Forex market hours

The foreign exchange market is the most liquid financial market worldwide, with an estimated $5.3 trillion traded daily. Forex is an over-the-counter product, hence there is no central physical exchange where the currencies can be traded, unlike shares that are traded on various stock exchanges.

The forex market is an interbank market, with large banks acting as market makers, offering their own prices. This means there are fewer trading restrictions, such as when and where you can trade, unlike stock market trading hours, where traders are restricted to a weekday timetable with specific hours.

When is the forex market open?

The forex market is open 24 hours a day, from Sunday evening until Friday night. This is due to the various international time zones which allow you to trade all hours of the day.

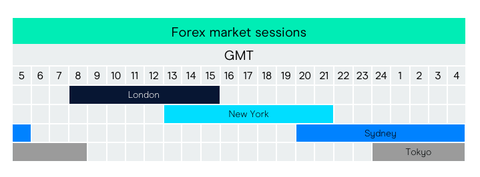

There are major trading sessions in these three locations:

- Tokyo (Asian session)

- London (European session)

- New York (North American session)

Forex market open times

During the autumn and winter months, the Tokyo session opens at 12am and closes at 9am UK time. It is one of the largest forex trading centres worldwide, with roughly a fifth of all forex transactions occurring during this session. During the Asian session, there’s likely to be more movement in currency pairs containing the yen, as well as Asia Pacific currency pairs, like AUD/USD.

The London session opens at 8am UK time and accounts for roughly 35% of all forex transactions (estimated £2.1 trillion daily). Due to the large volume of trading during the London session, there are likely to be lower spreads as liquidity is higher. However, the London session is also subject to high volatility, often making it the best to trade the major currency pairs, which offer reduced spreads due to the high volume of trades. This session closes at 4pm.

The New York session then opens at 1pm and closes at 10pm UK time. There is more liquidity at the start of the New York session due to the overlap with the previous London session. Towards the end of the session, there is typically minimal movement as the trading day winds down.

The Sydney session occurs from 8pm to 5am UK time, completing the 24-hour forex trading loop.

Forex trading sessions

What time should you trade forex?

Theoretically, the best time to trade is when the market is most active, so when the greatest volume of trades occur at one time. Such a climate offers high liquidity and tighter spreads. Therefore, the most optimal time to trade is during overlaps between open markets. The heaviest overlap is between the London and New York sessions.

During this time there is also high volatility, so despite there being a tighter spread initially, major economic news announcements could cause the spread to widen. However, high volatility can be favourable when trading in the forex market. See our guide on risk management for more on managing volatile markets.

The London session is also the busiest market of them all, particularly in the middle of the week. Trading on a Friday, however, offers lower volatility with fewer people trading, making liquidity lower. It’s also dependent on what currency pair you’re trading, for example, trading on JPY would be more apt during the Asian session. Practise trading on currencies through a spread betting or CFD trading demo account.

Most volatile currency pairs

Volatility is dependent on the liquidity of the currency pair, and is shown by how much the price moves over a period of time. This impacts the spread, with the price movement being depicted by the number of pips. There will be pairs which naturally have higher volatility, but numerous factors can come into play which can cause pairs to become more volatile.

Some of the most volatile major currency pairs are:

- AUD/JPY

- NZD/JPY

- AUD/USD

- GBP/AUD

Major currency pairs tend to have lower volatility compared with the exotic pairs, as when there is high liquidity, there tends to be lower volatility. Currency pairs from more developed countries tend to have lower volatility as prices are typically more stable. There is also lower supply and demand for currencies from emerging markets.

Major news events, for example, Brexit, can cause disruption and widen spreads. Price fluctuations can also be influenced by hikes in interest rates or commodity price surges.

Trading low liquidity pairs naturally means higher risk, and is recommended for the more experienced trader who has done their research and has a risk management strategy in place.

Trade forex market hours in Ireland

Discover forex trading using spread bets and CFDs on our award-winning trading platform*, Next Generation. We offer competitive spreads and margin rates on over 330 forex pairs, including major, minor and exotic crosses.

To get started with forex trading, visit our article on forex trading for beginners. For more advanced traders, visit our article on how to trade forex for professional tips and advice on fundamental and technical analysis.

Experience our powerful online platform with pattern recognition scanner, price alerts and module linking.

- Fill in our short form and start trading

- Explore our intuitive trading platform

- Trade the markets risk-free

*No.1 Web-Based Platform, Platform Technology and Professional Trading, ForexBrokers.com Awards 2021; Rated Highest for Trading Ideas & Strategies, Seminars & Webinars, Trade Signals Package and Ease of Account Application/Opening, based on highest user satisfaction among spread betters, CFD and FX traders, Investment Trends 2020 UK Leverage Trading Report; Best Overall Satisfaction, Best Platform Features, Best Mobile/Tablet App, rated highest for Charting, Investment Trends 2019 UK Leverage Trading Report; Best In-House Analysts, Professional Trader Awards 2019.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.