Forex trading for beginners

Learning to trade forex can be a tough topic for beginners, but this article will help you get started trading forex. This trading guide covers real-life forex examples, basic forex principles, beginner strategies and a step-by-step guide to getting started.

What is forex trading?

Forex trading is the process of speculating on currency price movements, with the aim of making a profit. Many currency conversions on the forex market are for practical use, and not for creating profit. However, traders can speculate on forex market price movements, with the aim of capitalising on correctly forecasting these movements.

For a more detailed definition of forex, visit our what is forex trading guide.

Trading forex step-by-step guide

- Open a spread betting or CFD trading account. You can open a demo or live account to trade on price movements of forex pairs.

- Start researching to find the FX pair you want to trade. Use our news and analysis section to keep up-to-date with market news which may impact FX, and our market calendar to keep updated with market-moving events.

- Based on your research, decide if you want to buy or sell. Is the research you’ve conducted indicating the base currency (the first-named currency in the pair) is likely to weaken or strengthen? Go long and ‘buy’ if you believe it will strengthen, or go short and ‘sell’ if you think it will weaken.

- Follow your strategy. Before placing a trade, ensure you have followed your strategy which should include risk-management. Also, see our tips on building a trading strategy.

- Place your forex trade. As per your strategy, place your forex trade with defined entry and exit points. Don’t forget to use risk-management conditions, such as a take-profit or stop-loss order.

- Close your trade, and reflect. By following your trading plan, exit the market at your forecasted limits. Think about how you performed, so that you can improve after each trade you make.

Forex trading examples

When placing trades on the forex market, you are trading the strength of one currency against another. For example, if you go long and ‘buy’ USD/GBP, you are speculating that the US dollar price will increase, relative to the price of the pound. Alternatively, if you go short and ‘sell’ EUR/AUD, you are speculating that the euro will weaken in comparison to the Australian dollar.

Example trades are a useful way to learn the process of forex trading. Our forex trading examples show the opening and closing of a trade position, and how to calculate the accompanied profit associated with the trade.

Forex basics

As a forex trading beginner, it’s important to understand the basics of the forex market. These fundamentals will help your understanding of the key aspects of the foreign exchange market and ultimately help you to make informed decisions.

The foreign exchange market

Forex, foreign exchange, or simply FX, is the marketplace where companies, banks, individuals and governments exchange currencies. It’s the most actively traded market in the world, with over $5 trillion traded on average per day. When trading currencies on the foreign exchange market, currency pairs are often split into major, minor and exotic (or emerging) currency pairs.

The US dollar is considered the most popular currency in the world, and constitutes around 60% of all central bank foreign exchange reserves. So it’s no surprise the US dollar is evident in many of the ‘majors’ (major currency pairs), which make up 75% of all forex market trades. As a beginner, it may be wise to trade the majors, as they’re known to be the most liquid and least volatile of the currency pairs.

Discover which forex pairs we offer, learn more about currency pairs, or dig deeper into how forex work with our what are forex currency pairs article.

Forex leverage

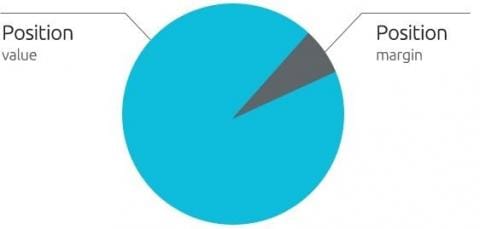

When you trade forex with a spread betting or CFD trading account, you trade with leverage. This means you only need to put up a portion of the full trade value to open a position, known as trading on margin. However, your exposure in the market will be based on the position's full trade value. It’s important to understand that both profits and losses are magnified when trading on leverage. Find out more about leverage when trading forex here.

Forex holding costs

When trading forex with us, a holding cost is applied which is either credited or debited to your account depending on the direction you’re trading, and the applicable holding rate. Holding costs are evident when you hold a position open past the end of each trading day (5pm EST). Generally, when you hold a buy position, a holding cost is credited to your account. If you hold a sell position, the holding cost is debited from your account. To find out how these holding costs are calculated, see forex holding costs explained.

