What is margin in forex?

Margin is the amount of money that a trader needs to put forward in order to open a trade. When trading forex on margin, you only need to pay a percentage of the full value of the position to open a trade.

Margin is one of the most important concepts to understand when it comes to leveraged forex trading. Margin is not a transaction cost.

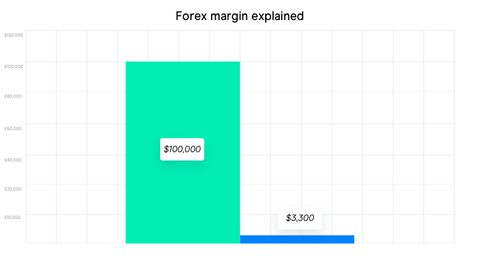

Forex margin explained

Trading forex on margin enables traders to increase their position size. Margin allows traders to open leveraged trading positions, giving them more exposure to the markets with a smaller initial capital outlay. Remember, margin can be a double-edged sword as it magnifies both profits and losses, as these are based on the full value of the trade, not just the amount required to open it.

The leverage available to a trader depends on the margin requirements of the broker, or the leverage limits as stipulated by the relevant regulatory body, ESMA for example. Margin requirements differ depending on forex brokers and the region your account is based in, but usually start at around 3.3% in the UK for the most popular currency pairs. For example, if a forex broker offers a margin rate of 3.3% and a trader wants to open a position worth $100,000, only $3,300 is required as a deposit to enter the trade. The remaining 96.7% would be provided by the broker. The leverage on the above trade is 30:1. As trade size increases, so does the amount of margin required.

Having a good understanding of margin is very important when starting out in the leveraged foreign exchange market. It’s important to understand that trading on margin can result in larger profits, but also larger losses, therefore increasing the risk. Traders should also familiarise themselves with other related terms, such as ‘margin level’ and ‘margin call’.

What is the margin level?

When a forex trader opens a position, the trader’s initial deposit for that trade will be held as collateral by the broker. The total amount of money that the broker has locked up to keep the trader’s positions open is referred to as used margin.

As more positions are opened, more of the funds in the trader’s account become used margin. The amount of funds that a trader has left available to open further positions is referred to as available equity, which can be used to calculate the margin level.

So margin level is the ratio of equity in the account to used margin, expressed as a percentage. The formula to calculate margin level is as follows:

Margin level = (equity / used margin) x 100

Margin trading example

For example, let’s say a trader places $10,000 in a forex account and opens two forex trades. The broker requires a margin of $2,500 to keep these two positions open, so the used margin is $2,500. In this scenario, the margin level is ($10,000 / $2,500) x 100 = 400%. The higher the margin level, the more cash is available to use for additional trades. When the margin level drops to 100%, all available margin is in use and therefore, no further trades can be placed by the trader.

Paying attention to margin level is extremely important as it enables a trader to see if they have enough funds available in their forex account to open new positions. The minimum amount of equity that must be kept in a trader’s account in order to keep their positions open is referred to as maintenance margin. Many forex brokers require a minimum maintenance margin level of 100%.

Margin call definition

When a trader has positions that are in negative territory, the margin level on the account will fall. If a trader’s margin level falls below 100%, it means that the amount of money in the account can no longer cover the trader’s margin requirements. The trader’s equity has fallen below the used margin. In this scenario, a broker will generally request that the trader’s equity is topped up, and the trader will receive a margin call. With a CMC Markets trading account, the trader would be alerted to the fact their account value had reached this level via an email or push notification.

When this happens, if the trader fails to fund their account some or all of the trader’s open positions may be liquidated. Traders should avoid margin calls at all costs. Margin calls can be avoided by monitoring margin level on a regular basis, using stop-loss orders on each trade to manage losses and keeping your account adequately funded.

Margined trading is available across a range of investment options and products. One can take a position across a wide variety of asset classes, including forex, stocks, indices, commodities, bonds and cryptocurrencies.

The difference between forex margin and leverage

Another concept that is important to understand is the difference between forex margin and leverage. Forex margin and leverage are related, but they have different meanings.

