Guaranteed stop loss orders

Guaranteed stop loss orders (GSLOs) work exactly the same as regular stop loss orders except that, for a small premium charge, they guarantee to close you out of a trade at the price you specify, regardless of market volatility or gapping.

Key GSLO points:

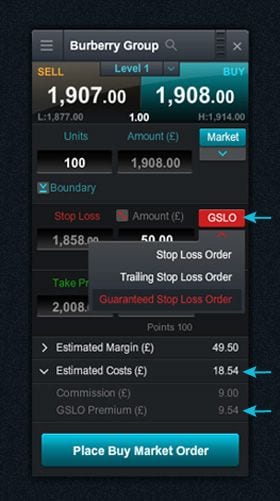

- You can only place GSLOs during trading hours. You can do this on any order ticket by choosing GSLOs in the stop loss order menu.

- GSLOs have to be placed at least a minimum distance away from the current market price. This distance will be displayed within the product overview and a warning will appear if you try to place it closer.

- If you add a GSLO to an open trade, the margin required will be the margin rate set by ESMA, or the maximum loss for that trade – whichever amount is greater. This GSLO-specific margin type is called 'Prime Margin' and will be displayed at the foot of the order ticket.

- There is a 'GSLO Premium' charge for placing a GSLO as you are guaranteed to be closed out at your specified price. This cost is an amount based on the current market price, and it will also be displayed at the bottom of the order ticket in your account currency.

- GSLOs can be placed on most products but please check the product overview to see if they can be placed on the product you are interested in.

- You can cancel a GSLO or switch to a regular stop loss order or trailing stop loss order at any time.

- Outside trading hours, you can only move the GSLO price further away from the current market price, not closer.

- Any modification is free of charge.

- The original GSLO premium will be refunded in full if a GSLO is not triggered. This can occur when a GSLO is removed from an open trade, changed to a regular stop-loss order or trailing stop-loss order, when a take-profit order is triggered or when an open trade is closed manually (fully or partially).

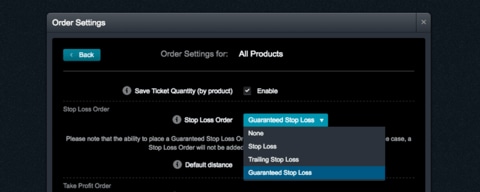

- You can have GSLOs applied as default when loading an order ticket – set this up via 'Order Settings'. If you use minimum position margin, the default value will equal the GSLO minimum distance. It is important to note though that if GSLOs are not available on a particular product, no default will be added to the order ticket.

Account positions screen

Trades with a GSLO attached are displayed in an aggregated area in the 'Positions' tab underneath positions placed using standard margin requirements. You have the ability to close or reduce all standard margin positions, close all prime margin positions or close all positions for that product using their respective aggregated rows. Alternatively, you can close out each position individually.

If you only have prime margin positions or standard margin positions for that product, only one aggregated row will be shown.

- A - Close or reduce positions across both GSLO & non-GSLO trades

- B - Close or reduce positions across non-GSLO trades

- C - Close or reduce positions across GSLO trades

- D - '(G)' symbol signifies that a GSLO is applied to the trade

Additional GSLO information:

- GSLOs will always trigger off the level 1 price.

- You cannot customise the GSLO to trigger from the buy, sell or mid-price as you can with regular stop loss orders.

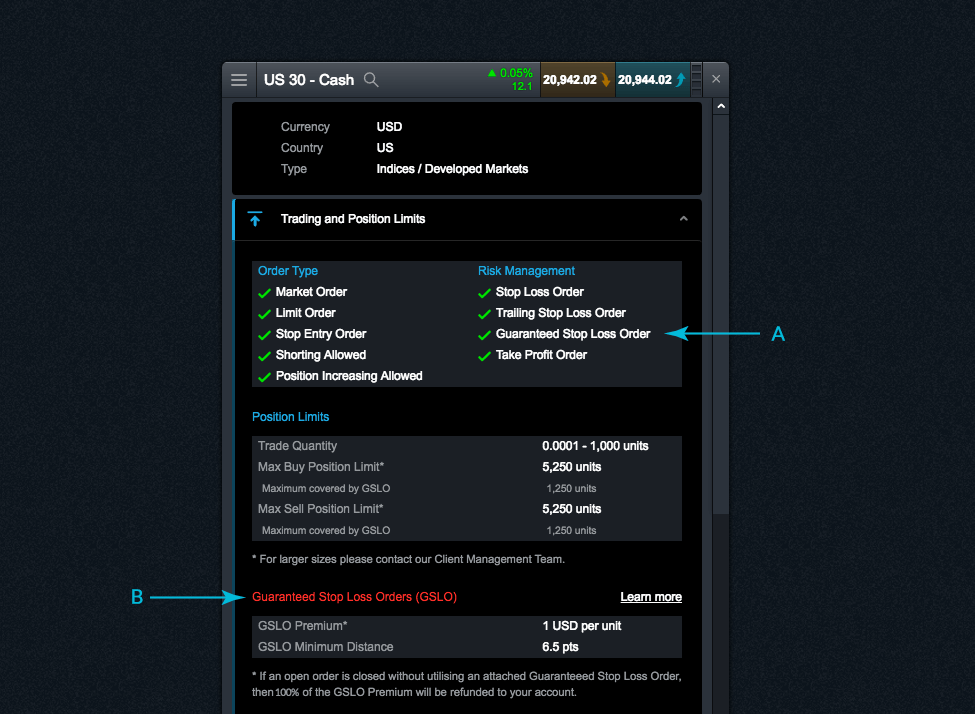

- Only a certain percentage of a product's maximum position limit can be placed with a GSLO attached. This amount is highlighted in the product overview.

- GSLOs attached to open trades will be adjusted to reflect corporate action.

- GSLOs will replicate the same behaviour as regular stop loss orders in respect to forward roll-overs. The GSLOs will be placed the same distance away in the far expiry date as it was in the near expiry date it is being rolled from.

Product overview

GSLO details are contained within the 'Trading and Position Limits' drop–down panel.

- A - This area will indicate whether GSLOs are available for that product. You can also see which other order types and risk management tools are available for this product. If they are not available a red 'x' will be shown next to the entry.

- B - This area will show you the GSLO premium amount, the GSLO minimum distance and the percentage of the GSLO premium refund if the order is closed without the GSLO being triggered.

Account close-out

There are two possible close-out levels applied to a trading account depending on the makeup of your open positions:

- If there are standard margin positions on the account the close-out level used will be the standard close-out.

- If there are prime margin positions on the account, the close-out level used will be the prime close-out level. This type of close-out level can close positions using both standard margin and prime margin.

For ease of use we display the cash value of these levels (rather than just a percentage).

You can view the relevant close-out percentage level for your account by hovering the mouse over the 'i' icon. A tooltip will appear with 'breach', 'warning' and 'restore' percentage levels.

Important notes

- Standard margin positions are closed before prime margin positions.

- If standard margin positions cannot be closed (due to markets being closed for example) the close out process will continue by closing GSLO positions

GSLOs are just one of the ways we help you manage the potential risks of trading. Read more about risk managment.