Beginner forex trading strategies

Forex trading strategies are usually differentiated by timeframe and market-specific variables. Strategies include trading market movements in minutes, or over several days. As a beginner you can test different forex strategies with a demo account and measure their relative success rate and suitability. You may also wish to try out and choose your preferred technical indicators for entry and exit points, and blend different aspects from several strategies. Some of the most common forex strategies include:

- Forex scalping is where traders hold multiple short-term trades and build profit based on small but frequent winning trades. This strategy may be best suited to traders who can commit a large proportion of their time to trading, and are more focused on technical analysis.

- Forex day trading is for traders who enter and exit at least one trade per day by predicting daily market movements, and are look to avoid overnight holding costs. This trading method may be best for traders who aren’t very comfortable with the extremely fast-paced trading methods in scalping, but still prefer shorter-term trading methods.

- Swing trading forex may be best suited to traders who prefer a balance between fundamental and technical analysis. Positions are open for several days, with the aim to buy at ‘swing lows’ and sell at ‘swing highs’, or vice versa if going short. Less time is spent analysing market trends in this method over some others, and there will be overnight holding costs and more chance of the market ‘gapping’.

- Position trading involves holding positions over long-term periods and ignoring short-term price fluctuations. Position trading may be best suited to traders who spend more time understanding market fundamentals, and less time undertaking technical analysis or executing trades.

To find out more about the types of strategies you can adopt when trading forex as a beginner, visit our forex trading strategies guide.

5 forex trading tips for beginners

- Understand the markets for both currencies: have an understanding of both currencies you are trading as part of the currency pair. Be aware of the main macro-environmental forces that could affect the markets you’re exposed to.

- Stick to your trading plan: following a trading plan will help you to take emotion out of your trades, and predetermine your entry and exit strategies. This structured way to trade markets can help to keep trades consistent and emotions at bay. Create a plan by using our trading strategy template here.

- Test, evaluate and try again: trading is about evaluation after each trade, in order to analyse what worked and what didn’t. When trading as a beginner, you will need time to develop a good trading mentality and understand that your trading psychology is a work in progress. You can test your trading strategies on our demo account.

- Follow the classic mantra: ‘cut your losses and let your profits run’, as part of your trading psychology. Don’t be tempted to take profit as soon as it appears, or be afraid of making a loss. Follow your trading strategy, and implement risk-management conditions to remove emotion from your trading.

- Choose the best trading partner for you: a reliable trading platform, customer service and consistent spreads are some of the important factors which help to determine your overall trading experience*. Learn why traders choose CMC Markets.

If you’re looking for a larger selection of forex trading tips, visit our 11 forex trading tips article.

Where to trade forex

You can trade forex via a spread betting or CFD trading account via desktop or mobile devices. Besides forex, you can access to thousands of financial instruments, including indices, cryptocurrencies, commodities, shares, ETFs and treasuries. Learn about our range of markets

Forex trading platform

When learning how to trade forex, many beginners struggle with the overload of information on trading platforms, and their lack of usability. When trading forex on our online trading platform, it’s worthwhile opening a demo account, which allows you to get accustomed to opening and closing trades, and practising your trading strategy. You can personalise our trading platform based on your trading preferences.

Forex mobile trading app

Whatever your level of trading experience, it’s crucial to have access to your open positions. With our award-winning mobile trading app*, you can access all of your positions, open and close trades with full order ticketing, use our fully functional charting software, and access many more features.

Bottom line

Once you’ve understood the basics of forex, try putting your new-found knowledge into practice with a demo account. You can test forex strategies and tips, and start to create a trading plan to follow. Once you’re comfortable with a strategy using the demo account, including managing your risk, and are familiar with the trading platform, you could open a live account to trade on forex for real.

*No.1 Web-Based Platform, Platform Technology and Professional Trading, ForexBrokers.com Awards 2021; Rated Highest for Trading Ideas & Strategies, Seminars & Webinars, Trade Signals Package and Ease of Account Application/Opening, based on highest user satisfaction among spread betters, CFD and FX traders, Investment Trends 2020 UK Leverage Trading Report; Best Overall Satisfaction, Best Platform Features, Best Mobile/Tablet App, rated highest for Charting, Investment Trends 2019 UK Leverage Trading Report; Best In-House Analysts, Professional Trader Awards 2019.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.