypto indices offer a unique, cost-effective way to trade on the wider cryptocurrency market without having to trade multiple, individual coins.

More than a cryptocurrency trading platform

Precision pricing

We aggregate pricing from 18 different feeds to get you a more accurate price.

Minimal slippage

With fully automated, lightning-fast execution in 0.0030 seconds*.

99.9% fill rate**

No partial fills or manual dealer intervention, regardless of your trading size.

Dedicated customer service

UK based, award-winning service 24/5, whenever you're trading^.

Crypto indices

Take a view across our full range, top or emerging cryptocurrencies with a single trade.

No stamp duty

No stamp duty to pay when trading CFDs on crypto indices†.

Major crypto indices to trade

We've grouped different cryptocurrencies together to create three new crypto baskets, each representing a cross-section of the sector.

All Crypto Index

This index contains all the cryptocurrencies we offer and aims to offer a wider indication of how the cryptocurrency sector is performing overall.

Emerging Crypto Index

The Emerging Crypto Index groups together seven less established ‘altcoins’ (alternative cryptocurrencies launched after bitcoin). It's designed to allow you to take a view on the smaller-cap cryptocurrencies. This index contains dash, NEO, stellar lumens, tron, monero and cardano.

Major Crypto Index

This crypto index tracks the performance of the largest, most liquid portion of the cryptocurrency market, and groups together the most recognised and established cryptocurrencies – bitcoin, ethereum, bitcoin cash and litecoin.

Cryptocurrency index details

View the spreads, margin rates and trading hours for our cryptocurrency indices in the table below.

| Instrument | Margin rate from | Minimum spread | Trading hours |

|---|---|---|---|

| All Crypto Index | 50% | 80 | 11pm Sunday - 9pm Friday |

| Emerging Crypto Index | 50% | 60 | 11pm Sunday - 9pm Friday |

| Major Crypto Index | 50% | 80 | 11pm Sunday - 9pm Friday |

How do crypto indices work?

Each crypto index is made up of a selection of cryptocurrencies, grouped together and weighted by market capitalisation (market cap). The market cap of a cryptocurrency is calculated by multiplying the number of units of a specific coin by its current market value against the US dollar. When a cryptocurrency goes up in value, its market cap will increase and therefore the value of the crypto index will rise, and conversely when cryptocurrency prices fall against the US dollar, the value of the crypto index will fall.

There are several benefits to crypto basket trading, rather than multiple individual cryptocurrencies. Firstly, it can be a more cost-effective way of trading on the cryptocurrencies, as it allows you to take a view on the sector as a whole without having to open a position on each individual coin. Trading on a crypto index can also help to spread some of your risk, as you aren’t being exposed to a single coin.

However, it's important to be aware that spread bets and CFDs are high-risk, speculative products. High volatility combined with leverage could lead to significant losses. As with any leveraged product, both profits and losses are magnified as they are based on the full value of your position, not just your initial deposit on a particular trade. While you could make a profit if the market moves in your favour, you could also make a loss if the trade moves against you, particularly if you don’t have adequate risk-management cover in place.

Increase your exposure to the cryptocurrency market

Expecting big things from crypto? We’ve grouped different cryptocurrencies together to create three new crypto baskets, allowing you to trade on multiple cryptos with a single position.

How our crypto indices are weighted

We've aimed to provide a diverse, balanced view of the cryptocurrency market's performance. For the Major Crypto Index, we've established a cap so that no single cryptocurrency can constitute a weighting of greater than 40% of the index. While no individual constituent makes up more than 40% of the Emerging Crypto Index, we may establish a cap of 40% for this index should it become necessary at a future date. The All Crypto Index gives 60% of the total weighting to major cryptos and 40% to emerging coins. Each individual cryptocurrency is then weighted equally within that banding. The weightings of any uncapped component that then fall below a 5% floor will be increased to that value, taking proportional market capitalisation from any uncapped index component.

We monitor our crypto indices periodically to see whether any adjustments need to be made to constituent weightings. We will also monitor closely for any hard or soft forks which may mean adjustments to the constituent cryptocurrencies are necessary. In the event that such adjustments are made, we will also change the index divisor to ensure that there is no resulting impact on the index prices.

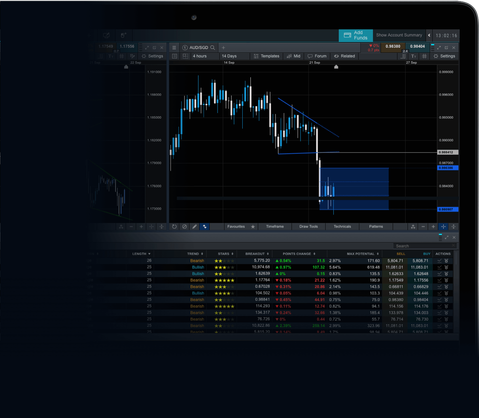

The platform built for cryptocurrency index trading

Fast execution, precise charting and accurate insights could prove to be vital to your success as a crypto index trader. Our award-winning trading platform was built with the committed crypto trader in mind.

Pattern recognition scanner

We automatically scan over 120 of our most popular instruments every 15 minutes for emerging and completed chart patterns, such as wedges, channels and head & shoulders formations.

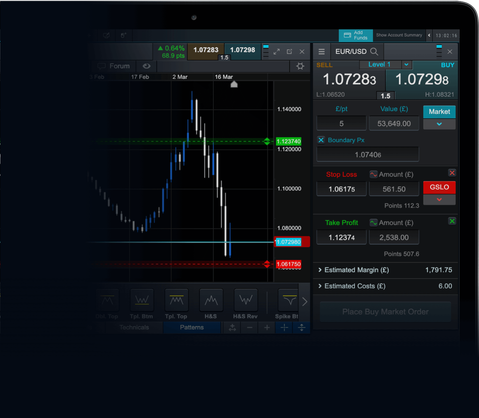

Advanced order execution

We offer a range of advanced order types, including trailing and guaranteed stop losses, partial closure, market orders and boundary orders on every trade, so you have the flexibility to trade your way.

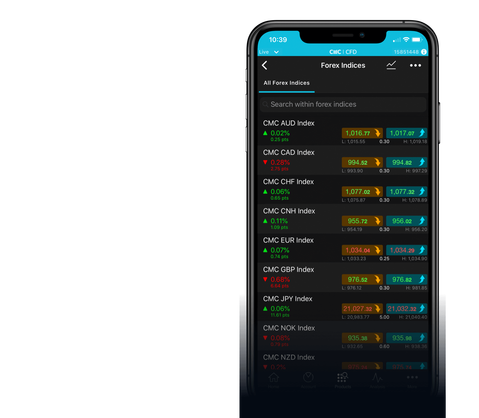

Award-winning app*

Industry-leading charting

Best Mobile Trading Platform

ADVFN International Financial Awards

No.1 Commissions & Fees

ForexBrokers.com Awards

Best Broker for Active Traders

Professional Trader Awards