We have already discussed what forex margin is. It is the deposit needed to place a trade and keep a position open. Leverage, on the other hand, enables you to trade larger position sizes with a smaller capital outlay.

A leverage ratio of 30:1 means that a trader can control a trade worth 30 times their initial investment. If a trader has $5,000 available to open a trade, they can effectively control a position with a total value of $150,000 if the leverage ratio is 30:1. In forex trading, leverage is related to the forex margin rate which tells a trader what percentage of the total trade value is required to enter the trade. So, if the forex margin is 3.3%, then the leverage available from the broker is 30:1. If the forex margin is 5%, then the leverage available from the broker is 20:1. A forex margin of 10% equates to a leverage of 10:1.

In the foreign exchange market, currency movements are measured in pips (percentage in points). A pip is the smallest movement that a currency can make. For most major currency pairs, such as GBP/USD, a pip is a price movement of 0.0001. If GBP/USD moves from 1.4100 to 1.4200, that is a movement of 100 pips, which is just a one cent move in the exchange rate. While a one cent move doesn’t sound like much, with the use of leverage, it could generate a significant profit for a forex trader.

That’s why leverage is important in the forex market, as it allows small price movements to be translated into larger profits. However, at the same time, leverage can also result in larger losses. Therefore, it’s important that leverage is managed properly and not used excessively. Leverage increases risk, and should be used with caution.

Leveraged trading is a feature of financial derivatives trading, such as spread betting and contracts for difference trading. Leverage can also be used to take a position across a range of asset classes other than forex, including stocks, indices and commodities.

Forex margin calculator

Calculating the amount of margin needed on a trade is easier with a forex margin calculator. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually. To calculate forex margin with a forex margin calculator, a trader simply enters the currency pair, the trade currency, the trade size in units and the leverage into the calculator.

The forex margin calculator will then calculate the amount of margin required. For example, let’s say a forex broker has a 3.3% margin requirement for EUR/USD, and a trader wants to open a position of 100,000 units. The currency pair is trading at 1.1500 and the trader’s account currency is USD.

When these details are entered into a forex margin calculator, it will calculate that the margin required is $3,795. In other words, $3,795 is needed to place the trade.

Forex margin calculators are useful for calculating the margin required to open new positions. They also help traders manage their trades and determine optimal position size and leverage level. Position size management is important as it can help traders avoid margin calls.

Before you start speculating on the foreign exchange market, it would help to get a better understanding of technical analysis, as well as risk management, so you can better analyse price action and protect yourself from sudden market moves.

Summary

In leveraged forex trading, margin is one of the most important concepts to understand. Margin is essentially the amount of money that a trader needs to put forward in order to place a trade and maintain the position. Margin is not a transaction cost, but rather a security deposit that the broker holds while a forex trade is open.

Trading currencies on margin enables traders to increase their exposure. Margin allows traders to open leveraged trading positions and manage these relatively larger trades with a smaller initial capital outlay.

If a broker offers a margin of 3.3%, the leverage available is 30:1. This means that the trader can trade $100,000 with an outlay of just $3,300. Margin level refers to the amount of funds that a trader has left available to open further positions.

When margin level drops to 100%, all available margin is in use and the trader can no longer open new trades. If the margin level falls below 100%, the amount of money in the account can no longer cover the margin required to keep the position open. When this happens, a margin call will occur and the broker may close some of the trader’s positions if the margin call is not met to bring the equity in the trading account back up to the minimum value.

Trading forex on margin is a popular strategy, as the use of leverage to take larger positions can be profitable. However, at the same time, it’s important to understand that losses will also be magnified by trading on margin.

Traders should take time to understand how margin works before trading using leverage in the foreign exchange market. It’s important to have a good understanding of concepts such as margin level, maintenance margin and margin calls.

Traders need to be aware that their forex positions could be liquidated if their margin level falls below the minimum level required.

See our beginners guide to trading forex to help you get started.

Disclaimer

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.