The three US benchmark indices futures finished lower on Independence Day as Wall Street closed. Globally, European stock markets ended in the red.

Asian equities are set to open lower as uncertainties arose following China’s decision to restrict exports of two metals, including gallium and germanium, widely used to make semiconductors for electric cars and other telecom equipment as a retaliation measure against the US and allies to curb the country’s technology advances. This warns of China’s domains in critical resource production for the prevailing AI race among tech companies, sparking concerns about further supply chain disruption amid a possible second trade war.

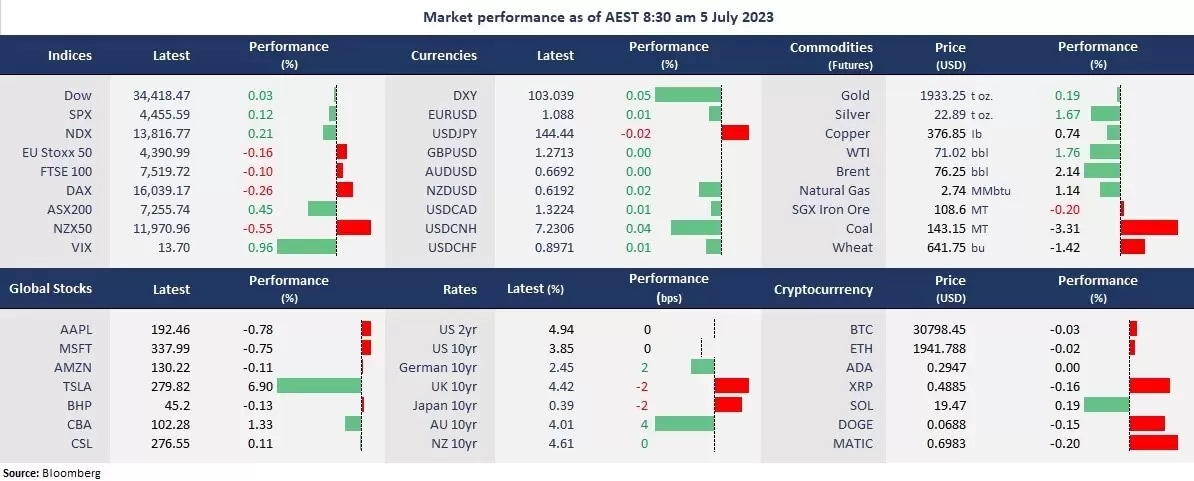

The US market open is yet to gauge sentiment ahead of the FOMC meeting minutes, while US second-quarter earnings season is approaching. The US dollar index strengthened slightly as the Eurodollar weakened following German trade balance data as the country’s export fell more than expected due to weakened EU members’ demands.

The Reserve Bank of Australia paused rate hikes as the economic outlook gloomed amid aggressive rate hikes. The ASX rallied following the news, while the Australian dollar bounced off a session low after an initial decline against the king dollar. Futures are pointing to a lower open across Asian equity markets. The ASX 200 futures were down 0.17%, Hang Seng Index futures fell 0.40%, and the Nikkei 225 slid 0.45%.

Price movers

- Six out of 11 sectors in the ASX 200 finished higher, with energy and real estate leading gains, up 1.16% and 1.08%, respectively. The rebound in Energy stocks may have been due to higher oil prices on Tuesday. And the real estate sector was boosted by the RBA’s rate-hike pause. Information technology and industrials were the laggards, down 0.14% and 0.15%, respectively.

- Meta launches a new app called Threads to compete with Twitter. Threads will be linked to Meta’s Instagram and are available to be pre-order in the Apple App Store and will go live on Thursday. It was the first time the social giant duplicated other social media’s functionality and could potentially gain millions of users from Instagram.

- Crude oil rebounded from the previous day's drop as the OPEC+ meeting kicks off today. Traders may bet on more output cut plans by the cartel as Saudi Arabic indicates to extend its 1 million barrels-per-day reductions infinitely if necessary.

ASX and NZX announcements/news

- Auckland Airport (ASX/NZX: AIA) annual results for the 12 months ending 20 June 2023 will be announced on 24 August.

Today’s agenda

- Australian retail sales for May m/m.

- China’s Caixin Services PMI for June

- OPEC meeting

Watch for market movements and invest now.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.