Automated trading allows traders to open and close trades automatically, but first the rules that the system will follow must be programmed. So it is not as simple as it may seem at first glance.

Automated trading - how it works and why it's so popular

Many traders dream of finding the perfect automated system that generates profits and requires little effort from the trader. An automated approach that makes all the trading decisions for you sounds great - doesn't it?

What is automated trading?

Automated trading is a type of trading that uses software programs to analyse the movements and prices of financial instruments and then automatically executes trades based on pre-defined strategies. This method does not require manual analysis and decision making and allows traders to automate their trading activities with minimal effort.

The algorithms that drive automated trading can be programmed to monitor multiple markets simultaneously, identify patterns in charts, perform calculations and place orders based on pre-defined criteria. By automating the process of analysing data and deciding when to buy or sell a particular asset, automated trading systems can help traders achieve their personal trading goals. In addition, automated trading systems require less time and effort than manual methods, where you first manually perform technical analysis and then determine the parameters for your positions, such as opening orders, trailing stops and guaranteed stop-losses.

The main advantage of automated trading is the ability to automate the decision-making process with minimal human intervention. This eliminates the need for tedious manual analysis and allows traders to react quickly to a changing market by placing orders almost instantly according to specific criteria. Automated trading also avoids the psychological factors that influence traders' actions.

How does automated trading work?

Automated trading systems are programmed using a variety of computer languages and programming techniques. Typically, these systems use machine learning algorithms to analyse price data, identify patterns and execute trades accordingly. This process is often automated using software applications that can be used from any computer or mobile device.

Automated trading is becoming increasingly popular as it allows traders to stay active in multiple markets, while having an advantage over manual traders who may miss trading ideas due to lack of time or experience. The rules for opening or closing a position can be based on simple conditions. Alternatively, they can be based on advanced strategies that require a thorough understanding of the programming language used to write the user's trading platform.

Choose your trading platform

You can trade on MT4* with CMC Markets

Set up your parameteres

Create the rules by which you want to trade

Trade with automation

The algorithm will trade for you according to your specifications

Ultimately, automation offers users greater accuracy and speed in executing trades compared to manual methods, making it an attractive option for novice and experienced traders alike.

Why is automated trading so popular?

Automated trading is becoming increasingly popular as it allows traders to react quickly to changing market conditions and place trades without having to manually analyse data. This allows traders to take advantage of short-term market opportunities while following pre-defined criteria for when to open and close positions. In addition, automated trading systems help to eliminate the human emotions that can come into play when trading, leading to impulsive and irrational decisions.

Advantages at a glance:

- Time independent: Adapt your strategy to your schedule by automatically executing trades day and night.

- Rational instead of emotional: Reduce the impact of emotional and gut decisions and focus on your planned strategy.

- Analyse the markets: Analyse all markets simultaneously and let trends and chart patterns be detected automatically using a variety of indicators.

- Trade faster: Real-time trades can be automatically executed multiple times without manual intervention.

Risks of automated trading

There are some risks associated with automated trading with EA's and robot trading that should be carefully evaluated. On the one hand, the use of automated trading systems can save a lot of time and stress, but on the other hand, it can also lead to a loss of invested capital, as most robots can only trade within a certain range.

A major risk is that automated systems are based on pre-defined programmatic rules and are not able to adapt to the current market situation. For example, if an EA has been programmed for a particular market condition and that condition no longer exists, this can lead to losses.

If you have not used risk management tools and there is a sudden and sharp breakout in the financial markets, all your profits can be lost in one go, just as with manual trading. Some trading robots are only profitable in a positive market trend, but can cause losses in a volatile market.

It is also important to remember that automated systems are not a guarantee of profits. Although they are usually based on thorough analysis and strategies, they cannot make the same human considerations and decisions. There is a risk that automated trading systems will react to certain patterns and ignore important factors such as fundamentals and current events.

Another risk factor in automated trading is technical failure. If the automated system does not work properly, significant losses can occur. It is also possible for hackers to access automated trading systems and manipulate or disrupt trades.

