What is an Expert Advisor (EA)?

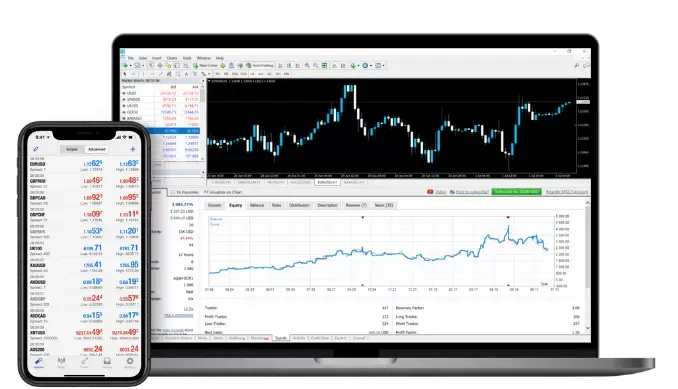

An Expert Advisor (EA) is a software program or script within the MetaTrader 4 (MT4) platform which automates your trading. Also known as a trading robot, an EA can generate and execute trading decisions on behalf of the trader based on predefined rules and parameters.

The primary purpose of an EA is to eliminate the need for manual trading and allow for continuous, systematic execution of trading strategies. EAs can analyse market conditions, generate buy and sell signals, manage trade entries and exits, apply risk-management techniques, and perform other trading-related tasks automatically.