To minimise the risks, it is important to understand how the automated trading system works and to test and monitor it thoroughly. It may also be helpful to compare different automated trading systems and seek expert advice before making a final decision. Finally, make sure you have sufficient capital to cover any losses that may arise from automated trading.

Which trading platform can be used for automated trading?

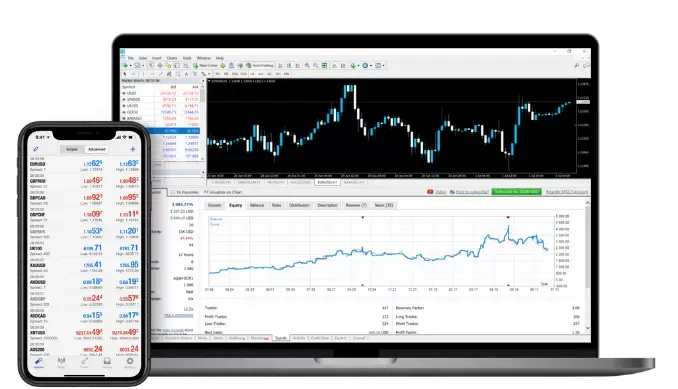

The type of trading platform you use for automated trading depends on the asset class and strategy you use. Most traders use MetaTrader4 (MT4), NinjaTrader or cTrader platforms to access the markets and trade algorithmic strategies. Many brokers also offer their own proprietary platforms.

MT4 at CMC Markets

MT4 stands for MetaTrader 4 and is one of the most popular trading platforms for automated trading. Developed by software company MetaQuotes, MT4 is offered by many brokers, such as CMC Markets, to access a wide range of markets and apply algorithmic trading strategies. With an MT4 account from CMC Markets, you can trade Forex, Indices, Cryptocurrencies and Commodities via MT4 with tight, competitive and reliable spreads.

MT4 allows both manual and automated trading and supports a variety of order types, including stop-loss and take-profit orders.

The platform has many features, including an intuitive user interface, comprehensive analysis tools and the ability to program custom indicators and Expert Advisors (EAs). EAs are automated trading systems that can execute trades based on pre-defined programmatic rules. As a CMC Markets client, you can also use many indicators and add-ons free of charge free of charge, such as autochartist.

You can customise your trading strategy by creating your own trading algorithms and indicators on the MetaTrader 4 platform, as well as placing various orders. When you import Expert Advisors (EAs), they can search for trading opportunities that match your pre-defined parameters. The EAs can either notify you or automatically open a position.

Fundamentally, MT4 is very customisable because it provides traders with a programming language. This allows you to create and test your own indicators and EAs.

The platform also has a large online community where traders can share their programs, discuss issues and get advice.

Why trade on MT4 with us?

Unrestricted trading

There are no restrictions on minimum stop-loss or take-profit distances, or stop-loss and take-profit limits, especially useful for high-volume traders.

Hedge your positions

We give clients the ability to go long and short at the same time on a specific instrument, which means there’s no interruption for traders using Expert Advisors (EAs).

London-based server

Our London-located server and industry reputation helps us provide a tier-one liquidity solution, so we can consistently deliver lightning-fast execution speeds.

No scalping restrictions

We don’t have any scalping restrictions, or penalise clients who practise scalping trading strategies with us.

Hassle-free application

With a straightforward application process, you can be up and trading in no time.

Free premium indicators and EAs

Hone your technical analysis and tap into our suite of additional premium MT4 indicators and EAs, included at no cost.

Expert Advisors (EA) vs. Scripts - what is the difference?

There are generally two categories of automated systems: Expert Advisors (EA) and Scripts. Expert Advisors are designed by experienced professionals who write algorithms to analyse market trends and automate the trading process. Traders receive signals from EAs to help them make decisions when opening trades.

Scripts, on the other hand, allow traders to execute pre-defined sets of commands. For example, if a trader wants to enter and exit a position quickly, they can use scripts to automate the process. Scripts are also used for tasks such as closing all open positions or setting stop-loss orders.

Conclusion

Each trader must decide for themselves whether automated trading is an option for them. It can be a useful tool when time is of the essence, or it can be a tool for discipline. Besides the benefits, it is important to consider the risks and whether this form of trading suits your personal strategies.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.